Spotify Technologies (SPOT 11.41%) has more than doubled its revenue and monthly active users since its initial public offering (IPO) four years ago.However, the stock has underperformed over that time, going down 39% since Spotify's IPO.

A stock will catch up with the underlying company's financial performance in the long run. The good news is that Spotify is steadily adding new users even in a challenging economy. Here are two reasons the stock is a buy for the long term.

1. Growing demand

No matter what comes along to compete for people's time, such as video games or social media, music has always been in demand. Over the last few decades, music streaming has emerged as the largest driver of growth in the $28 billion global recorded music industry.

Despite sky-high inflation and economic uncertainty, consumers are still signing up for Spotify. The company reported a 20% year-over-year increase in monthly active years for the third quarter. While growth in premium subscriptions has slowed recently, management said that subscribers exceeded their guidance by 1 million in the quarter.

| Metric | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | YoY Growth |

|---|---|---|---|---|---|---|

| Premium subscribers | 172 | 180 | 182 | 188 | 195 | 13% |

| Ad-supported monthly users | 220 | 236 | 252 | 256 | 273 | 24% |

| Total monthly active users | 381 | 406 | 422 | 433 | 456 | 20% |

Data source: Spotify. YoY = Year over year.

One advantage that can keep people locked into their Spotify subscription is the ubiquity of the service. Nine out of 10 premium users use Spotify across several devices, and this eager engagement tends to lead to higher lifetime value and lower cancellation rates.

2. Music is cheap

Wall Street is concerned about Spotify's operating loss of $228 million last quarter, which has worsened this year as more users opt to sign up for free ad-supported plans that generate lower margins than paid subscriptions. However, a sell-off in the stock over Spotify's profitability is a no-brainer buying opportunity for the following reason.

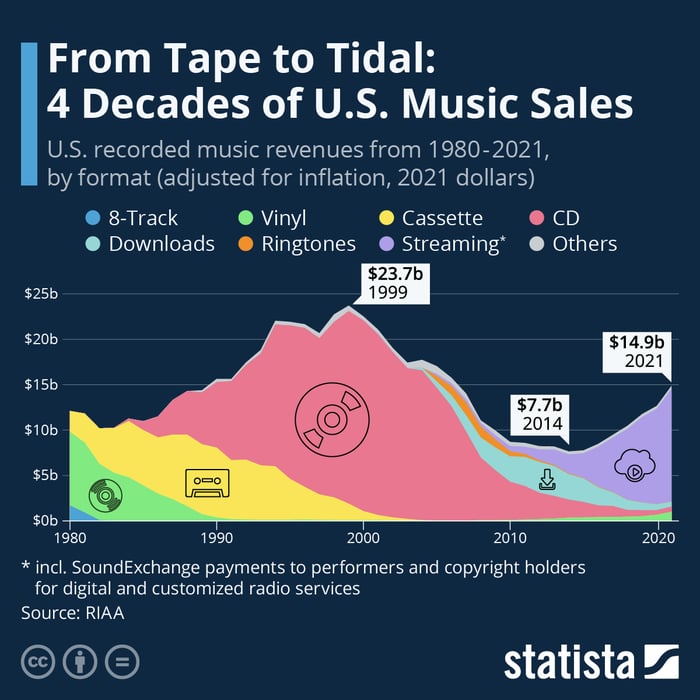

Music streaming services are under-monetized. People are spending significantly less on music today than they did 20 years ago, and a big reason for that is the affordability of streaming compared to physical media.

Image source: Statista.

Apple just raised the price of Apple Music, and it's only a matter of time before Spotify follows suit in the U.S. market. Spotify has raised prices 46 times across international markets in the last two years. Even after those increases, the platform still continues to grow the number of premium subscribers.

Buy the stock while growth expectations are low

Spotify could follow Apple's lead and raise prices tomorrow if it wanted to. Still, management seems more inclined to give consumers more value through a growing podcast library and enhancements to personalization. Spotify's management is choosing to widen the net as much as possible now and worry about maximizing margins later. This is the right strategy to maximize the company's long-term potential for profitable business growth.

A few years ago, the stock was valued at a high price-to-sales (P/S) ratio of over 6, which implied the expectation for a double-digit operating margin over the long term. With the stock trading at a P/S multiple of 1.24 at the time of writing, the lofty expectations for high margins are gone. The premium has been taken out of the stock, making it a potential bargain at these price levels.