As the growth stock sell-off gradually morphed into a bear market, many high-quality companies fell sharply despite consistently improving results. Three such examples -- MercadoLibre (MELI 1.96%), The Lovesac Company (LOVE 0.55%), and Pool Corp (POOL 2.49%) -- all trade at depressed valuations despite growing revenue by 690%, 480%, and 120%, respectively, over the past five years.

Growth rates like these, paired with lower valuations, hold the potential to create a potent one-two punch for investors. Let's look at what makes these stocks once-in-a-decade opportunities today.

1. MercadoLibre: Fintech steals the show

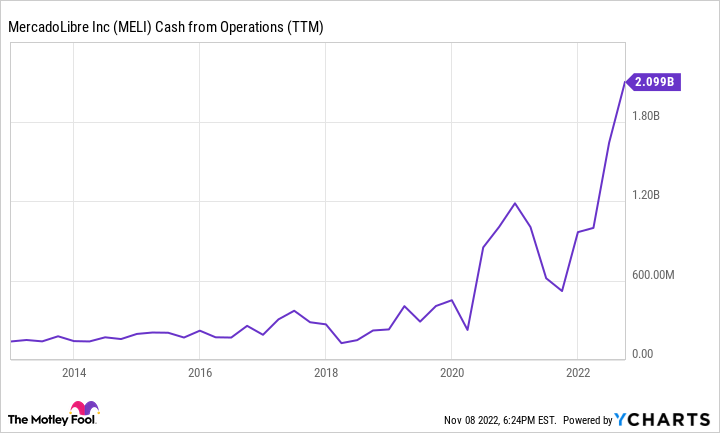

Down 50% from its all-time highs, Latin American fintech and e-commerce juggernaut MercadoLibre is an excellent example of a stock's price moving counter to its burgeoning operations. Despite selling off amid slowing growth from its commerce segment and rising provisions for its MercadoCredito loans unit, the company posted its highest $2 billion operating cash flow over the past year.

MELI Cash from Operations (TTM) data by YCharts.

Powered by 88 million active users, which grew 12% compared to last year, MercadoLibre continues to become enmeshed into the fabric of the Latin American community. Accounting for over 20% of Latin American online gross merchandise volume (GMV), the company's commerce segment grew 33% despite physical retail reopening across the region.

However, as impressive as this e-commerce foothold is, MercadoLibre's fintech unit (MercadoPago) aims to become the company's core segment. Growing revenue by 115% in Q3, MercadoPago now accounts for 46% of revenue and has 42 million unique fintech users.

With 70% of Latin America's population still unbanked or underbanked, according to Forbes, MercadoLibre's fintech growth may just be starting. Additionally, 72% of MercadoPago's total payment volume (TPV) comes from outside its marketplace. This figure highlights that its digital wallet and payment capabilities go far beyond sales on its platform, providing additional growth avenues for the company to explore.

Most importantly for investors, this growth potential comes when MercadoLibre's valuation is near decade lows.

MELI Price to CFO Per Share (TTM) data by YCharts.

In MercadoLibre's case, operating cash flow per share provides a better insight into the company's valuation as it spends heavily on capital expenditures, weighing on free cash flow.

MELI Free Cash Flow data by YCharts.

At just 23 times cash from operations, MercadoLibre's 61% revenue growth rate, steady e-commerce progress, and massive fintech potential make it a once-in-a-decade opportunity for investors.

Lovesac: 45% sales growth but priced for none

While the home-furnishings industry and once-in-a-decade buying opportunity rarely end up in the same sentence, Lovesac's one-two punch of growth and low valuation may make it happen.

The company is sporting revenue growth of 480% since its initial public offering (IPO) in 2018, so one might imagine that its stock has fared relatively well over the same time. Instead, however, its share price is almost exactly where it was at its IPO.

Well, that's fine, you may think. It's probably another sold-off growth stock that keeps posting massive losses on the bottom line. Yet, that's not the case either as earnings per share (EPS) turned positive during the pandemic and never looked back.

LOVE Normalized Diluted EPS (TTM) data by YCharts.

Now trading at just 8 times earnings, Lovesac's low valuation has the potential to act like a loaded spring rocketing its share price higher.

LOVE PE Ratio data by YCharts.

As crucial as this cheap valuation could prove for investors, Lovesac's growing customer base and environmentally friendly "sactionals" (couch pieces that can be arranged variously) bring additional excitement to investors.

Image Source: Lovesac Q2 2023 Investor Presentation.

With sactionals making up 87% of the company's sales, Lovesac could rebrand as "The Sactional Company" as its beanbag products now only account for 11% of revenue. Regardless, these modular sactionals have continued to grow in popularity as their reconfigurability and optional accessories (seat tables, drink holders, coasters, etc.) make them endlessly customizable.

Further adding to Lovesac's rising popularity among younger generations is that 100% of its upholstered fabric comes from repurposed plastic bottles. With the standard sactional pit configuration using nearly 1,000 plastic bottles, the company's products are not only beloved by customers, but also a net positive for the world.

Sporting a strong customer lifetime value of $2,880, compared to a customer acquisition cost of $549, Lovesac's minuscule valuation and growing customer count make it a compelling starter-position candidate with multi-bagger potential.

Pool: A quiet recurring-revenue business

As the No. 1 distributor of pool products worldwide, Pool stock has delivered total returns of over 700% in the last decade alone. Across the last 20 years, these returns jumped to over 3,800%, making the company a 37-bagger for its shareholders over that time.

Leading this incredible rise for Pool are its stable operations that are designed to thrive whether the housing market is booming or cooling off. 58% of its sales come from recurring sources, such as maintenance supplies that need to be purchased no matter what.

On top of this steady inflow of sales, an additional 22% of purchases come from replacement and refurbishment services, which the company calls "semi-discretionary." These predictable sales build a beautiful floor for Pool in trying times, reducing the boom or bust nature of the housing cycle.

POOL PE Ratio data by YCharts.

The shares now trade at just 16 times earnings, and that cheap valuation has has caught management's attention. With a history of buying back stock at a discount, Pool is back at it again, repurchasing nearly $500 million in shares over the past year.

With a dividend yield of 1.2% and a tiny payout ratio of 18%, the company also has plenty of room to grow its dividend.

Pool continues to prove itself as a master at returning cash to shareholders. Trading well below its lowest price-to-earnings ratio this decade, Pool's steady growth looks like a once-in-a-decade opportunity for growth and income investors alike.