Since you came here looking for value stocks, I'll try not to waste your time with merely borderline value investing opportunities. To the contrary, I believe online marketplace eBay (EBAY 0.88%) and furniture company Lovesac (LOVE 2.21%) are downright cheap right now, and the numbers back this up.

I also considered furniture store RH, automotive retailer Advance Auto Parts, and OLED technology company Universal Display Corporation for this article. However, while I do believe those offer good value as well, eBay and Lovesac both trade under $100 per share, whereas the others don't.

Here's why eBay and Lovesac are good value buys with those Benjamins.

1. eBay: $46.60 per share

eBay isn't a one-stop online shop for everything, and it likely never will be. But it's still a very relevant platform, excelling in a number of key categories. Management calls them "focus" categories. For perspective regarding its relevance, eBay has over $76 billion in trailing-12-month gross merchandise volume (GMV) -- the sales value of the products sold on the platform.

eBay's management intends to maintain its relevance by doubling down on what its buyers want. For example, eBay is quite the car-parts retailer, and lately it's been elevating its presence in this market by sponsoring related events and shows. It also acquired a company called myFitment to improve listings on the eBay platform, ensuring vehicle-parts information is uploaded correctly.

Another example of an eBay focus category is collectibles. This category includes trading cards. And trading card sales volume has more than doubled for eBay since 2019. The company is improving its offerings with the launch of eBay Vault -- a service for high-value collectibles that makes it easier to store, authenticate, and trade these items. It's also recently acquired trading-card marketplace TCGplayer.

I believe eBay will remain a solid player within its core categories for the foreseeable future. And by facilitating these transactions for third parties, the company enjoys high profit margins -- its gross margin is almost 73% year to date.

A quick note on value stocks -- a cheap valuation is often indicative of market pessimism. In eBay's case, its active buyers fell 11% year over year in the third quarter of 2022 to 135 million, and GMV also fell 11% to $17.7 billion. This leads some to believe eBay's business is dying. But as already pointed out, it remains strong in core categories, and I expect that to continue.

eBay has earned about $2.5 billion in income from operations over the past 12 months -- its market capitalization is only 10 times larger than this, which is inexpensive.

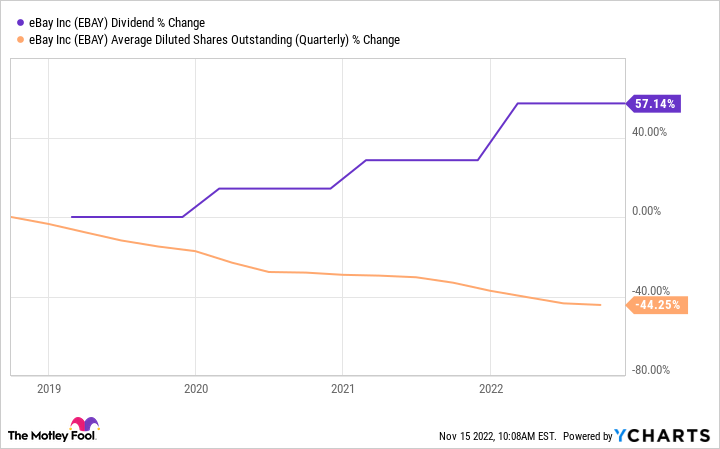

Management is repurchasing shares and quickly scaling up its dividend, as the chart below shows -- two priorities going forward that can drive market-beating shareholder returns. Therefore, it doesn't need to grow revenue to return more capital to shareholders, it just needs to hold its ground. And I believe that will be a likely outcome for eBay.

EBAY Dividend data by YCharts

2. Lovesac: $27.69 per share

As already mentioned, value stocks typically bake in pessimism. That's the case with Lovesac stock, and for good reason. The company sells high-quality but high-priced beanbag chairs and sectional couches. And this business doesn't provide the company with recurring revenue.

To be fair, eBay's revenue isn't recurring either. But its users are far more likely to make multiple purchases in a year than Lovesac's customers. After all, you can only buy so many couches for your home.

To its credit, Lovesac's revenue growth is incredible. In fiscal 2022 (ended on Jan. 30), its revenue jumped 55% from fiscal 2021. And through the first two quarters of fiscal 2023, the company has generated $278 million in net sales, up 50% from the comparable period of fiscal 2022. The growth is impressive -- but therein lies the risk.

Investors question whether Lovesac's sensational growth is sustainable. Management appears to question it too. In its most recent conference call, management said that "We are not providing formal guidance" because it sees a wide "range of potential outcomes." It's hard to predict how sales for premium-priced furniture will fare during a slowing economy with high inflation.

Lovesac stock has already jumped 38% from its recent low, but it's still dirt cheap. The company has earned $44.4 million in trailing-12-month net income and has a market cap of $419 million. This means its price-to-earnings (P/E) ratio is less than 10.

For comparison, the P/E average for the S&P 500 is currently about 20 -- Lovesac's valuation is, therefore, roughly half that of the market's average.

LOVE PE Ratio data by YCharts

The good news for Lovesac is that it estimates it's only achieved 2% market share, at most. Therefore, it could double sales and still have a small piece of the market, which makes the possibility look achievable.

Moreover, management has roughly doubled its available inventory over the past year in anticipation of future demand. But Lovesac's merchandise doesn't change much year to year. Therefore, even if sales slow in the near term, it can patiently hold merchandise and sell later at full price when demand rebounds.

For these reasons, I see Lovesac as a low-risk opportunity even if sales weaken in coming quarters.

Of these two stocks, eBay is the one I'd buy today. Investing -- even value investing -- is still about thinking long-term. I have nothing against Lovesac and would even consider buying it at some point. But I'm far less confident at this moment about Lovesac's staying power.

By contrast, since it's been around for over 20 years, I strongly believe eBay has done enough to stay alive at least throughout this decade, generating robust cash flow and rewarding shareholders along the way.