Broadly speaking, 2022 wasn't a good year for the stock market. But don't let that stop you from using what's historically been the world's best tool for building wealth. Dividend stocks can be an excellent route for investors looking for less volatility and some passive income to pad their pockets.

Continuously diversify your portfolio, and build around a stable of high-quality businesses with strong financials. Don't know where to start? Consider these five blue chip stocks with excellent fundamentals that can kick-start a successful long-term investing journey.

1. This Buffett favorite isn't going flat

Coca-Cola (KO 1.56%) is a name virtually everyone knows, but its boring business model might cause some to overlook this excellent dividend stock. It's one of Warren Buffett's largest and longest-held investments. The company sells sodas, waters, juices, teas, and hot coffees, totaling $42 billion in trailing-12-month revenue. Importantly, Coca-Cola is very profitable; it converts 29% of its sales into free cash flow, cash profits that fund its dividend.

Coca-Cola is also a Dividend King, an S&P 500 company with 60 years of consecutive dividend growth. Such a long track record underlines how durable Coca-Cola's business has been. Investors can get a 2.9% dividend yield today, and the dividend payout ratio is quite reasonable at 57%. In other words, investors should look forward to dividend raises for years to come.

KO Dividend data by YCharts

2. Consider this household product Dividend King

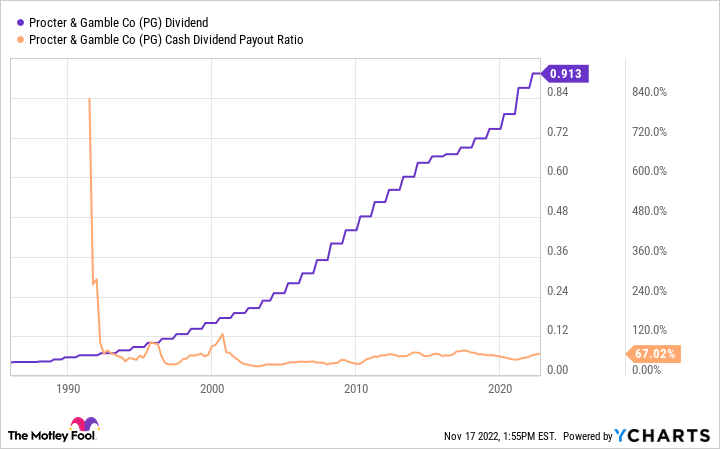

Procter & Gamble (PG 0.67%) owns many brands you'll find in your bathroom or cleaning closet at home. This conglomerate's products spanning 10 categories, are sold in over 170 countries and total more than $80 billion in annual sales. Just like Coca-Cola above, P&G is a simple, boring business that also makes a lot of money; the company is getting about $0.17 in cash profits from every revenue dollar it brings in.

Those cash profits typically flow into shareholder pockets; Procter & Gamble has paid and raised its dividend for 66 years in a row -- crowning the stock as a Dividend King and giving it one of the longest active dividend growth streaks. Procter & Gamble's payout ratio is manageable at 67%, and the business has a strong balance sheet carrying $6.7 billion in cash. The stock is a timeless blue chip built to last years into the future, making it an easy choice for anchoring a portfolio.

PG Dividend data by YCharts

3. Build your portfolio around this housing retailer

Home Depot (HD -1.67%) is North America's largest home improvement retailer. Maintaining and remodeling a home is expensive, but that's fueled Home Depot's growth over the years. Today the company is putting up serious numbers, generating $157 billion in trailing-12-month revenue. Retail is famously competitive, but Home Depot has excelled; revenue has grown by an average of 8% annually over the past decade. It successfully used its network of 2,319 stores to integrate e-commerce into its business while remaining profitable; the company is converting 9% of its sales into cash profits.

Home Depot has paid and raised its payout for 13 consecutive years, a trend that should continue. The company's dividend payout ratio is just 68%, leaving room for future increases. Home Depot also repurchases billions of dollars' worth of stock each year, taking those shares out of circulation and slowing the payout ratio's rise. Home Depot's steady performance makes it an outstanding dividend stock for getting real estate-related exposure in your portfolio.

HD Dividend data by YCharts

4. Enriching shareholders one burger at a time

McDonald's (MCD -0.02%) is arguably the world's most famous restaurant chain; it has more than 38,000 locations worldwide. The brand's fame and low-cost products have helped it grow through the economy's ups and downs since the 1950s.

Ironically, McDonald's most significant moneymaker isn't burgers; it runs a franchise business model, where people pay McDonald's for the intellectual property to set up restaurants. McDonald's gets rent and royalties from those restaurants, making the company more of a real estate business than anything else.

Consumers still jam the drive-thrus, making McDonald's locations durable real estate over the years. That's created excellent dividend growth; McDonald's is a Dividend Aristocrat with 47 consecutive dividend raises. The franchise model doesn't require a lot of cash to be maintained, so McDonald's sends most of its cash profits to shareholders.

The stock yields 2.2%, and the dividend takes up about 70% of cash flow. The Golden Arches is another boring but lucrative business (see a theme here?) that investors can hold without losing much sleep at night.

MCD Dividend data by YCharts

5. Paint your portfolio with this blue chip stock

Sherwin-Williams (SHW -1.07%) makes investing about as dull as watching paint dry, but it pays shareholders well. The company sells various brands of paints, sealants, and other industrial coatings for multiple applications.

Sales totaled more than $21 billion over the past four quarters, and 9% goes into the company's coffers as free cash flow. As an industrial stock, Sherwin-Williams can be sensitive to recessions, but its steady dividend is evidence of management that has navigated the business through the ups and downs.

Management has boosted the dividend for 44 straight years, yet another Dividend Aristocrat on this list. The moral of this story? You can build around dividend stocks with a proven model for success and the fundamentals to continue thriving. Sherwin-Williams has a 64% dividend payout ratio that keeps it affordable and doesn't limit its financial flexibility.

SHW Dividend data by YCharts

Sherwin-Williams isn't sitting still. It acquired Valspar, one of its largest competitors, in 2017, further anchoring its presence in the paint and coatings space. Investors can feel good owning the stock for its reliable dividend and the potential upside of active management.