Shares of GrowGeneration (GRWG -4.47%), which operates a chain of retail stores focused on the cannabis hydroponics growing business, are up 72% over the past 30 days, and there might be a lot more where that came from -- assuming the stock doesn't come falling right back down. According to its third-quarter earnings report, which was in line with analysts' estimates, sales are crashing, gross margin is narrowing, and its retail footprint is shrinking, all while management is unabashedly saying that more pain is on the way.

Nonetheless, GrowGeneration's shares are still cheap, and a new wave of cannabis legalization means that the company's market will soon grow even more. So is GrowGeneration a smart investment or is the stock's run-up a fluke that'll burn your money? Let's look at the evidence for both arguments.

Why this stock's rise might be unsustainable

When cannabis businesses set up their cultivation facilities, hydroponics equipment is key to maximizing the yield of their plants. Plus, it takes a lot of plant nutrients, grow lights, and environmental control apparatuses to keep marijuana plants happy and productive. And selling all of those critical products to businesses and consumers is how GrowGeneration is supposed to make money. Therefore, it makes sense that if the cannabis industry experiences a downturn, the company's value would take a hit, and vice versa -- though it also sells its products for general hydroponics use, which might mitigate the impact.

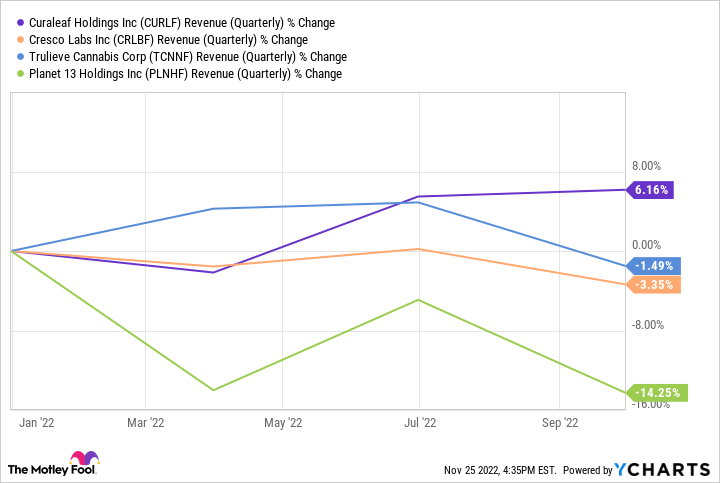

But take a look at this chart of some of the leading marijuana cultivation operators in the U.S. -- Curaleaf, Cresco Labs, Trulieve Cannabis, and Planet 13:

CURLF Revenue (Quarterly) data by YCharts

As you can see, quarterly revenue growth looks nothing like a boom. Based on sales growth for these companies, it's probably unlikely that those players are looking to purchase a lot of hydroponics equipment. And after reporting that its quarterly revenue declined by 39% year over year, GrowGeneration's management freely admits that the company "faced significant industry and economic headwinds" in 2022, and that "we're still not prepared to definitively say the worst of the cycle is behind us."

On average, the Wall Street analysts covering the stock on average expect revenue of $275.5 million this year, and $273.7 million next year, which means that their perspective is entirely compatible with what management is saying.

To make matters worse, GrowGeneration still isn't profitable, and its quarterly gross margin eroded over the past year, with the Q3 readout of 25.9% looking even weaker than the 29.4% in the same quarter last year. It's hard to see how any of the above would drive the stock to rise in any durable way. And that makes it very challenging to believe that the shares might be a buy right now.

The long term looks good, if you can stomach the near-term risk

The trick to GrowGeneration's recent rise is that its third-quarter update also included a revision of its 2022 sales forecast, with management's estimate rising from a low of $250 million to a new lower boundary of $270 million, a value that was actually toward the higher end of the range offered at the start of the year. Things aren't as bad as the company itself (or the market) expected. And even if there's no boom in sales, marijuana legalization was approved on ballot measures in a couple of states in the 2022 election earlier this month, so demand for hydroponics equipment is likely going to increase somewhat.

In principle, this company could still be an attractive long-term buy. Over the last 12 months, its cash burn was only around $4.1 million, and it even had free cash flow of $5.5 million in Q3. In other words, its $71 million in cash and equivalents means that it won't run out of money anytime soon, so its chances of surviving long enough for the marijuana industry to recover from its present doldrums are high.

Of course, you'll need to be quite comfortable with the risk of your investment taking an uncomfortable haircut in the next year or so. It's not very likely that GrowGeneration underestimates its sales this way for more than one year in a row. So stay away if you're prone to sleepless nights stemming from the performance of your growth stocks; GrowGeneration will need a good amount of time to deliver on its potential.