The dark cloud of a bear market has a silver lining: It offers investors opportunities to get in on great stocks for a bargain price. But sometimes there are opportunities that truly stand out. I'm talking about once-in-a decade sort of opportunities. And in these cases, you'll want to take action right away.

Today's bear market is handing us a few once-in-a-decade buying opportunities on a silver platter. Which stocks am I talking about? Big biotech Vertex Pharmaceuticals (VRTX -1.02%), cruise giant Carnival (CCL 1.49%) (CUK 1.34%), and electric vehicle (EV) leader Tesla (TSLA 12.06%). Let's take a look at why you should buy these players before 2023.

1. Vertex Pharmaceuticals

Vertex shares are heading for a 44% gain so far this year. Yes, the stock defied the bear market. But its potential to grow is far from over. The most bullish Wall Street predictions call for it to increase another 40% in the coming 12 months. Whether gains happen that quickly or not, you're still likely to benefit if you buy Vertex now and hold on for the long term.

Here's why. Vertex has reached a critical transition point. The company makes billions of dollars in revenue and profit selling cystic fibrosis (CF) treatments. And it may be about to add another big market to its repertoire.

Vertex is submitting exa-cel, its treatment candidate for blood disorders, to regulators in the U.S., the U.K., and Europe right now. If approved, exa-cel could become Vertex's next blockbuster drug -- and show that the company can succeed beyond CF.

Vertex also recently launched a phase 3 trial for its nonopioid candidate for pain management. Today's selection of painkillers is limited. So, this could be another major product on the horizon.

Right now clearly is a key moment in Vertex's story. If the company brings these new products to market, earnings and share price could climb.

2. Carnival

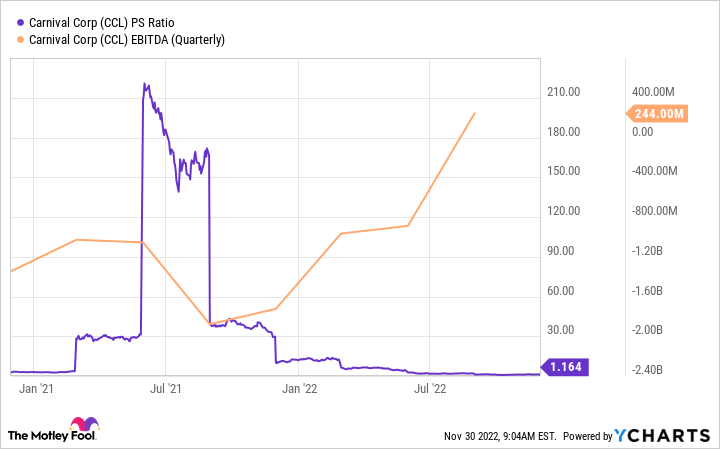

Carnival has fallen about 50% this year. The company's profit crashed and debt ballooned after it halted sailings earlier in the pandemic. Today, earnings are starting to recover -- yet the shares are trading at a lower level in relation to sales than they were when earnings were at a standstill.

CCL PS Ratio data by YCharts

And there are signs recovery truly is underway at the world's biggest cruise operator. Carnival's adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) turned positive in the third quarter for the first time since cruises resumed.

The company also reported an 80% increase in revenue from the second quarter. And, importantly, booking volumes are higher than the already strong levels Carnival reported back in 2019.

Of course, Carnival still remains a risky player. Rising interest rates could weigh on the company in two ways. They could make the company's variable rate borrowings more costly. And today's interest rate environment -- hurting the consumer's wallet -- may eventually impact bookings. So the most cautious investors may want to watch Carnival from the shore.

But if you're comfortable with some risk, today may be a once-in-a-decade opportunity to take the plunge before earnings and share price take off.

3. Tesla

Tesla shares are heading for a 44% decline this year. And the EV giant is trading at its cheapest ever in relation to trailing-12-month earnings. This is as revenue and profit advance.

Rivals have taken some market share from Tesla. But the company still holds an impressive 65% market share in the U.S. EV market -- and 86% share in the luxury EV market, according to S&P Global Mobility.

And the company has continued to report growth in spite of headwinds like higher costs and pressure from foreign exchange rates. Today's stronger dollar means sales abroad are worth less when brought back home.

In the third quarter, Tesla reported record revenue, operating profit, and free cash flow. The company's operating margin also came in at an industry-high level of more than 17%. And Tesla's vehicle deliveries continue to climb. In the quarter, they increased 42% to more than 343,000.

This momentum should help Tesla reach an important goal: The vehicle maker aims to reach 50% average annual growth in deliveries over time.

Tesla has managed well in a difficult environment. Once the economic situation improves, things should get easier for the company. Economic downturns are temporary situations. All of this means Tesla may be offering investors a once-in-a-decade buying opportunity before 2023.