After 11 volatile months for the stock market, it's hard to know what to expect for next year. Equities could sink even lower if the economy continues its not-so-impressive run. But the market, ever forward-looking, could also stage a comeback if investors start seeing the light at the end of the tunnel.

At this point, it's impossible to know if stocks have already bottomed out, or whether they will at some point next year, but buying shares of beaten-down stocks while they remain down is a great move regardless. Let's consider two stocks that deserve serious consideration: Etsy (ETSY 2.86%) and Pinterest (PINS 0.89%).

1. Etsy

E-commerce specialist Etsy was a bit of a market darling before the COVID-19 pandemic, and the switch to online shopping in the early days of the outbreak helped it gain even more prominence. But the company's progress has slowed since. That's hardly surprising. The coronavirus tailwind came to a halt, and consumers are spending less money due to inflation. Etsy's platform primarily offers vintage and handmade goods, which aren't necessarily cheap.

Still, Etsy's headwinds are temporary. Let's consider two reasons why. First, although it has slowed this year, the e-commerce industry is on a sustainable long-term growth trajectory supported by the convenience and massive library of choices it offers consumers while helping businesses reach a wider audience and decrease some expenses and costs.

But even in the U.S., where e-commerce penetration is higher than in most other places, it accounted for just 14.1% of total retail sales in the third quarter, leaving miles of whitespace ahead. Second, Etsy's niche -- vintage and handmade goods -- is highly specific, and the company has already built an ecosystem of buyers and sellers interested in such products. The value of its platform will increase as more merchants attract more clients to it, and vice versa, granting the company a powerful network effect.

Etsy estimates a $2 trillion total addressable market (TAM). The company generated $2.5 billion in revenue over the trailing-12-month period, an increase of 6.3% year over year and a tiny fraction of its TAM. Etsy has barely started to make headway within the vast opportunities it could profit from. And the company's shares and valuation remain down compared to their late-2021 highs, even after a recent uptick.

ETSY PE Ratio (Forward) data by YCharts.

Etsy is arguably still a bit pricey. To see this, consider it commands a price-to-earnings ratio of about 33 versus about 20 for the S&P 500. But Etsy's solid long-term prospects are worth a premium. Investors should strongly consider scooping up shares of the e-commerce specialist before it's too late.

2. Pinterest

Pinterest is a social media company with a much cleaner image than some of its competitors. It hasn't been involved in as many scandals, drama, or controversies as Twitter or Meta Platforms' Facebook. That's a good thing since Pinterest positions itself as a place to share positive content in the form of images that allow people to fuel various creative activities. The company makes money from advertising, an industry that isn't at its best right now.

Due to the tricky economic landscape, many businesses have decreased their ad spending and budgets. However, Pinterest is managing to grow its top line regardless. In the third quarter, the company's revenue increased by 8% year over year to about $685 million, partly due to its average revenue per user coming in at $1.56, 11% higher than the prior-year quarter. Squeezing more money out of its existing user base is one way in which Pinterest can continue.

And it can continue to grow by leaps and bounds in this area. The company is looking to expand its average revenue per user by increasing engagement, particularly among those users who come to the platform more regularly. Of course, a lot will depend on Pinterest's ability to increase its user base. In the third quarter, it had 445 million monthly active users (MAUs), a number that remained flat compared to the year-ago period but jumped by 12 million compared to the second quarter.

Pinterest went through a period of declining year-over-year and sequential subscriber growth, but things seem to be stabilizing. Further, management said a Google search algorithm that came into effect in November 2021 impacted its MAUs growth, a problem it expects to solve by year-end. That should allow Pinterest to keep attracting more users. It's also worth noting that the company is well-positioned to transform its platform into an e-commerce hub.

Users on Pinterest freely share, save, and collect images of the things they like, allowing businesses to target them with ads referencing similar products. Pinterest's desire to progress in this area may be why it appointed Bill Ready as its new CEO in June. Ready, a former Alphabet executive, is an "online commerce expert," according to the company. E-commerce is another major long-term opportunity for the social media giant.

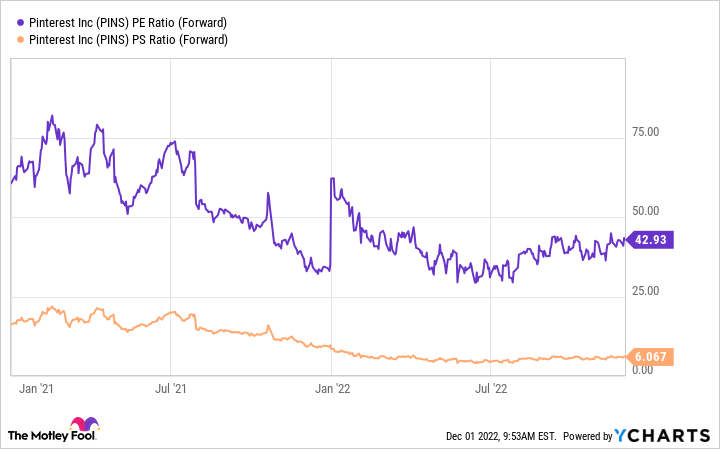

Pinterest's stock has also been rebounding in the past few months, but it remains way below its early-2021 highs.

PINS PE Ratio (Forward) data by YCharts.

Will Pinterest's recent rally continue into next year? Perhaps not. But I expect the company will ride the next bull market whenever it comes. Don't wait too long before buying some Pinterest shares.