As of this writing, 65 companies form an elite group of dividend stocks known as Dividend Aristocrats. The rules for inclusion in this club are simple: Companies have to pay a dividend every year for at least 25 years while also increasing the dividend every year during that time. As long as the streak is kept alive, the company remains on the Dividend Aristocrats list.

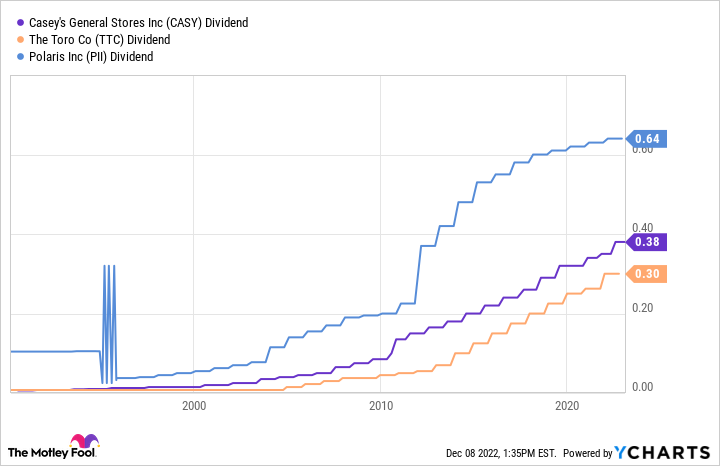

However, there is one other qualification that investors are less familiar with. All Dividend Aristocrats must be members of the S&P 500. And that's too bad for Casey's General Stores (CASY 0.88%), Toro (TTC -0.21%), and Polaris (PII -1.05%), since they're not in the S&P 500. If they were S&P 500 stocks, they'd be card-carrying members of the Dividend Aristocrats right now.

CASY Dividend data by YCharts

If you love Dividend Aristocrats but are tired of cycling through the same 65 companies for investment ideas, then Casey's, Toro, and Polaris are alternative ideas that likely meet your high standards. Here's why.

1. Casey's General Stores

Casey's is an Iowa-based convenience store chain. It caters to small towns in the U.S. Midwest that may be a long way from the conveniences of larger cities. Therefore, Casey's sells a little bit of everything, such as gas, hot pizza, and a variety of everyday household essentials.

Casey's is a great business in any economy -- people always need food and gas, and there are fewer alternatives in the small towns Casey's operates in. And it's a stock that has rewarded shareholders for a long time. Casey's started paying a dividend way back in 1990 and has paid and raised it every year since.

Typically, Casey's is a low-growth company. Fiscal 2022 (which ended April 30, 2022) was an exception. In fiscal 2022, Casey's added 228 new locations -- its most ever in a single year. However, 207 of these locations were acquired from other companies. So don't expect that kind of growth going forward. Indeed, through the first two quarters of fiscal 2023 (ended Oct. 31), it's only added 11 net new locations, bringing its total to 2,463.

Casey's doesn't need outsized revenue growth to create shareholder value. The business is stable and profitable. And management is authorized to repurchase $400 million in stock right now.

Moreover, Casey's has a dividend payout ratio of just 14% (a healthy payout ratio is generally considered to be anything below 50%). In short, the company has ample room to raise its dividend for many more years, making Casey's stock a great option for someone looking for dividend growth.

2. Toro

Toro is a global outdoors business selling lawnmowers, snowblowers, lighting systems, and more. And it's been in business for over 100 years. However, even after being around for a century, the business still hasn't found its ceiling. The company generated $3.3 billion in net sales through the first three quarters of 2022 (ended July 29), which is a record for Toro.

Although more than 100 years old, Toro is still leaning into future technologies like autonomous lawnmowers and battery-powered equipment. And perhaps its ongoing bent toward innovation is why Toro resonates with professionals. For perspective, 76% of the company's sales came from professional customers in the third quarter of 2022. And professional sales were up an impressive 23% year over year.

One thing to watch with Toro is its profitability. Through the first three quarters of 2022, its net income of $326 million is down nearly 7% from the comparable period of 2021. In short, the company doesn't have many levers to pull to improve its margins.

Indeed, over the past five years, Toro's net income has grown slower than revenue.

TTC Net Income (TTM) data by YCharts

The silver lining for dividend investors is Toro's payout ratio. It's not as low as Casey's, but it's still quite low at only 32% -- not bad for a company that's raised its dividend every year for 27 years.

Overall, I'd say demand for Toro's products is as strong as ever, and the company looks like it will keep building on its 100-year legacy. And considering its payout ratio is still low, I expect it will keep increasing its dividend for years to come, which again might make this an ideal investment for investors interested in dividend growth more than dividend yield.

3. Polaris

Investors looking for significant dividend income now may not be content with Casey's or Toro. The dividend yields for these two stocks are low at 0.6% and 1.1% respectively. If you're looking for something juicier, then Polaris and its dividend, yielding 2.4%, might be more to your liking.

Like Toro, Polaris has raised its dividend for 27 consecutive years, and its a streak that can continue as well. Keeping the dividend streak alive is expressly stated by management as a top priority for capital deployment.

A lot of Polaris' business comes from customers buying off-road vehicles, motorcycles, and boats for recreation. This kind of business tends to pull back during recessions, so investors could see some fluctuations in operating results. Moreover, Polaris is already a leader in the global power sports industry -- one that's projected to only grow modestly in coming years.

These factors could limit revenue growth for Polaris in coming years. However, the company does have immediate opportunities for profit growth. On the gross profit side of the equation, it's fixing supply chain issues and raising prices to cover the increase in its costs, which should bring its margin back to more historical levels. And regarding earnings per share, it can grow this profitability metric by repurchasing shares. It's authorized to repurchase $475 million in shares right now.

I believe Polaris' potentially limited growth is adequately accounted for in the stock's valuation. It trades at just 18 times trailing earnings, compared to about 20 times earnings for the S&P 500 -- a below-average valuation.

Perhaps the best part about Polaris from a dividend investment perspective -- and Casey's and Toro for that matter -- is its payout ratio is low at 31%. And all three of these companies have stable businesses that have stood the test of time. I fully expect all three to remain resilient.

Dividend growth is clearly a priority for this trio, and all three have room to keep increasing the payouts in coming years. This is why all three of these are top stocks for Dividend Aristocrat investors to consider today.