Like many in the technology sector, advertising tech firm The Trade Desk (TTD 1.41%) saw its stock price plunge in 2022. At one point, the company's stock exceeded $100 per share in 2021, but several macroeconomic factors this year pummeled shares to a 52-week low of $39.

These macroeconomic conditions, such as high inflation, contributed to a downturn in the digital advertising industry. Moreover, uncertainty around how the industry is dealing with rising consumer privacy concerns contributed to The Trade Desk's stock decline.

How well The Trade Desk navigates these factors affects the company's ability to maintain revenue growth through stormy economic seas. Looking at The Trade Desk's performance through this turbulent year provides insight into what investors can look forward to in 2023 and beyond.

The Trade Desk's revenue performance

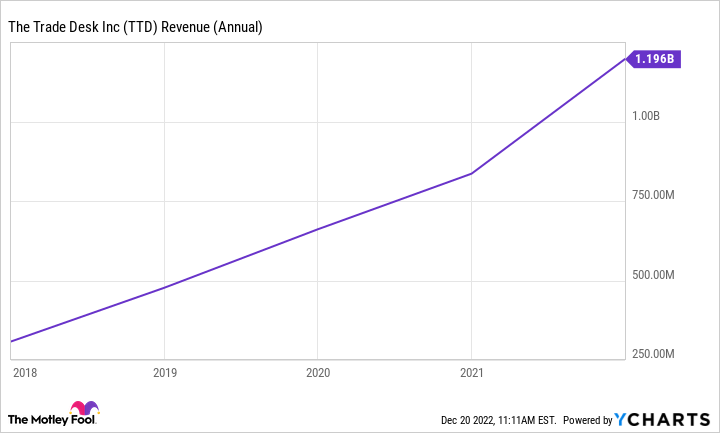

Although The Trade Desk's stock price was a roller coaster of ups and downs in 2022, the company proved resilient in the face of an uncertain economy, delivering double-digit, year-over-year revenue growth. The Trade Desk saw revenue rise 36% through three quarters this year, reaching $1.1 billion. Last year, the company didn't hit $1 billion in sales until the fourth quarter.

This revenue growth is astounding given, in 2021, the company saw a massive 55% year-over-year sales increase through three quarters. The Trade Desk's revenue growth last year benefited from consumers spending more time online due to the coronavirus pandemic.

This created a spike in demand for digital advertising as marketers rushed to put ads where customers were. As a result, the advertising industry's digital ad spending growth hit an all-time high in 2021.

With consumers gradually returning to pre-pandemic behavior this year, 2022's global digital ad spending growth cooled off. This makes The Trade Desk's 2022 revenue jump over 2021's high bar particularly impressive as it continues years of consistent revenue growth.

Data by YCharts.

The Trade Desk's answer to digital privacy

A key challenge to The Trade Desk's ongoing revenue growth is how it's addressing consumer privacy concerns while maintaining an advertiser's ability to target consumers with ads. The digital advertising industry is currently undergoing a massive transformation in terms of how it will target consumers in the future, since the traditional use of browser-based, third-party cookies is disappearing.

Apple implemented the ability to opt out of ad targeting by apps on its iPhone last year. So many customers adopted it that Facebook's parent, Meta Platforms, suffered a significant loss of revenue. Alphabet's industry-leading Google Chrome browser is implementing similar changes in the future.

The Trade Desk's answer to the elimination of third-party cookies is its Universal ID 2.0 (UID2) product. UID2 will encrypt a consumer's email address and assign an identifier to it, which is then used by advertisers for digital targeting.

With UID2, advertisers don't get direct access to consumer information, affording consumers with a measure of privacy, while maintaining accurate targeting for ads. UID2 has already been adopted by several large firms in the advertising industry, including Nielsen, PubMatic, and the Omicron Media Group.

The Trade Desk's approach with UID2 helped it secure the contract to provide digital advertising for the Walt Disney Company's streaming service, Disney+. UID2 allows Disney to leverage its proprietary customer data for ad targeting, yet keep its customer identities shielded from marketers buying digital ad space from Disney. Disney+ began showing ads this month, which will contribute to The Trade Desk's fourth-quarter earnings.

More growth for The Trade Desk

Along with revenue growth, The Trade Desk is growing free cash flow. Over the trailing 12 months, The Trade Desk saw free cash flow increase 53% over the prior year, reaching nearly $500 million.

The Trade Desk's success is thanks to the growth of connected TV (CTV). With the advent of streaming, many consumers have cut the cord from cable to CTV, and advertisers are following suit, shifting their spending away from linear television. Industry forecasts estimate CTV ad spending will more than double from last year's $17.2 billion to $43.6 billion by 2026.

This tailwind is already helping The Trade Desk. According to CEO Jeff Green, CTV is The Trade Desk's "fastest growing channel and it has rapidly become our largest."

In addition, the digital ad industry's overall growth from $521 billion in ad spending last year to $876 billion in 2026, combined with The Trade Desk's CTV and UID2 successes, means the company is capable of maintaining its history of revenue growth for years. Its ability to increase revenue amid this year's uncertain economic environment shows the company is resilient. These factors make The Trade Desk look like a good buy.