In cyclical fashion, we find ourselves yet again in the midst of a crypto winter. And as they have in previous crypto winters, critics and naysayers contend that Bitcoin (BTC -2.55%) is dead, that it can't rise again, that it's a Ponzi scheme heading to zero, and that it will never recover.

All of these jabs at Bitcoin have been occurring since it was created in 2009, and yet all it has done since is go on a historical run and become the best-performing asset in history. Bitcoin forces us to think about what money actually is and how it should function. Should money be inflated at the desire of any government or central authority? Is money just an idea, or should it be backed by tangible assets? What makes one form of currency better than another?

Bitcoin has been touted by some as a near-perfect form of currency. Even with its volatility, which is viewed as a characteristic of new assets that eventually wanes, there is reason to believe that Bitcoin will once again rise from the ashes and reward investors who are patient and hold for the long haul.

One of Bitcoin's key features as sound money is its inherent scarcity. Ingrained in its code is a hard limit: There will only ever be a maximum of 21 million bitcoins in circulation. The only way this could be changed is if 51% of nodes running the Bitcoin network were in agreement, and I don't think that would ever happen. It's one of the crucial aspects that make Bitcoin, Bitcoin.

That limited-supply argument helped propel Bitcoin's price during the last 14 years. Since 2009, demand for Bitcoin has only increased, and it will likely continue as it remains resilient, proves to be a viable store of value, and people around the world look for more sound forms of currency.

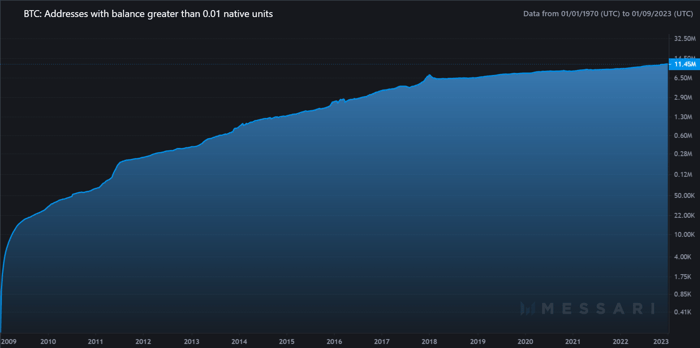

To better showcase the dynamics behind Bitcoin's supply and demand, consider the two charts below.

Chart No. 1: Rising demand

There are a handful of metrics that could be used to display the growth in Bitcoin's demand. You might see charts showing the number of active addresses (wallets that send or receive Bitcoin during a specified period), transaction volume, or some other statistic trying to capture a glimpse of activity on the Bitcoin blockchain.

However, while I believe Bitcoin could eventually become a viable form of currency for everyday transactions, most investors who favor it today are drawn to it as a store of value. So to capture its increased demand as a store of value, below is a chart of all Bitcoin addresses that currently hold at least 0.01 bitcoins -- and it's currently sitting at an all-time high.

Image source: Messari.

You will notice that the chart is displayed on a logarithmic scale. If it were plotted on a linear scale, the line would show a continuous ascension from left to right. Unlike the linear charts that you may be more used to viewing, logarithmic ones are better suited to displaying wide ranges of values or when one wishes to describe the rate at which something grows.

As you can see, the number of addresses holding at least 0.01 Bitcoins increased the most early on in the token's history but since then, it has continued to rise even in the midst of the current crypto winter. At more than 11 million today, this metric has risen by 70% in the last five years and is up 3,000% since 2013. Talk about demand.

Chart No. 2: Outstanding supply

Now let's look at supply. The chart below shows Bitcoin's shrinking supply-side growth. With only 21 million bitcoins set to ever be created, there can only be so many to meet the appetite of increased demand -- especially considering that around 91% of all Bitcoins have already been mined.

Image source: Messari.

Again, this graph is plotted on a logarithmic scale because it is more sensitive for displaying the rate of change. Notice the difference in slope compared to the other chart? That's because the rate at which new bitcoins enter circulation is decreasing and will only continue to slow. Rather than being inflationary, Bitcoin is considered a deflationary asset -- a great quality for a store of value to possess. Deflationary assets increase an individual's purchasing power over time rather than decreasing it. This is the exact opposite of just about every government-issued currency.

There are around 19.25 million Bitcoin in circulation today, leaving only 1.75 million more to enter the supply until around the year 2140, when the last Bitcoin will be mined. Given that near-zero coin inflation, Bitcoin could benefit from increased demand and limited supply well into the future. Thanks to increased demand, Bitcoin's price has skyrocketed over the last decade, and I believe it will climb again as it becomes more scarce. That's why I'm a Bitcoin buyer right now.