Warren Buffett has a case for the title of the greatest investor of all time; understandably, a $110 billion net worth gets you a lot of respect. The Oracle of Omaha owns many stocks, but it could be his holding in Bank of America (BAC -1.42%) that gets me the most excited. The banking giant is Berkshire Hathaway's largest holding other than Apple.

So what has me excited? Or, more importantly, why should you get excited about Bank of America stock? To put it plainly, Wall Street isn't giving Bank of America enough respect. I'll show you how that is and why the stock could be poised to deliver strong investment returns.

Disrespect? Look at that valuation!

Bank of America stock trades at a price-to-book ratio of just over 1.1, roughly on par with the stock's average over the past five years. However, partially due to rising interest rates, Bank of America is achieving a higher return on equity than its average in that period. In other words, the company is more profitable, but the stock's valuation doesn't reflect it.

BAC Price to Book Value data by YCharts

While bank earnings can be inconsistent, one can compare Bank of America to the broader market. The stock's price-to-earnings ratio is just 11. How do we know that's cheap? The S&P 500 trades at a forward P/E of 17; consider that analysts are pegging estimated earnings growth for the S&P 500 at 5.5% in 2023. Analysts' estimates for Bank of America call for more than 14% earnings growth this year.

Said another way, investors are willing to pay more than twice as much for a dollar of earnings from the S&P 500 versus Bank of America, despite the latter growing more than twice as fast. A fair question might be, why? Investors could be wary of banks based on the risk that the economy falls into a recession, and the threat of defaulting loans could frighten those who still remember the catastrophe of the Great Recession more than a decade ago, which spurred controversial bailouts of flailing lenders.

But times have changed. The Dodd-Frank Act was enacted shortly after the Great Recession to prevent a future financial sector collapse by giving regulators more authority in overseeing large banks. Additionally, Bank of America has proven excellent at managing its capital, increasing its common equity tier 1 ratio to 11% at the end of the third quarter, above its required 10.4%. This means that the bank is better equipped to endure potential financial distress. No investment is risk-free, but Bank of America's financials seem to stand on solid ground, which Buffett seemingly agrees with, given the bank's 10.8% weighting in Berkshire's enormous investment portfolio.

More profits on the way?

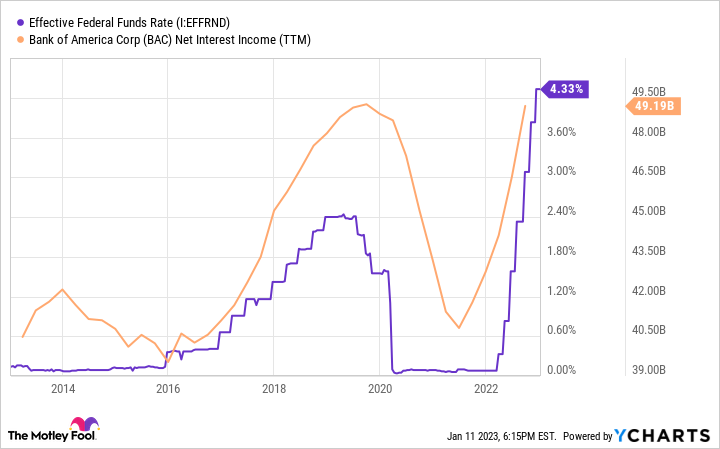

Rising interest rates have been the talk of Wall Street for about a year now, but fewer folks are discussing how that could benefit Bank of America. As a rule of thumb, rising interest rates are generally good for banks, which benefit from a wider spread between their cost of deposits and the interest earned on loans. You can see below how net interest income directly correlates with the federal funds rate, the rate set by the Federal Reserve that determines how much banks charge each other for overnight loans. In other words, Bank of America makes more money when rates rise.

Effective Federal Funds Rate data by YCharts

Some Fed officials believe the rate could top out at around 5% in 2023, which still leaves quite a bit of room from where it currently sits. The most recent consumer price index report, a widely watched inflation measure, came in as expected at 5.7% for December (excluding energy and food prices), showing that inflation is cooling -- but not yet down to the Fed's 2% target. More rate increases could further line Bank of America's pockets.

Spoon-feeding cash to shareholders

Bank of America is very profitable, generating billions in annual profit. After any capital needs are addressed, it sends the leftover earnings to shareholders through share repurchases and dividends. Not only has the company reduced its shares outstanding by 21% during the past five years, but the dividend has increased 83%, rising for nine straight years.

BAC Shares Outstanding data by YCharts

The dividend yield is 2.6% at the current share price, and analysts forecast earnings-per-share growth to average 7% annually during the next three to five years. That alone will earn investors nearly 10% in yearly total returns, and we haven't factored in a potential rebound in the stock's depressed valuation. When you add it all up, Bank of America looks like a true blue-chip financial stock that investors can own in confidence, much like Warren Buffett himself does.