While a recession in 2023 is far from a foregone conclusion, the possibility of a mild economic pullback at some point this year is a key concern for investors. Fortunately, equities that pay out above-average dividends frequently make excellent safe-haven investments during uncertain economic times.

For a host of reasons, stocks and exchange-traded funds (ETFs) with elevated shareholder distributions often produce market-beating returns on capital during economic downturns. First and foremost, equities that pay dividends are generally associated with dependable free cash flows, although companies operating in cyclical industries like shipping or manufacturing are clear exceptions to this rule of thumb.

Image source: Getty Images.

Second, most management teams are reluctant to reduce dividend payouts. A dividend cut implies that a company is under financial duress -- and that's a signal management teams generally try to avoid sending to shareholders. Third, above-average dividend yields can help mitigate short-term stock price declines.

With all this in mind, I think income-seeking investors may want to consider adding Guggenheim Strategic Opportunities Fund (GOF -0.62%) and Fidus Investment (FDUS -0.30%) to their portfolios this year. Here's why.

Guggenheim Strategic Opportunities Fund

Closed-end funds (CEFs) are a popular vehicle among income investors, largely because they tend to dole out higher-than-normal dividends due to their frequent use of leverage to amplify returns.

Guggenheim Strategic Opportunities is a prime example. This leveraged closed-end mutual fund has paid out a stable monthly distribution of $0.1821 per share since mid-2013. At current share prices, that equates to an annualized yield of 13.5%.

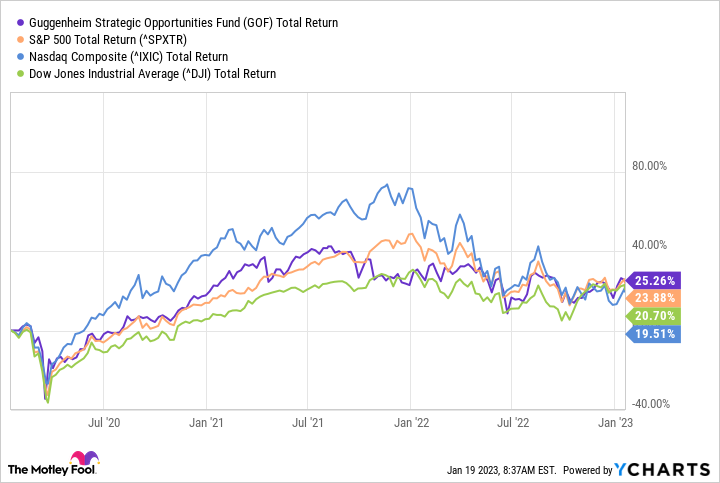

From a total return standpoint, Guggenheim Strategic Opportunities Fund has generated slightly better returns than all of the major U.S. stock indices over the past three years.

GOF Total Return Level data by YCharts.

Guggenheim Strategic Opportunities Fund's net asset value has declined by 19.7% over the past 12 months. Moreover, the fund's share price has fallen by 18.4%. Despite that, it still trades at a hefty premium of approximately 23.3% at the time of this writing. In the world of CEFs, premiums above 10% are considered "extreme" by most money managers.

Guggenheim Strategic Opportunities' sizable premium says a lot about how investors view this investment vehicle. While it would be easy to construe it as a red flag, I think it shows that investors trust management's ability to successfully navigate this turbulent market. The fact of the matter is that this fund has consistently paid out the exact same distribution to shareholders for 117 straight months. Moreover, the CEF has never reduced its monthly payouts since its inception in 2007.

The bottom line is that Guggenheim Strategic Opportunities has proven to be a reliable income generator in a wide variety of market conditions. This simple fact suggests that 2023 will be another market-beating year for the fund and its shareholders.

Fidus Investment

Fidus Investment is a closed-end business development company. Its core business centers around providing customized debt and equity financing solutions to lower middle market companies -- businesses with annual revenues in the $5 million to $50 million range.

Fidus' shares have generated better overall returns than every major U.S. stock index except the Nasdaq Composite over the past 10 years. In 2022, Fidus' shares yielded a handsome 17.2% total return on capital for shareholders; meanwhile, the S&P 500 dipped by approximately 18.1% last year.

How is Fidus crushing the broader markets? First, it pays a dividend that yields 9.54% at current share prices. That's definitely an attractive yield for income investors. Second, the company's top line is on track to rise by 16.5% in 2023. As a result, Fidus ought to have ample free cash flow to support its above-average distribution.

Keeping with this theme, the company's trailing 12-month payout ratio stands at a mere 42%. So, with income set to rise even further in 2023, Fidus should have no trouble covering its impressive payout to shareholders this year. That kind of built-in safety margin could prove to be a major catalyst for the company's shares in 2023.