Not many semiconductor companies manufacture their own chips anymore. Continually building and upgrading factories to keep up with the latest technology is an expensive proposition, to say the least. A single extreme ultraviolet (EUV) lithography machine, used to make the most advanced chips, costs as much as $200 million. The total cost of a new advanced semiconductor fabrication plant (fab) is measured in billions of dollars.

Tough to topple

This prohibitive barrier to entry is the strongest argument for investing in semiconductor foundry leader Taiwan Semiconductor (TSM -0.34%). TSMC manufactures more than 50% of all chips made by foundries. The nearest competitor, Samsung, isn't even close.

Both Samsung and Intel are gunning for TSMC, but beyond those two chip companies, real competition is relegated to more mature manufacturing processes. No. 4 player GlobalFoundries, for example, stopped developing advanced 7nm manufacturing tech in 2018 to focus on existing manufacturing processes. Plenty of chips use older manufacturing tech, but the latest CPUs, GPUs, and other high-performance chips require bleeding-edge tech to push performance and efficiency to new heights.

TSMC makes a lot of money from these advanced manufacturing nodes. The company is essentially the only option for customers like Apple, which now uses homegrown chip designs for its iPhones, iPads, and MacBooks. The incredible performance of those chips is partly due to TSMC's manufacturing edge over the competition.

In TSMC's latest quarter, 54% of revenue came from the company's advanced nodes, which include its 7nm and 5nm technologies. Profitability is incredible. On $19.9 billion of total revenue, TSMC managed a net profit margin of 47.3%. When you're the only game in town, customers have little choice but to pay up. Back in October, Apple reportedly gave in to TSMC's demands for price increases, an impressive display of the company's pricing power.

The downturn will sting

While TSMC will remain the market leader for the foreseeable future, its pandemic-era profits may be an anomaly. TrendForce expects global foundry revenue to slump 4% in 2023, the first decline since 2019. Global foundry revenue surged by at least 24% in 2020, 2021, and 2022.

What was a severe shortage of semiconductor manufacturing capacity during the pandemic has given way to a bit of a glut. DigiTimes reported in November that TSMC's utilization rate for its 7nm process nodes had fallen below 50% as customers cut orders. The PC market is in shambles, with shipments crashing 28.5% year over year in the fourth quarter. Demand for smartphones is weak as well.

TSMC expects revenue to drop as much as 5% year over year in Q1, and the company trimmed its capital spending plans to account for weak demand. But with supply now seemingly well above demand for the process nodes that account for the bulk of the company's revenue, a significant decline in profit this year appears likely.

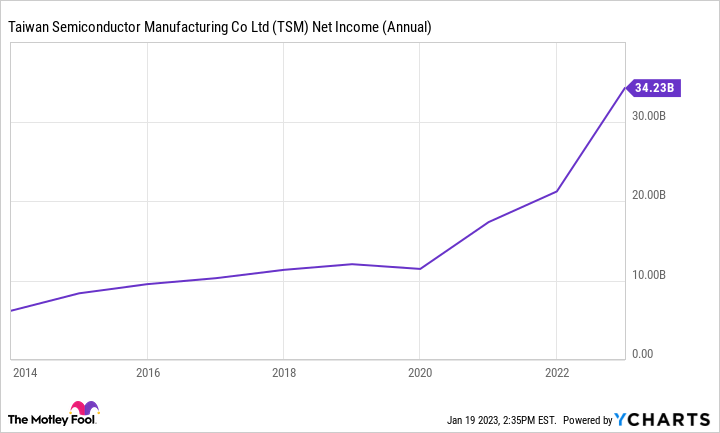

TSM Net Income (Annual) data by YCharts

The spike in profits TSMC enjoyed over the past few years could fade away, bringing margins back to pre-pandemic levels or worse if the downturn lasts longer than expected. Looking further ahead, heavy spending from Samsung and Intel to catch up could eventually put pressure on the market leader.

TSMC generated about $34 billion of net income in fiscal 2022. At the current stock price, the price-to-earnings (P/E) ratio sits at roughly 13. That may seem like a bargain for a company as dominant as TSMC, but investors shouldn't ignore the possibility that the company's sky-high profits won't last.