If you sold Roku (ROKU 1.91%) stock last year, you're not alone. Shares of the leading streaming platform tumbled 82% last year, and the sell-off in the stock was somewhat deserved.

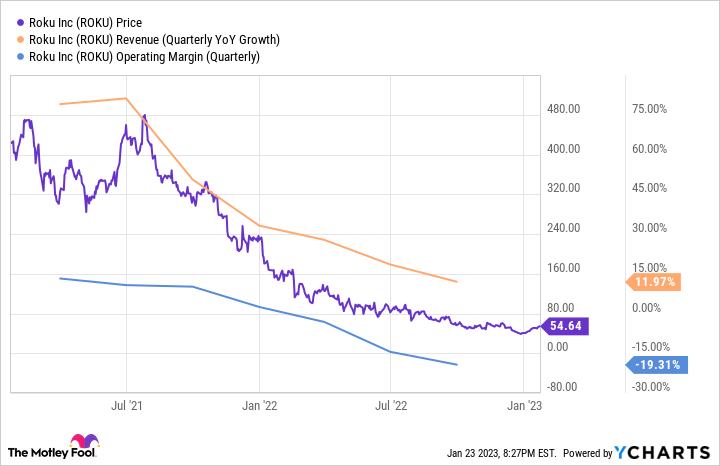

After a boom during the pandemic, the stock crashed as revenue growth slowed significantly through 2022, and profits turned into losses after the company stepped up investments in its growth. The chart below shows how revenue growth and profitability have weakened over the last two years as the stock price has fallen.

Even worse, Roku expects revenue growth in the fourth quarter to turn negative due to weakness in the broader digital ad network as peers like Alphabet and Meta Platforms have also reported dramatically decelerating revenue growth. And yet, despite the headwinds in the business, interest in the streaming platform is stronger than you might think.

The company just crossed 70 million active accounts on the platform earlier this month, adding 9.9 million new accounts in 2022, a year when subscriber growth was sluggish at major services like Netflix (NFLX -0.51%) and Walt Disney's Disney+. The 9.9 million accounts added was actually better than the company did in 2021. Viewing time on the platform was also up solidly with streaming hours for 2022 reaching 87.4 million, an increase of 19% from the year before.

As those numbers show, Roku is delivering steady growth even if the financial numbers seem to say otherwise.

Image source: Getty Images.

Roku's opportunity is still massive

Based on the stock's plunge last year, investors seem to believe Roku's best days are behind it. The growth story is mostly over, they seem to think, especially given the challenges streamers like Netflix are facing, and the company will struggle to turn a profit. At this point, the stock is down nearly two-thirds from where it was at the start of 2020 before the pandemic happened.

However, if you're thinking of throwing in the towel on Roku, take a look at this chart below from Netflix.

Image source: Netflix.

The chart above shows what percentage of TV consumption takes place through Netflix, other streaming, and linear. As you can see, even in the U.S., streaming still makes up less than 40% of total TV time, showing there's a significant opportunity for the streaming industry.

The chart shows how Netflix still has a lot of room to gain market share, but it seems even more bullish for Roku as a distribution platform. That's because Roku's model is driven partly by advertising, which is dependent on viewing time. As more viewing time shifts from linear TV to streaming, the company will certainly benefit.

Even better, streaming leaders like Disney and Netflix have just launched advertising tiers, and demand for those should go up over time. Additionally, advertising video-on-demand consumption should also go up as platforms like Warner Bros. Discovery's HBO Max have also recently launched ad tiers.

Why Roku stock is a buy

Roku has proven its ability to grow streaming consumption even in a difficult environment, and the remaining transition from linear TV to streaming will continue to drive its growth.

Eventually, the disconnect between viewing time on the platform and the underlying business performance, as measured by revenue and profits, will disappear, and the correlation will return.

Roku is set to report fourth-quarter earnings, and analysts expect both a wide loss on the bottom line and a decline in revenue. With the weakness in the ad market, it will take at least a few quarters for the business to get back to growth, but the long-term opportunity is clear.

TV consumption is gradually shifting from linear TV to streaming, as is television advertising. As the leading streaming distribution platform in the U.S., Canada, and, Mexico, Roku is poised to capture that opportunity.

As the recent results show, it won't necessarily be a straight path, but Roku will get there over time.