Mastercard (MA 1.15%) and Visa (V 0.62%) are two giants of the financial services world and account for a huge portion of the card-based payments market. Which stock will offer investors better bang for their buck? Read on for differing bull cases from two Motley Fool contributors.

Visa is one of the most profitable businesses in the world

Parkev Tatevosian: Visa has spent decades cultivating relationships with merchants and consumers. The result is a financial transaction network that spans the world. Instead of using cash for purchases, which can be cumbersome, time-consuming, and unsafe, consumers can whip out their Visa cards and pay instantly. That can partly explain why Visa's revenue has soared from $11.8 billion in 2013 to $29.3 billion in 2022.

Since much of the investment to build out the network was made decades ago, Visa's business is incredibly profitable now. Between 2013 and 2022, the company averaged an operating profit margin of 65.5%. You would be hard-pressed to find many companies with operating profit margins this high. The good news for investors is that competition in the industry is light. Its main rival, Mastercard, is not actively offering promotions or incentives, or undertaking expensive ad campaigns to take market share.

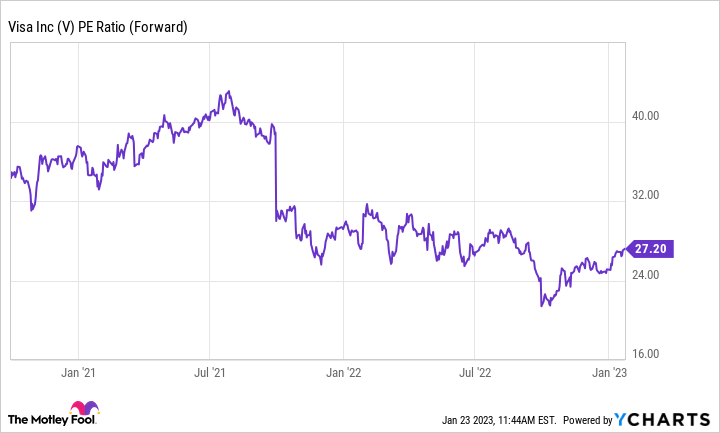

V PE Ratio (Forward) data by YCharts

That could lead to persistently high profit margins for several years, perhaps decades. The stock is trading at a forward price-to-earnings ratio of 27, which is a fair price for a company with excellent profit prospects. With the risks of a recession rising in many economies, Visa's revenue growth could slow. However, since the company makes its money taking a percentage of sales, higher inflation is a tailwind for Visa.

Mastercard could post better growth

Keith Noonan: Mastercard is the world's second-largest payment processor, trailing behind only Visa in the category. While Visa's edge in card-based payments gives it an edge in terms of generating revenue and net income, Mastercard may have an easier time gaining share at this point than its chief rival.

Mastercard also generates more of its revenue from markets outside the U.S. This could very well prove to be a negative in the short term depending on what the global economy does over the next year and depending on how trends bear out in different regions, but the geographic composition of Mastercard's business could also put it in better position to capitalize on the growth of the global middle class over the long term.

With its forward price-to-earnings ratio sitting at roughly 31, Mastercard looks more expensive than Visa along that metric, and the market seems to be willing to pay somewhat of a premium for both companies due to their strong competitive positioning and appealing long-term growth prospects. But there's a reason that the market is willing to assign a higher multiple to Mastercard.

MA PEG Ratio (Forward) data by YCharts

In the near future at least, analysts generally expect Mastercard to grow earnings per share at faster rate. As the chart above illustrates, the company has a significantly lower forward price/earnings-to-growth (PEG) ratio than Visa. A PEG ratio below 1 is often a sign that a stock is undervalued, and this metric supports the case that Mastercard is actually the cheaper of the two stocks despite carrying a higher forward earnings multiple overall.

Which stock is the better buy?

For investors seeking broad-based exposure to the financial services space, buying both Mastercard and Visa stocks could be the right move. Both companies have historically proven to be relatively recession resistant, and both are positioned to benefit from the long-term growth of the global economy. Each company should also continue to benefit as cash continues to account for a decreasing portion of spending and commerce continues to migrate to digital channels.

If you're only looking to add one of these stocks to your portfolio, the best way to pick between the two is to weigh their business strengths, growth outlooks, and valuation profiles. Visa and Mastercard have a lot in common, but you may decide that one stock or the other is a better fit for your personal risk tolerance and portfolio goals.