Walt Disney (DIS -0.45%) stock fell 43.9% in 2022, underperforming the S&P 500's decline of 19.4%. Investors can lay some of the blame on Disney+, where spending on new content led to a $4 billion operating loss for Disney's direct-to-consumer segment in fiscal 2022 (ended Oct. 1).

Disney's weak financial results led to former CEO Bog Iger coming back to take over the reins from Bob Chapek in November. From 2006 through 2019, Iger orchestrated the acquisitions of Pixar, Marvel Entertainment, Lucasfilm, and Twenty-First Century Fox's entertainment assets, which turned out to be game-changing deals for Disney's success at the box office over the last 10 years.

However, Iger's priorities will be different this time around during his planned two-year stay as CEO. Here's what to watch and why the stock has significant potential upside.

Disney aims to improve streaming profits

Disney stock is up 21.7% year to date, and it could climb higher as Iger executes his plan to lower costs and boost profits.

Before Iger's return, Disney was already shifting its streaming strategy to grow profits over emphasizing subscriber growth. In the last earnings report, Chapek declared that the direct-to-consumer segment had reached peak operating losses and would begin to show improvement going forward.

Part of that plan involved price increases to subscription plans and the launch of the ad-supported Disney+ tier in December. However, given the softness in the advertising market right now, the ad-supported tier probably won't contribute meaningfully to Disney's bottom line this year.

Nonetheless, investors expect to see narrowing losses in the direct-to-consumer segment, which is why the stock is up year to date. The direct-to-consumer business reported an operating loss of nearly $1.5 billion in the fiscal fourth quarter, down from a loss of $630 million in the year-ago quarter. The escalating losses in streaming, included in Disney's media and entertainment segment, weighed on the company's total profit and led to the collapse in Disney's stock.

| Segment | Fiscal Q4 Revenue | Fiscal Q4 Operating Profit |

|---|---|---|

| Disney media and entertainment distribution | $12.72 billion | $83 million |

| Disney parks, experiences, and products | $7.42 billion | $1.51 billion |

| Total segment revenue | $20.15 billion | $1.59 billion |

Data source: Walt Disney. Chart by author.

On top of the plan to reverse streaming losses, Iger has said he wants to give more content decision-making back to the creative teams, whereas, under Chapek, decisions were centralized under Disney's Chairman of Media and Entertainment Distribution. Iger's change is intended to improve efficiency in content production and lower costs. Most importantly, it should enhance Disney's storytelling capabilities -- the heart of the company's intrinsic value -- which should pay dividends well beyond 2023.

Disney stock is undervalued

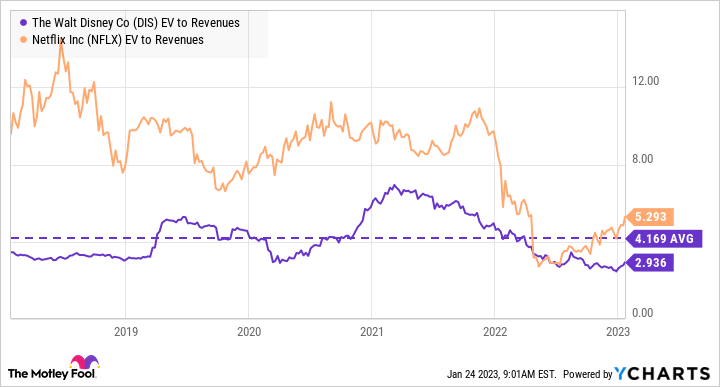

The stock's outperformance since Iger came back signals that investors are largely in favor of the changes being made, but the stock is still trading at a big discount to its previous trading history. The stock currently trades at an enterprise value-to-revenue multiple of 2.9, which is below Disney's five-year average EV-to-revenue ratio of 4.16.

Disney has emerged as a powerful force in streaming, with 164 million subscribers on Disney+, while the parks continue to grow revenue beyond the pre-pandemic peak. The only thing that changed at Disney is lower profits, so it makes sense that if management can shore up the bottom line, the stock should start climbing.

In fiscal 2019, Disney's net profit from continuing operations was $10.4 billion on $69.5 billion in total revenue. Last year, Disney earned $3.2 billion in net profit on $82.7 billion in revenue.

Netflix wasn't a highly profitable business in its early days of investing in original content. But Netflix currently earns a profit margin of 14% and trades at an EV-to-revenue multiple of 5.3, which is much higher than Disney's valuation.

Data by YCharts.

This is why there is speculation on Wall Street that Disney might spin off its linear networks, specifically ABC, this year. This would separate Disney from the cord-cutting on cable and turn it into more of a pure-play entertainment business. Stripping away the legacy networks would give Disney better growth prospects and make it easier for investors to value the company and, theoretically, deliver investors a higher return.

Regardless of what moves Disney makes, the long-term value of the company is undervalued right now. Disney has the most recognizable brands in the entertainment industry. It speaks volumes about its brand power that it grew revenue at the parks last year, including a 6% increase in per capita spending in the most recent quarter despite a weak consumer spending environment.

With Iger back at the helm, along with activist investors like Nelson Peltz trying to influence change to unlock more value for shareholders, there are plenty of catalysts to send the stock higher in 2023.