When is the best time to buy a stock? According to one of the most popular investing phrases, it is best to buy low. But "low" can mean very different things. Even a stock trading at its all-time high can be considered at a "low point," provided it will only go up from there.

On the other hand, stocks that have been battered and bruised in a downturn could still not be worth buying since their prospects may be too poor for them ever meaningfully to recover. But what if a company is down substantially and has the tools to bounce back? Buying its shares while they are down would qualify as "buying low."

With that in mind, let's look at two growth stocks that fit the bill: Tandem Diabetes Care (TNDM 1.25%) and Fiverr (FVRR -2.00%).

1. Tandem Diabetes Care

Medical device specialist Tandem Diabetes Care focuses on the diabetes market, as its name suggests. The company has been an innovator in the field, and right now, it makes money by selling its prized insulin pump, the t:slim X2. Tandem Diabetes Care's prospects depend on the underpenetrated market where it operates, the rise in the prevalence of diabetes, and its ability to attract customers with its products.

Let's unpack all of that a little more. The adoption of insulin pumps has been growing partly at the expense of multiple daily injections (MDIs) since the former are less painful and less prone to human error after an initial learning curve. Studies have found that pump usage results in fewer diabetes-related complications for patients. Yet, in the U.S., 64% of those with type 1 diabetes still use injections; an even greater share of patients in most markets outside the U.S. does.

Second, the prevalence of diabetes is rising, a trend projected to continue for the next few decades. But why would patients opt for Tandem's t:slim X2 insulin pump? This device comes with perks that few of the competing ones offer, from its size -- it is up to 38% smaller than other pumps -- to its ability to completely automate insulin delivery when combining it with DexCom's G6 continuous glucose monitoring system.

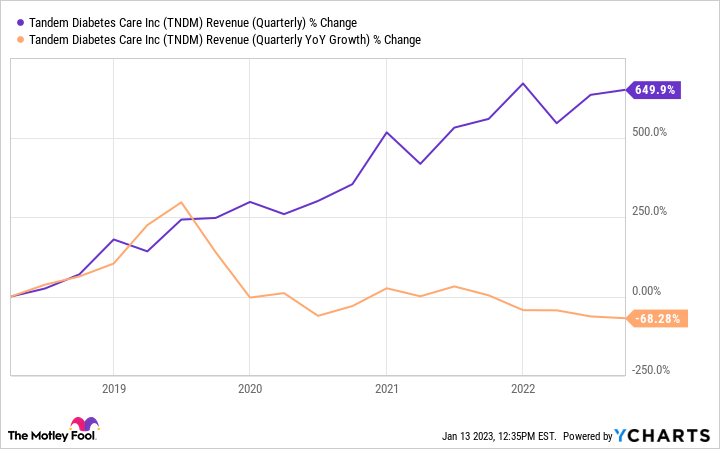

Tandem Diabetes Care estimates that roughly 50% of its customers converted from another pump, with the other half switching from MDIs. The company's revenue has grown rapidly in the past five years, although revenue growth rates have slowed considerably too -- one of the reasons its shares have underperformed lately -- but that's to be expected as the company matures.

TNDM Revenue (Quarterly) data by YCharts

At any rate, there remain plenty of opportunities for Tandem. Expect the top line to continue rising for a long time. Once economic and market conditions improve, Tandem Diabetes Care should rebound and deliver solid returns for a while.

2. Fiverr

Fiverr is an online platform where businesses, individuals, and contractors selling their services meet. The website is incredibly valuable for freelancers since it allows them to advertise their work and attract customers without relying on the challenging and lengthy process of generating organic traffic to a website they build from scratch.

For companies, Fiverr is a one-stop shop for experts and professionals in dozens of fields, all of whom can be hired quickly and with fewer expenses than it takes to hire a full-time employee. In other words, it's a platform where everyone wins and that is helping the gig economy continue on its march forward.

According to analysts at Orbis Research, the market size of freelance platforms will register a compound annual growth rate of 15.3% through 2026. And it won't stop then. Freelancing allows people more versatility and freedom than traditional 9-to-5 jobs, which many enjoy. For instance, a survey shows 84% of freelancers say their work situation allows them to live the lifestyle they want.

The more people turn to freelance, the more businesses like Fiverr will benefit. The company makes money by charging transaction-based fees. More transactions will result in more revenue for the company, all else being equal. And given that the value of its platform increases as more people use it (the network effect), Fiverr has a good chance at keeping and continuing to attract freelancers and those looking for their services.

It is true that the company's revenue growth has dropped, especially compared to the highs of the pandemic when the gig economy experienced an abnormal boom -- a familiar story on Wall Street, especially in the tech industry.

FVRR Revenue (Quarterly) data by YCharts

But these short-term dynamics hardly derail the company's long-term prospects. Fiverr is well-positioned to profit from an unstoppable ongoing trend in the labor market, and benefits from a competitive edge in the form of the network effect.

That makes the company an excellent stock to hold on to for a while, especially for those who get in now that shares have declined by 54% in the past 12 months.