Technology stocks were the cool kid in school a couple of years ago, but the fall from grace has been brutal in this bear market. Admittedly, 2022 was rough, but that doesn't mean that growth and technology stocks won't eventually enjoy their time in the sun again.

Now is a great time to be accumulating shares; a quality stock that's fallen 50% means that your money is buying twice as many shares as a year ago -- that is the type of bargain hunting that can make you very wealthy in the long run. Here are three great stock ideas for today and beyond.

An emerging advertising power

The U.S. Department of Justice filed an antitrust lawsuit against Alphabet for its dominance in the digital advertising space; The Trade Desk (TTD 3.35%) could be a potential winner in the aftermath, though it's not as if the company's needed help growing. The Trade Desk is a cloud-based demand-side ad exchange that lets advertisers create ad campaigns.

Digital advertising has long been dominated by companies like Alphabet, which are walled gardens. You play by their rules and get no data beyond what Alphabet (or others like Meta Platforms) allow. The Trade Desk gives advertisers more control, which has helped the company grow enough to triple revenue over the past few years. Additionally, The Trade Desk is very profitable, turning $0.32 of every revenue dollar into free cash flow.

TTD Revenue (TTM) data by YCharts

The stock has fallen more than 50% from its high, valuing it at a price-to-sales ratio (P/S) of 17. That's about what it traded at before the COVID-19 market bubble. Precedence Research estimates that the digital ad market could double by 2030 to $1.25 trillion, meaning that The Trade Desk's growth opportunities remain intact moving forward.

A company striking down cyberthreats

Cybersecurity has become a huge and expensive problem for enterprises; according to IBM, the average global data breach costs more than $4 million, and that cost doubles for breaches in the United States. CrowdStrike Holdings (CRWD -0.68%) is among a new generation of companies offering solutions that can keep up with evolving cybersecurity threats.

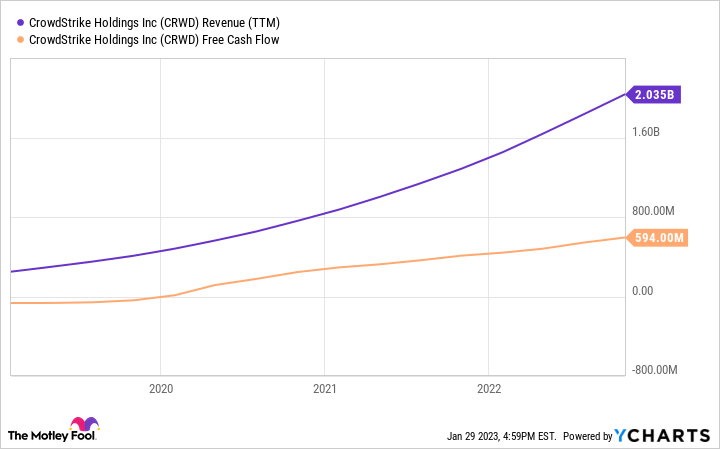

CrowdStrike's security is cloud-based, so it can update in real time. Traditional antivirus software is installed locally on a device and then receives periodic updates. That's great unless the software hasn't seen a threat before and can't detect it. The product quality shows up in CrowdStrike's growth; revenue surpassed $2 billion over the past 12 months, and analyst estimates call for at least 30% revenue growth over the next four years. The business is asset-light, generating $594 million in cash profits, a 29% conversion rate.

CRWD Revenue (TTM) data by YCharts

But shares have plummeted more than 60% from their high despite continued (and profitable) growth. The stock is now valued at a P/S of less than 12, its lowest since the company went public in 2019. Given the company's growth and strong financials, the stock's bright future makes the current decline an opportunity worth considering acting on.

A Warren Buffett technology stock

Famed investor Warren Buffett typically avoids technology stocks (outside of Apple) but found a space for Snowflake (SNOW 2.53%) in Berkshire Hathaway's portfolio. Snowflake operates a cloud-based platform that lets businesses store and analyze data. Many companies want to use data but don't want to store it locally, or maybe the data is disorganized or comes from many different sources. Snowflake's platform solves all of these problems.

The interesting thing about data is that it doesn't necessarily expire; it can be stored and referenced as far back as needed. Additionally, more data is constantly being created. All the world's data totaled approximately 50 zettabytes in 2020 but could triple by 2025. In a way, it's an addressable market that almost grows infinitely. Snowflake's annual revenue is approaching $2 billion (free-cash-flow profitable), and management is targeting $10 billion in revenue by fiscal 2029.

SNOW Revenue (TTM) data by YCharts

Once again, a growing company with a bright future has seen its stock decimated in this market. Shares have declined 60% from their peak and now trade at a P/S ratio of 26. That valuation is still among the highest on Wall Street, but it at least leaves room for returns if Snowflake delivers on its long-term revenue guidance.