The COVID pandemic may have hastened the flight of families out of cities, but rural revitalization is a trend that has been under way for at least a decade. Tractor Supply (TSCO 1.02%) is one of the primary beneficiaries.

The rural-lifestyle retailer just reported blowout third-quarter earnings. Although its 10-year track record of reporting double-digit e-commerce sales growth was broken earlier this fiscal year, online sales continue to expand and remain a key component of Tractor Supply's long-term strategy to reach new markets and customers.

Image source: Getty Images.

It took Tractor Supply 72 years to open 1,000 stores, then just 10 years to open its next 1,000 locations. With 2,066 stores in operation today and an aggressive store-opening plan in place, let's see where this rural-living retailer will be five years from today.

Ringing the register

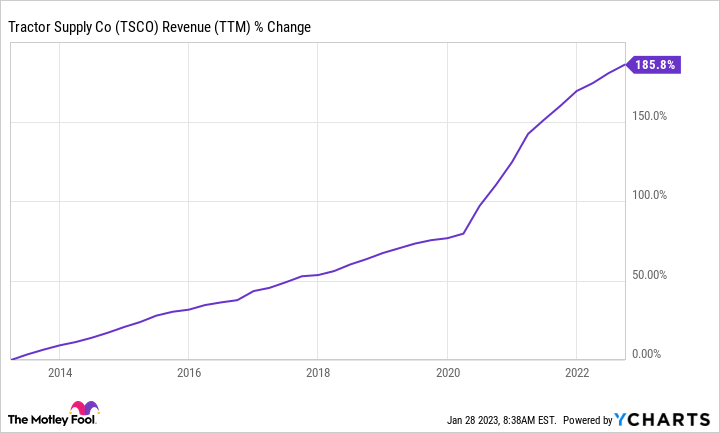

Revenue is on a roll. While sales have been climbing steadily since the start, they went parabolic during the pandemic. Though the rate of growth eased this year (revenue was up almost 12% in 2022 compared to a 20% gain for all of 2021), Tractor Supply is still growing.

It's difficult for any business to maintain such a torrid pace. But it's notable that even though comparable store sales grew 6% in 2022, that was on top of the 17% in 2021, which itself was in addition to the 23% jump in 2020.

Revenue has grown 70% since 2019 -- an astonishing pace that really shows no sign of letting up, since the trend toward fleeing cities remains as strong as ever.

TSCO Revenue (TTM) data by YCharts. TTM = trailing 12 months.

An expanding footprint

Tractor Supply has a three-pronged plan for growth: Invest in itself, expand its reach, and acquire new businesses where it makes economic sense.

As it opens more stores in more locations, it also needs new distribution centers to support them. Tractor Supply is the world's largest seller of bag feed and food for livestock and companion animals, and it shipped more than 8 billion pounds of consumable, usable, and edible products through its supply chain in just the third quarter.

The retailer also broke ground on its 10th distribution center during the quarter, this one to be located in Maumelle, Arkansas, which will help support both rising sales volumes at existing locations and the new volume that will arise from building out new ones.

Data from Tractor Supply SEC filings. Chart by author.

Investing in itself

All this is no small expense. Over the past three years, Tractor Supply spent almost $1.7 billion on its stores, distribution centers, technology, and other strategic initiatives.

On the mergers and acquisitions front, Tractor Supply acquired Orscheln Farm & Home, a chain of 175 farm and ranch supply stores throughout the Midwest U.S., for $320 million. Tractor Supply will only get a net 81 new stores, as it agreed to sell 85 others to win Federal Trade Commission approval of the deal.

The deal gives the retailer over 2,100 locations, 50,000 employees, and more than $14 billion in annual revenue. Tractor Supply also operates approximately 200 Del's Farm & Feed and Petsense stores.

Sharing the wealth

Tractor Supply has paid a dividend since 2010, and it currently yields 1.6% annually. But the retailer has increased the payout for 13 consecutive years, and with a payout ratio (the amount of dividends paid out in profits) of just 38%, the rural lifestyle company's dividend is both safe and has plenty of room for future increases.

Over the past three years, Tractor Supply increased its shareholder payout by an average of 39% annually. The retailer usually announces a dividend increase right around this time of year (last year it announced a 77% hike on Jan. 27), and by the time you read this, it may have done so again.

TSCO Dividend data by YCharts

Can the juggernaut be stopped?

It certainly doesn't seem so. While companies can always run into trouble by making too many acquisitions or overspending on a purchase, which either distracts management or drains its finances, or both, Tractor Supply has shown itself fairly adept at integrating companies into the fold.

It also maintained a narrow focus of buying businesses within its wheelhouse of competency and not straying far from what it knows.

Of course, the market has appreciated the company's abilities and doesn't offer much of a discount on its stock. Shares trade for 24 times trailing earnings, 21 times next year's estimates, and less than twice its sales -- all metrics that suggest it is reasonably priced.

Yet there's no reason to believe the stock will suffer any significant setbacks, and with a sustainable dividend thrown into the mix, Tractor Supply is definitely a company you will want to be owning in five years' time.