The housing recession took a toll on a number of sectors last year, including mortgage bankers and mortgage real estate investment trusts (REITs). Rising interest rates caused a collapse in mortgage-banking revenue and severely dented the balance sheets of the mortgage REITs. Another victim of the housing recession has been homebuilding, including the companies that supply the sector.

One of the biggest suppliers to the residential construction industry is timber REIT Weyerhaeuser (WY 0.19%). The lull in homebuilding negatively impacted earnings last year. Given the discouraging news, is this a stock to avoid?

Image source: Getty Images.

Weyerhaeuser is highly correlated with residential construction

Weyerhaeuser is one of the largest private owners of timberland. It owns and/or manages 24.7 million acres of timberland in the United States and Canada. The company operates three segments: timberlands, real estate and energy natural resources, and wood products. Its wood products include structural lumber, oriented strand board, engineered wood products, and other construction products.

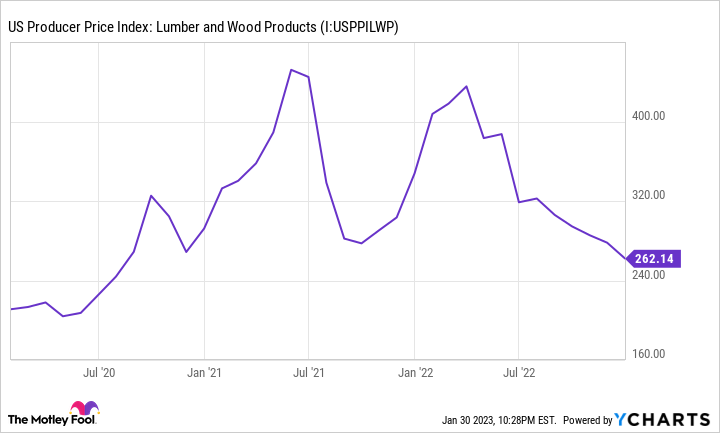

Lumber prices are a big driver of Weyerhaeuser's earnings, and lumber pricing has been volatile over the past couple of years. Lumber trades as a commodity. However, the index below includes more goods than simply lumber. It's the lumber and wood products component of the Producer Price Index, which measures inflation at the wholesale level.

You can see how volatile this index has been over the past two years. Lumber prices almost quintupled in 2021 as supply chain issues drove up prices. It had another spike in early 2022 before selling off to reach pre-pandemic levels.

US Producer Price Index: Lumber and Wood Products data by YCharts.

The quarterly dividend generally accounts for less than half the annual dividend

Weyerhaeuser has an unusual dividend structure. It has a normal quarterly dividend that's meant to be sustainable throughout the housing cycle. The company also pays an annual special dividend, which is meant to pay 75% of funds available for distribution back to shareholders. Note that Weyerhaeuser also can use funds to buy back stock, as well as a dividend.

In 2021, earnings were strong, and Weyerhaeuser paid a $0.50 per share special dividend and a $1.45 per share variable dividend, in addition to its quarterly dividend of $0.17 per share. For 2022, Weyerhaeuser paid no special dividends, and its variable dividend was $0.90 per share. Funds available for distribution fell to $2.327 billion from $2.623 billion. For the entire year, the total dividend yield was 5%, which is still pretty healthy in a down year for housing.

The first half of 2023 could be tough for homebuilding

The big question now is how housing will perform in 2023. Affordability has become a major problem for homebuyers as home prices have risen since the pandemic began and mortgage rates have been pushed up by aggressive Federal Reserve monetary policy. Unfortunately, the Mortgage Bankers Association sees housing starts falling by 9.7% to a total of 1.412 million units, which isn't going to help demand for structural lumber and other building supplies.

On the plus side, housing is an early-stage cyclical industry, so it's likely to be one of the first sectors to recover after a recession. This means we could see a rebound in housing toward the end of 2023.

Weyerhaeuser is driven primarily by residential construction, and 2023 appears to be tough for the homebuilding sector overall. Investors might have to wait six months or a year for the housing cycle to return to growth mode.

However, once it does, it should be set for a long run, as the U.S. has a serious housing deficit. The dividend yield (based on just the normal quarterly dividend) is only 2.1%, so income investors might want to look elsewhere.