Banks are generally meant to be conservatively run businesses, though some take on bigger risks than they should. Investors are treating Bank of Nova Scotia (BNS 0.60%) as if it's a risky player today, pushing its yield up to a relatively high 5.6%. By comparison, SPDR S&P Bank ETF has a yield of just 3% or so. Here's what is going on at Bank of Nova Scotia and why it's a solid risk/reward trade-off for most long-term dividend investors.

1. The Canadian foundation

The first thing that investors need to understand about Bank of Nova Scotia -- or Scotiabank, as it is more commonly known -- is that it hails from Canada. That's not a small issue. The Canadian government strictly regulates the country's banking industry. It has created a system in which a small number of large banks dominate the domestic market. Scotiabank is one of those banks, and it is unlikely to be unseated anytime soon. This is a solid foundation for growth opportunities elsewhere (more on this in a second).

Image source: Getty Images.

There's an additional level of complexity here, though. Canada's regulators are highly conservative, and that has translated into generally conservative banks. Simply put, if the regulators demand you err on the side of caution, then you err on the side of caution. It is something that Canadian banks like Scotiabank have pretty much baked into their business models. That's another strong piece of the foundation.

Scotiabank's Tier 1 capital ratio, a measure of how well a bank is prepared to handle adversity, is a solid 11.5%. That's better than many U.S. peers, including Bank of America's (BAC 3.33%) 11.2%.

2. Core and explore

Like other Canadian banks, Scotiabank is well aware that its Canadian business is, at best, a slow-growing affair. That's why most of the major Canadian banks have looked south of the Canadian border for expansion opportunities. Generally that means building a U.S.-based banking business. Scotiabank has some exposure to the U.S., but it has ventured even further south for growth. It is a large player in South America, giving it exposure to emerging markets. Emerging markets are expected to grow more quickly than the mature U.S. market (and the Canadian market) over the long term.

To put some numbers on all of this, Bank of Nova Scotia is the No. 3 bank in Canada, No. 3 in Peru, No. 3 in Chile, No. 5 in Mexico, and No. 6 in Colombia. That is a pretty unique makeup relative to Canadian and U.S. banking peers.

To be fair, Scotiabank's efficiency ratio, a measure of bank profitability, is a touch higher than some of its peers, at least partly because of this foreign exposure. But it remains a solid 59.4% (by comparison, Bank of America's ratio is 63% -- lower is better). The long-term benefit of being in emerging markets should outweigh the near-term drag on profitability.

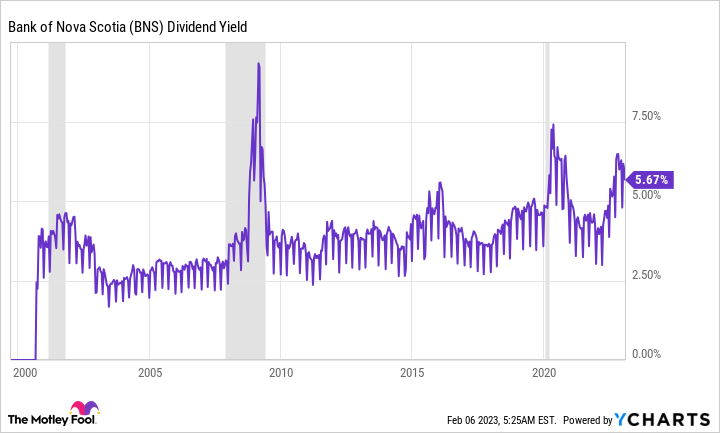

3. Yield

Rising interest rates have investors worried about banks, since higher rates could lead to a recession and, thus, increased loan delinquencies at the same time as loan demand slows. This is a very real concern. But remember that Scotiabank is a relatively conservative Canadian bank, so its 5.6% dividend yield needs to be couched in that context. And yet the yield is not far from its highs hit during the Great Recession and the 2020 pandemic-driven bear market.

BNS Dividend Yield data by YCharts

Here's the thing: Bank of Nova Scotia has increased its dividend in 43 of the last 45 years. That's pretty impressive and suggests that the high yield isn't a massive risk for dividend investors. In fact, it may be a huge opportunity if you think in decades and not months or quarters. It might be even cheaper than you think if you are comparing it to similar banks with lower yields, like peers TD Bank or Royal Bank of Canada, which yield 4.1% and 3.8%, respectively. The key differentiator being the long-term growth opportunity that Scotiabank's South American exposure offers.

Looking for more

Dividend investors tend to be conservative by nature, so seeing Bank of Nova Scotia's yield at a historically high point that's also elevated relative to peers might put you off. But there's a risk/reward trade-off that shouldn't be ignored. Yes, there's additional risk involved with Scotiabank's South American exposure, but management has done a good job of navigating that in the past, given its impressive dividend track record. Thus, the elevated yield may be pricing in too much bad news. And that suggests that this conservative Canadian bank may be too cheap to ignore today.