Walt Disney (DIS 0.18%) owns some of the most valuable entertainment properties on the planet, but its stock price has taken a beating over the last year. The widening losses in Disney's streaming business caused Wall Street to lose confidence in its growth strategy, which sent the stock plummeting from its previous highs.

In November Disney announced the return of former CEO Bob Iger to lead the company again, picking up the baton from exiting CEO Bob Chapek. Iger is moving quickly to rein in costs, while continuing to invest in areas that will create returns for shareholders. The stock has responded in kind, up 21% year to date.

Here are three reasons Disney could keep moving higher in the next bull market.

1. Bet on this CEO

While Iger plans to only serve as CEO for two years, his return is a major catalyst. The board of directors has given him a mandate to set the strategic direction of the company for renewed growth, and his previous record leading Disney sets expectations for good things to happen.

Iger said the company will embark on a "significant transformation" over the next few years. This transformation will mostly focus on reversing Disney's deteriorating profitability in the direct-to-consumer business, including Disney+.

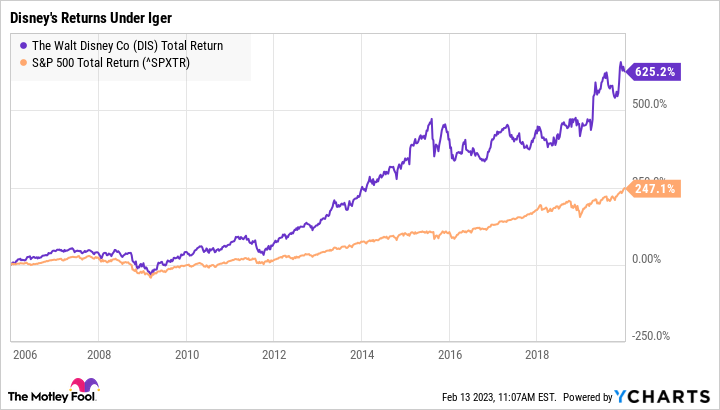

Iger deeply understands Disney's brands and how to deliver market-beating returns to investors. From 2005 through 2019, his capital allocation skills ultimately delivered a market-beating return of 625%, including dividend reinvestment, compared to the 247% total return of the S&P 500 index.

Data by YCharts

2. Disney is moving in the right direction

The good news is that Disney is already seeing strong increases in revenue across its entertainment business. Double-digit revenue growth from the parks and direct-to-consumer businesses helped offset a small drop in revenue from the media networks (ABC and ESPN), which are feeling pressure from the shift to digital media and weakness in advertising.

The problem that Iger has to correct is Disney's plummeting free cash flow. To stop the bleeding, management is targeting $5.5 billion of savings across the company, with most of the savings coming from marketing cuts and reducing the workforce.

Disney is already showing progress, with the direct-to-consumer segment narrowing its operating loss from over $1.4 billion in the previous quarter down to $1 billion in the most recent quarter.

Iger noted that these cost cuts should boost profits even while the company continues to invest in new content to drive growth:

We believe the work we are doing to reshape our company around creativity, while reducing expenses, will lead to sustained growth and profitability for our streaming business, better position us to weather future disruption and global economic challenges, and deliver value for our shareholders.

Consistent with Disney's previous guidance, Iger expects Disney+ to turn a profit by fiscal 2024. As investors see progress toward that goal in the coming quarters, the stock should climb higher.

3. Timeless brands

The most important reason to buy Disney stock is the timeless value of its brands.

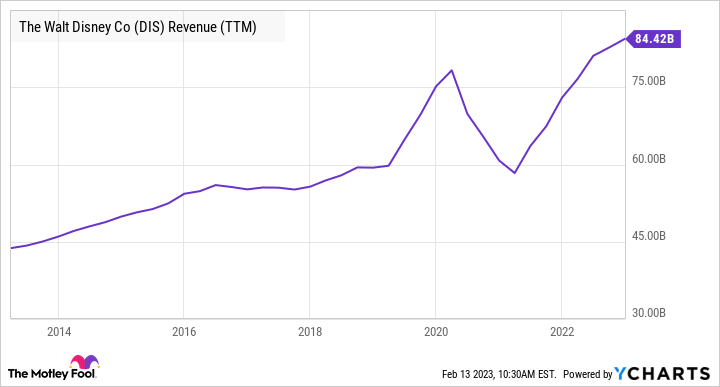

Disney started licensing Mickey Mouse merchandise over 90 years ago. The company has grown from short films and merchandise to a large entertainment empire within striking distance of crossing $100 billion in annual revenue.

DIS Revenue (TTM) data by YCharts

There are no limits to Disney's growth potential. The creation of a new story (e.g. Frozen) or character (e.g. Baby Yoda from The Mandolarian) can spawn new streams of revenue spanning multiple categories, such as park attractions, toys and games, and merchandise.

There's no better time to invest in a timeless brand than when it's down. Disney stock is currently trading 47% below its all-time high, but with steps being taken to improve Disney's financial results, the stock probably won't stay down for much longer.