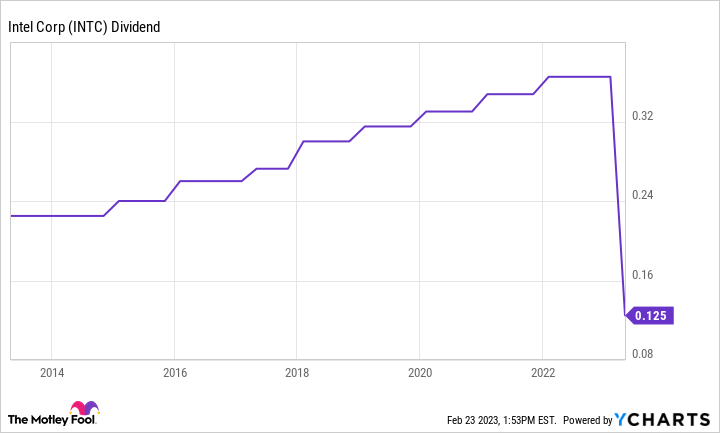

Intel (INTC 1.77%) recently revealed that it's resetting its dividend policy. The semiconductor giant is cutting its quarterly payout by 66% to $0.125 per share. That reduction ended years of steady growth for the dividend.

It's a stark reversal for a company asserting several times last year that it remained committed to paying a strong and growing dividend. However, with the macroeconomic environment deteriorating considerably since then, it was clear that Intel's dividend was in trouble.

Empty promises

The cracks started to form underneath Intel's financial foundation early last year. The company reported disappointing second-quarter results in late July, with revenue falling 22% to $15.3 billion and non-GAAP (generally accepted accounting principles) net income plunging 79%.

CEO Pat Geisinger commented on the results:

This quarter's results were below the standards we have set for the company and our shareholders. We must and will do better. The sudden and rapid decline in economic activity was the largest driver, but the shortfall also reflects our own execution issues.

That led Intel to take several actions to navigate the challenging environment so it could continue investing in its expansion program, including accelerating the deployment of its smart capital strategy. Those actions led CFO David Zinsner to comment in the second-quarter release, "We remain fully committed to our business strategy, the long-term financial model communicated at our investor meeting, and a strong and growing dividend." While the company cut its revenue guidance range to $65 billion-$68 billion (from $76 billion at its analyst day in February), Intel reaffirmed its adjusted free cash flow forecast of -$1 billion to $2 billion.

The company took a major step in advancing its smart capital strategy a month later by introducing a first-of-its-kind semiconductor co-investment program for building manufacturing capacity. Intel and Brookfield Infrastructure (BIPC -0.47%) (BIP -1.33%) agreed to jointly invest up to $30 billion into the semiconductor's manufacturing expansion in Arizona. The joint investment will see Intel funding 51% of that capital, while Brookfield Infrastructure will finance the other 49%.

Intel noted that the transaction would enhance its strong balance sheet, protecting its cash and debt capacity. The company stated that this would allow it to continue funding a healthy and growing dividend. That would have continued the steady upward trend in the dividend.

A steady erosion

Unfortunately, Intel's financial results continued to deteriorate. It cut its full-year revenue guidance range again in the third quarter to $64 billion-$65 billion. On top of that, Intel revised its adjusted free cash flow forecast to -$2 billion-$4 billion.

INTC Dividend data by YCharts

The company would go on to report a final revenue number below the low end of its revenue guidance range at $63.1 billion. Meanwhile, even though adjusted free cash flow hit the low end of its range at -$4 billion, that was only possible because Intel pushed $3 billion of capital initiatives from the fourth quarter into 2023.

The rapid deterioration of Intel's financial results led the company to subtly change its tone regarding the dividend on the fourth-quarter conference call. When asked by an analyst about the security of the company's dividend, Zinsner said it's "committed to maintaining a competitive dividend."

That language was a notable shift from the CFO's prior proclamations of Intel's full commitment to paying a "strong and growing dividend." It suggested that the company could reduce its payout to a level competitive with the broader market.

That's exactly what happened. Intel's 66% dividend reduction takes its dividend yield down from over 5% to around 1.9%. This rate makes it competitive with the S&P 500's 1.7% dividend yield.

An erosion of trust

The swift, significant deterioration of market conditions came at a bad time for Intel because it has meaningfully increased capital spending to expand its manufacturing capacity. That led the company to cut costs, including its dividend, so it doesn't see a deterioration in its balance sheet.

While the move makes sense, the company's management team did itself a disservice by ensuring investors of the security of its dividend over the past year. That has eroded the trust that the company's long-term strategy will deliver the expected increase in revenue and free cash flow. It makes Intel an unappealing long-term investment until the company shows it can actually deliver on its promises.