There are a lot of things that factor into whether a company should be considered a great dividend stock, but they all boil down to whether the company is healthy enough to continue delivering and raising its dividends.

A stock with a great dividend yield and lousy financials is a house of cards waiting to become a dividend trap. Great dividend companies are those whose distributions are in no danger of being cut because their businesses are growing and they have plenty of free cash flow to cover their dividends.

Medtronic (MDT -1.41%) offers a dividend that yields roughly 3.23%, nearly twice that of the S&P 500 average dividend yield. The medical equipment maker's shares are down more than 18% over the past year, but the healthcare company checks all the boxes for what a great dividend stock should be. It's also trading lower than it usually does right now, at only 27 times earnings. Let's take a closer look.

Consistency is key

Medtronic has raised its quarterly dividend for 45 consecutive years. That shows investors two things: 1) a strong commitment to dividend growth and 2) cash flow that allows the company to sustain continued dividend increases.

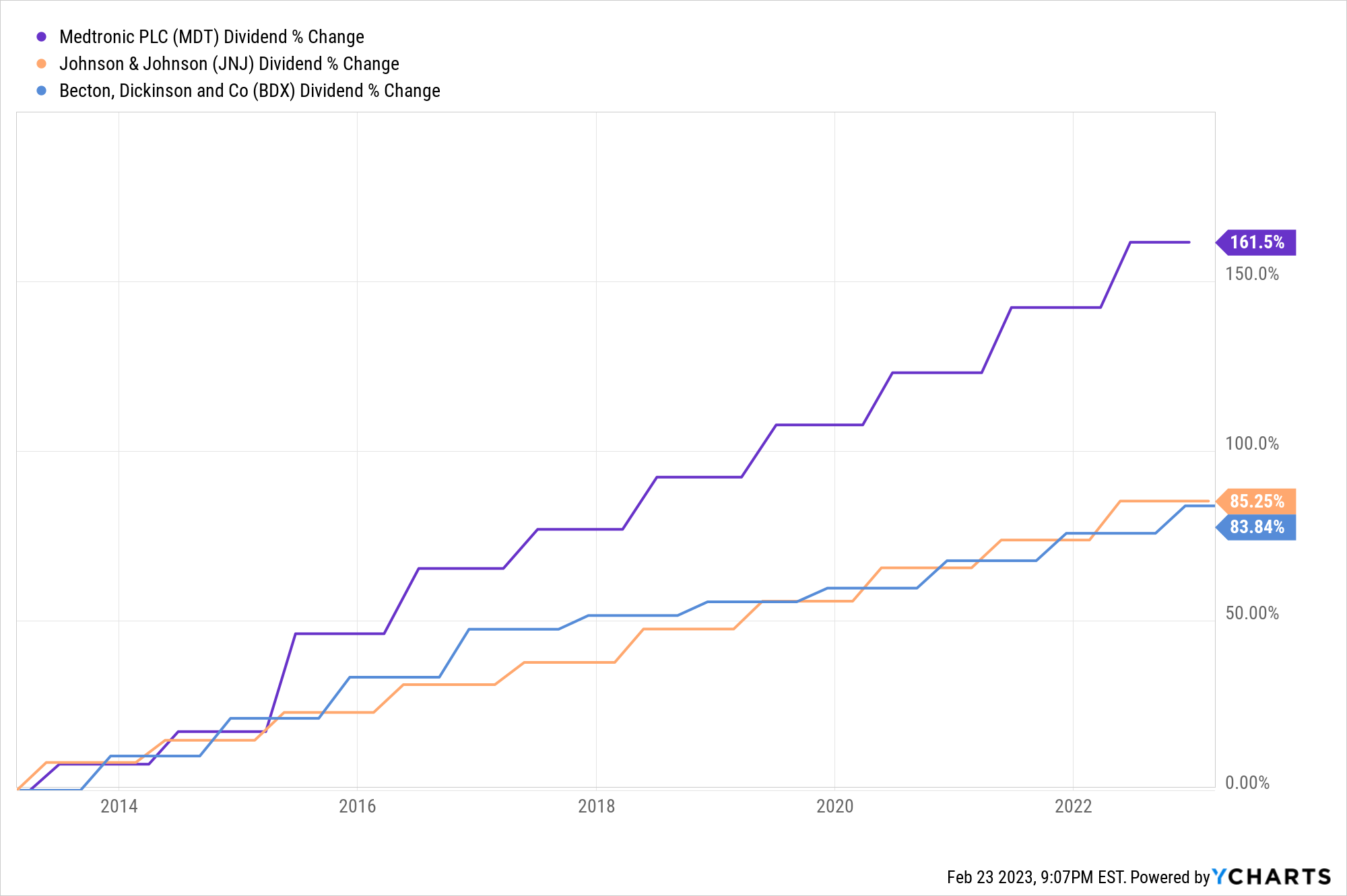

The company increased its quarterly dividend by 8% in fiscal 2023 to $0.68 per share. Over the past 10 years, it has boosted its dividend by 162%, twice the rate of Johnson & Johnson and Becton, Dickinson & Co., two medical device makers with similarly long dividend track records. Considering Medtronic's consistent free cash flow, there's room for dividend growth. The company's cash dividend payout ratio is 72%, lower than Becton, Dickinson's 80% and only slightly higher than Johnson & Johnson's 68%.

MDT Dividend data by YCharts

Steady revenue growth

Over the past decade, Medtronic has increased yearly revenue every year except for 2020, when the COVID-19 pandemic curtailed elective surgeries, and with it, sales of medical equipment. The company's revenue has risen 91% over the past 10 years, while net income has climbed 45%.

More recently, the company's revenue in the third quarter was reported as $7.7 billion, flat year over year, thanks to the impact of unfavorable foreign currency exchange rates. That's more of a macroeconomic problem, though, and could reverse if inflation continues to slow, and the company's earnings should rise as supply chain issues subside.

The company is continuing to see strong sales in its cardiovascular and neuroscience portfolios, which were up 1% and 5%, year over year, respectively. The company also said it expected organic revenue growth of 4.5% to 5% in the fourth quarter and tightened guidance for non-GAAP earnings per share (EPS) of $5.28 to $5.30, up from earlier predictions of $5.25 to $5.30.

Continuous innovation

Medtronic has spent some $2 billion on research and development over the past nine months. With that effort has come new products that should boost revenue next year. The company's Hugo robotic assisted surgery (RAS) system launched last February in Europe and already looks to be the biggest potential competitor to the da Vinci RAS from Intuitive Surgical.

Both systems are frequently used for urological and gynecological surgeries, but Hugo's four arms may make it better suited for more general surgeries. Robotic-assisted surgeries are considered less invasive than traditional surgery and lead to quicker recovery time. One report by iHealthcare Analyst said that sales of RAS devices are expected to grow at a 17.3% compound annual rate through 2029, reaching a $24.7 billion market at that time.

The Hugo system is approved for urologic and gynecologic procedures in Europe and Canada, and in December began a clinical trial in the United States. The trial, following a Food and Drug (FDA) Investigational Device Exemption, will evaluate the Hugo for urologic procedures on up to 122 patients at six sites.

The company is also seeing strong sales for its leadless pacemakers, whose sales were up 14% in the third quarter, year over year. The company's Aurora extravascular implantable cardioverter-defibrillator, which was just approved in Europe, helped the company's defibrillation solutions business increase sales by 7%; that number should rise if and when the device is approved for use in the United States.

Another product to watch for is the company's GI Genius intelligent endoscopy module, which is the first such system to use artificial intelligence to assist doctors in finding signs of colon cancer, such as polyps, that could otherwise be overlooked. The product, which launched in 2021 after getting FDA clearance, helped the company increase revenue in its gastrointestinal therapies last year. Colon cancer affects one in 20 adults in the U.S., but it is 90% survivable if caught early.

All the ingredients

Medtronic continues to keep a strong pace of innovation that should allow it to grow revenue, with 150 product approvals over just the past 12 months, as of the third quarter.

Meanwhile, it is still a great dividend stock because it has an above-average dividend yield, a payout rate that is sustainable, and -- perhaps most importantly -- the commitment to maintain its dividend. In its third-quarter earnings presentation, Medtronic said it expects to spend at least 50% of its free cash flow on shareholder returns, with dividends being the priority for its returns. In five years, the company will likely become a Dividend King.