With equities kicking off 2023 on an upbeat note, there is real hope in the investing community that the stock market will remain northbound for the rest of the year. It's hard to know whether it will, but it may be a bit easier to predict the probable trajectory of some individual corporations.

Consider the case of CRISPR Therapeutics (CRSP -1.98%) and Fiverr (FVRR -0.96%), two stocks that have soared this year along with the broader market. These companies have important developments that could help them perform well through 2023. And more importantly, both look like solid stocks to buy even beyond this year. Let's dig in.

1. CRISPR Therapeutics

CRISPR Therapeutics is a gene editing-focused biotech. The company's shares are up by 36% this year, an impressive performance compared to the broader market. Perhaps CRISPR Therapeutics' run of form in 2023 has to do with the fact that it is inching closer to being a commercial-stage biotech.

The company has been developing exa-cel with its longtime partner, Vertex Pharmaceuticals, and the two entities have initiated regulatory submissions in Europe while rolling submissions are ongoing in the U.S. CRISPR Therapeutics and Vertex could launch this product by the end of the year or in early 2024.

What is exa-cel? It is a gene-editing therapy that targets a duo of rare, genetic, blood-related conditions: sickle cell disease (SCD) and transfusion-dependent beta-thalassemia (TDT). Exa-cel has shown real promise in clinical trials in treating both illnesses, neither of which has many safe and effective treatment options.

That's why the therapy has received various designations from health regulatory agencies in the U.S. and Europe. They include the Fast Track and Orphan Drug designations, among others. The former helps expedite the review process for a drug that fills an unmet medical need, while the latter grants various benefits to experimental drugs that target rare diseases.

These all point toward a high probability that exa-cel will earn approval, which could send CRISPR Therapeutics' shares skyrocketing. There should be a multibillion-dollar market available here, given the high price tags (typically in the millions) that gene-editing treatments tend to command and the roughly 32,000 patients the two companies will first focus on.

This medicine alone should allow CRISPR Therapeutics to generate solid revenue for years. The company also has an exciting pipeline, often a key aspect in the long-term success of biotech companies. CRISPR Therapeutics intends to start clinical trials for two oncology-focused candidates this year, CTX112 and CTX131, while other programs under its belt are currently undergoing studies.

With the money from exa-cel and an ambitious gene-editing platform that has already impressed, expect CRISPR Therapeutics to rise in prominence in the next decade and deliver solid stock market performance.

2. Fiverr

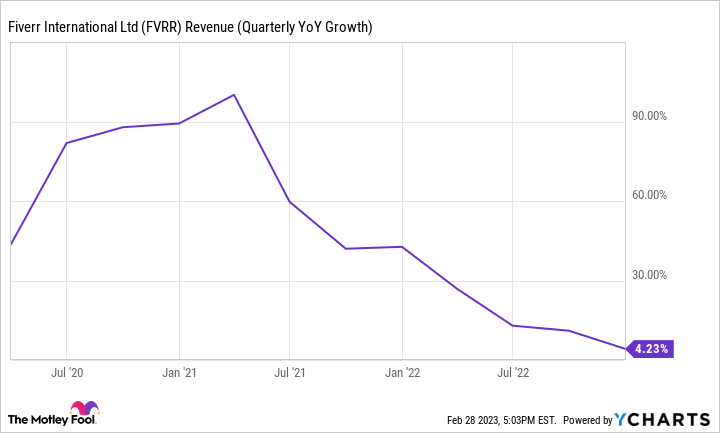

Fiverr was punished last year as it encountered many of the same problems as other so-called pandemic stocks: challenging year-over-year comparisons, slowing revenue growth, higher costs, and red ink on the bottom line.

FVRR Revenue (Quarterly YoY Growth) data by YCharts

But the company's most recent update helped it get back in the good graces of investors. Mind you, Fiverr's fourth-quarter revenue growth of 4.2% to $83.1 million still wasn't very impressive. But the company showed signs of progress and improvement on other fronts. Notably, Fiverr's net loss per share of $0.03 in the fourth quarter was much better than the net loss per share of $0.53 reported in the year-ago period.

Management explicitly said it was prioritizing a disciplined approach to reduce costs and improve efficiency, all of which could continue having a positive impact on the bottom line. Beyond that, another solid reason to buy shares of Fiverr is the company's position in the gig economy. As a platform that helps connect freelancers and businesses that need their services, Fiverr's services create winners on both sides of the transaction.

Freelancers get to advertise their skills on a website where clients are already looking for them. The alternatives would be to look for clients themselves or build their own websites from scratch. Both options are far more time-consuming. Meanwhile, businesses can hire talented freelancers easily and rapidly, bypassing the need to onboard full-time employees, who require all sorts of benefits.

In a classic example of the network effect, the value of Fiverr's platform increases as more people use it. An increasing number of freelancers will attract more businesses to it, and vice versa. That grants Fiverr a competitive advantage.

And with more people seeking flexibility in their jobs, the gig economy is on an upward trajectory, which should only help Fiverr's business over the long run. According to one projection, this market will clock in a compound annual growth rate of 16.18% through 2028.

Fiverr estimates its U.S. total addressable market to be $247 billion, of which it has barely scratched the surface. Fiverr's stock remains down by 47% over the trailing-12-month period. I expect the company's shares to keep rebounding this year, as its greater focus on efficiency helps lift its performance. For those willing to hold its shares for five years or more, Fiverr will most likely not disappoint.