Tech company C3.ai (AI 4.10%) is one of the hottest stocks on the markets this year, with its share price surging 145% through just the first few months of 2023. That's a big change from the 64% price drop it incurred last year. A big reason for the change in fortune is the growing popularity of artificial intelligence (AI) this year, thanks to the emergence of the AI chatbot ChatGPT.

C3.ai uses AI to help companies in various industries, including oil and gas company Shell, which uses C3.ai's AI technology to manage its equipment and identify potential failures ahead of time. AI has the potential to transform and improve the operations in many industries -- but C3.ai itself remains unprofitable and its growth has stalled.

Is C3.ai a good business to invest in today, or is this stock too risky to own?

Trading volumes are through the roof

In the past there have been periods where interest in trading shares of C3.ai have surged, but nothing like what has been taking place this year. Investors have undoubtedly been encouraged by ChatGPT's potential, and what that could mean for C3.ai's business.

Last month, around the time when the stock's trading volume was surging, C3.ai CEO Tom Siebel had an interview with the Silicon Valley Business Journal, discussing the impact of ChatGPT. Siebel said, "this is going to fundamentally change the model of the enterprise applications we have built." He pointed to the ability to integrate something the public is comfortable using, such as a search engine platform, with other forms of AI as being a game changer for the business. "This will be an accelerant to our business because it will make it much easier to adopt," he said.

Is profitability in sight?

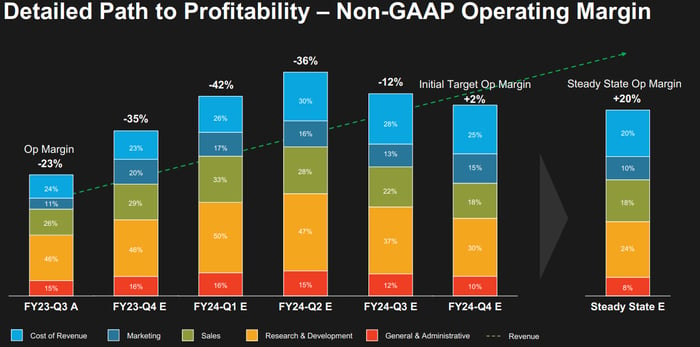

Siebel is also optimistic that while C3.ai's business isn't profitable today, it may not be too long before it is. Within five quarters, the company could be profitable and cash-flow-positive -- on a non-GAAP (adjusted) basis.

Image source: Ce.ai Q3 presentation.

At a negative 23% operating margin today, the company has a lot of work to do to get to breakeven as it invests in its future growth.

However, investors need to also remember this is an adjusted number and so true breakeven may be even further away. For the fiscal 2023 third quarter (ending Jan. 31), the company's net loss was $63.2 million, which is a 60% increase from the $39.4 million loss it incurred in the prior-year period. And another troubling fact was that revenue of $66.7 million declined 4% year over year.

Is C3.ai stock a buy?

The surge in C3.ai's stock this year doesn't look warranted given the state of its financials. While the company expects profitability by the end of the next fiscal year, that also implies some strong revenue growth that isn't taking place right now. And with businesses scaling back investments amid a concern of a possible recession looming this year, I'd be cautious in assuming a big turnaround anytime soon.

The stock's volatility and deep losses are enough a reason to avoid buying C3.ai right now. The consensus price target is just above $20 for the tech stock, suggesting that analysts see plenty of downside risk for C3.ai. Without much stronger financials, investors are better off avoiding the stock as there definitely looks to be more hype than substance behind C3.ai's gains this year.