Whether you're growing from $200,000 to $1 million or hoping to take $20,000 to $100,000 over a period of 10 years, you'll need an average 17.5% annual return.

While this would amount to market-beating returns, all three companies below have market capitalizations below $7 billion and are still in the early chapters of their long-term growth stories.

Growing revenue between 27% and 57% over the last 12 months, Doximity (DOCS -0.77%), Medpace (MEDP -0.62%), and Progyny (PGNY 2.57%) look poised to meet this 17.5% annual return threshold. This is especially true considering that each company has carved out a unique niche in healthcare verticals that should only grow over the long haul.

Let's explore what makes these businesses perfect for an evenly allocated basket of stocks to 5x over the next decade.

1. Doximity

The United States healthcare industry is worth a staggering $4 trillion, of which physicians control about 73% of the spending. Incredibly enough, over 80% of these physicians -- and roughly 90% of medical school graduates -- already use Doximity's all-in-one healthcare platform.

On Doximity's platform, verified medical professionals can talk with colleagues, set work schedules, host telehealth appointments, read relevant healthcare news and research, and coordinate patient care. These tools create an incredibly sticky product that medical professionals come back to use daily.

This is hugely valuable to pharmaceuticals and health systems (hospitals, for example), as Doximity's newsfeed is an undeniably attractive option for marketing its products directly to these physicians. Sporting a marketing return on investment (ROI) of 17 times and 11 times for health systems and pharmaceuticals, respectively, the value of advertising with the company has become abundantly clear.

This marketing ROI helps businesses justify whether their marketing spend is producing strong results or not, with a mark of 10x or higher considered exceptional -- making Doximity's figures very promising.

Thanks to these stunning figures, it may be no surprise that the company's sales have nearly doubled in just shy of two years since its initial public offering (IPO). However, the stock still trades at a price to sales (P/S) ratio of 17 -- a steep valuation that has caused the stock to remain below its initial public offering (IPO) price.

Despite this decline, its 29% net income margin in the fiscal third quarter of 2023 (ended Dec. 31, 2022) highlights the immense profitability possible from the company's platform.

Counting all 20 of the top 20 health systems and pharmaceuticals as clients, Doximity's dollar-based net retention (DBNR) rate of 119% from Q3 show that this growth is here to stay. DBNR measures how much an existing customer base increases its spending from one year to the next, making Doximity's 119% mark a promising sign for long-term growth.

Better yet, Doximity only has a 5% market share of the 415 prescription brands generating over $100 million in sales annually. This leaves ample room for DBNR to grow as advertising recovers from the declines in spending it saw in 2022. Additionally, among the company's largest 20 clients, DBNR was even higher at 127% -- highlighting that it doesn't need to rapidly acquire new customers to post impressive sales growth.

With management guiding for preliminary sales growth of 20% through 2024, Doximity's massive network of medical professionals looks poised to grow more valuable with time, making the stock an ideal candidate for this healthcare stock basket.

2. Medpace

Clinical contract research organization (CRO) Medpace generates around 94% of its sales from small and mid-sized biopharma companies developing or testing drugs and medical devices. Differentiating itself by only offering its full suite of services for biopharmas progressing through the phases of the clinical process, Medpace is an attractive proposition for its tiny clients in need of support and experience.

Confirming this value proposition, the company grew revenue and earnings per share (EPS) by 28% and 61% in the fourth quarter of 2022. These results came despite many small biopharmas facing funding issues amid a rising interest rate environment where risks, such as funding smaller drug developers, are viewed with more skepticism.

However, despite the impressive earnings results, the market has let the stock's price gradually slip as it awaits the fallout of this weakening funding environment.

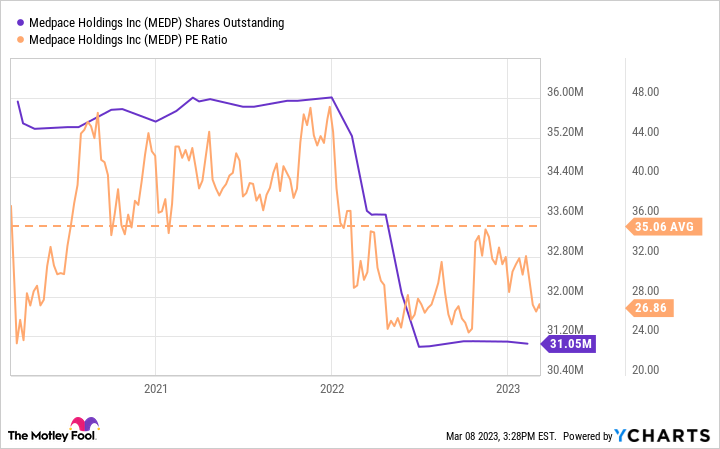

With the stock trading well below its three-year average price-to-earnings (P/E) ratio, it is now at a valuation similar to when management bought back 14% of total shares outstanding in 2022.

Data by YCharts.

Posting average sales and earnings per share (EPS) growth of 29% and 54% annually over the last five years, Medpace is a classic example of a premium business trading at a fair (if not discounted) price.

While the next year or so may be turbulent as some of its inadequately funded customers struggle (or even fail), the company's long-term story remains intact. With Grand View Research estimating 14% annualized growth through 2030 for the biotech industry, Medpace looks like a great prospect to meet our 17.5% annual growth threshold.

3. Progyny

With 1 in 5 married couples struggling with infertility, Progyny's fertility benefits are rapidly being adopted by employers. Thanks to its value-based, outcomes-focused model, Progyny has averaged 25% to 30% cost savings for its rapidly growing client base compared to standard carrier-based policies.

Since going public in 2019, the company's share price has more than doubled, despite being cut in half from its all-time highs in 2021.

Over this same time frame, however, Progyny's sales have nearly quintupled, leaving its P/S ratio near its all-time low, at 4.4. Thanks to this much more reasonable valuation, the company, with its leadership position in providing fertility benefits, looks all the more interesting -- especially after it grew sales by 68% in its most recent quarter.

Growing its total covered lives from 110,000 in 2016 to over 5.4 million at the end of 2022, it is clear that Progyny's value proposition resonates with its members. Recording 17% higher pregnancy rates, 25% lower miscarriage figures, and 27% higher live birth rates than the national averages, this growth is quite understandable.

Boosted by these incredible stats, Progyny's net promoter score (NPS) of 81 makes a lot of sense. NPS is scored on a scale of negative 100 to 100 and measures how likely a customer is to recommend the product to a friend, with a positive number indicating happy customers. This makes the company's score of 81 tremendous and helps make the stock a perfect addition to this healthcare basket.