The precipitous fall for Datadog (DDOG 0.50%) stock is back on. After a decent rally to kick off 2023, shares reversed course and are now down 10% so far this year -- and down nearly 70% from their all-time highs.

This comes in spite of what appears to be a very solid Q4 2022 financial update from Datadog. Is it time to buy the dip on this cloud infrastructure and application performance software provider?

2022 ends with a bang -- and a footnote

Datadog reported year-over-year revenue growth of 44% to $469 million in Q4 2022. GAAP net loss was $29 million, versus net income of $7.2 million a year ago. Free cash flow in Q4 was positive $96 million (down from $107 million last year, though this can be a volatile profit metric).

Full-year 2022 was a pretty good year as far as all-out growth was concerned. However, the discrepancy between GAAP net loss ($50.2 million) and positive free cash flow (positive $353 million) was primarily employee stock-based compensation of $363 million -- more than double the amount shelled out in 2021.

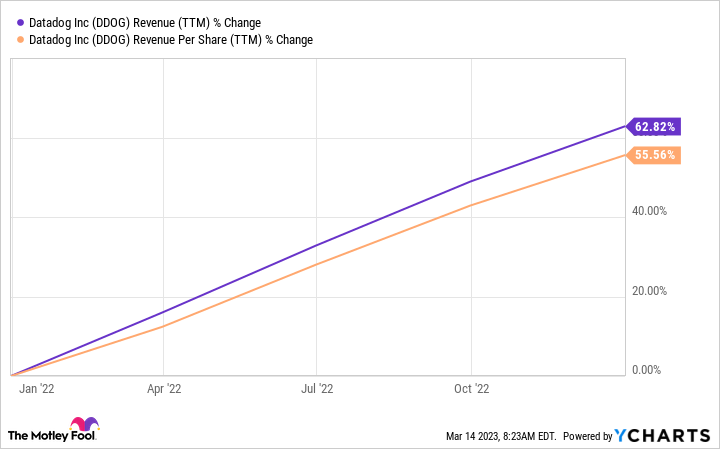

Thus, as has been the issue with some other high-growth software-as-a-service companies, growth on a per-share basis (both for revenue and free cash flow) isn't quite as good as it appears at Datadog.

Data by YCharts.

Compounding the problem is the outlook for 2023. At the midpoint of guidance, Datadog is still expecting revenue to expand at about a 24% clip (versus 63% last year). Macroeconomic headwinds are catching up with cloud companies like Datadog at precisely the time employee stock-based comp is ramping up. This means a further deterioration in Datadog's per-share growth is definitely on the table for the year ahead.

Its valuation still isn't "cheap"

Nevertheless, expected double-digit percentage growth given the present threat of a recession is noteworthy. Datadog's modern IT infrastructure and app performance services keep picking up lots of new customers, for good reason, and the long-term potential for this company remains bright.

But high valuation concerns still remain, which is what has kept me away from Datadog stock all this time since the IPO in 2019. Even after falling so far in the last year, shares trade for nearly 13 times trailing 12-month sales, and 61 times trailing 12-month free cash flow. Suffice it to say investors still have at least a couple of years of double-digit expansion priced in at this point.

If you still like Datadog for the long term, a dollar-cost average plan where you buy very small amounts (perhaps monthly or quarterly) of this stock and build it into a larger position over time still makes the most sense. Personally, I'm not buying at this point. Given the company's outlook for slowing growth this year and plenty of new stock still getting issued to employees, I believe Datadog will remain a volatile stock at best in 2023.

The good news is Datadog had $1.88 billion in cash and short-term investments and debt of only $739 million at the end of 2022. The company could begin to repurchase stock to offset the dilution from stock-based comp and to help bridge this current period of market uncertainty. If management announced such a program, it could be a game changer for me.

In the meantime, I do still like cloud infrastructure software, as cloud computing will continue to be a top priority for enterprises around the world for the foreseeable future. But I prefer Dynatrace (DT 1.06%). It isn't growing as fast as Datadog, but it isn't a slow grower either (and isn't trailing Datadog by much on free-cash-flow-per-share growth over the last year). It was also highly profitable by all metrics last quarter, upgraded its outlook for the next fiscal year, and trades for a more reasonable valuation. Dollar-cost averaging is the method I've been employing with this stock as well.

At this juncture, I'm still not seeing the right mix of metrics to make me call Datadog a buy. For now, I'm putting this one in the "reassess later" file when economic headwinds start to ease.