Small-cap stocks with promising growth prospects can have substantial upside. But they often come with risks, as their modest valuations also suggest that they are relatively unproven businesses.

One stock that investors and analysts are incredibly bullish on these days is Anavex Life Sciences (AVXL -0.53%), which has a market capitalization of just $730 million. Here's a look at why there is excitement behind the company and whether this ix an investment you should consider adding to your portfolio.

Its drug candidate for treating Alzheimer's has great potential

Key to Anavex's success will be centered around Anavex 2-73 (blarcamesine), which has been showing promise as a potential treatment for Alzheimer's in late-stage trials, with the next step being for the healthcare company to discuss the results with regulators and health officials. The treatment has also been studied as an option for people with Rett syndrome (a neurodevelopmental disorder) and Parkinson's disease dementia.

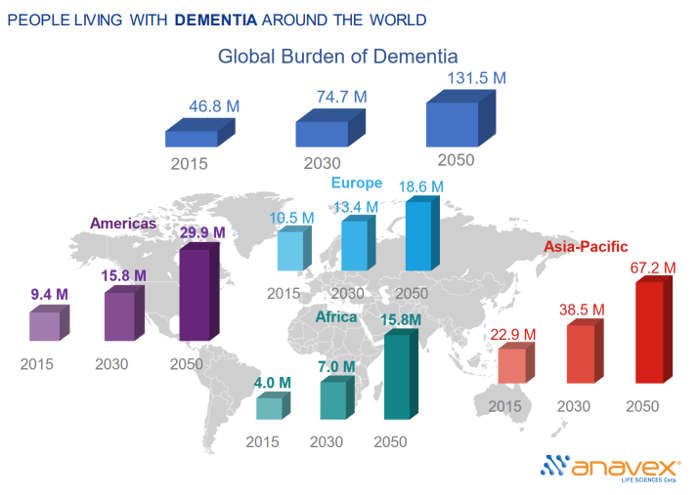

A quick look at the chart below, and it's clear why analysts see incredible potential for the stock if Anavex 2-73 gets the green light.

Image source: J.P. Morgan Healthcare Conference presentation.

The risk may not be all that high with Anavex

Anytime you invest in a company that isn't generating any revenue, you're taking on a big risk. That's the situation Anavex is in right now. But the positive here is that the company is sitting with plenty of cash on its books, and that gives it plenty of stability in the near term.

Image source: J.P. Morgan Healthcare Conference presentation.

By only burning through $24.2 million in cash in its most recent fiscal year (ended in September 2022), Anavex has demonstrated some good fiscal discipline. If it keeps its costs under control, that can ensure its cash balance lasts for multiple years. That's great news for investors because it means the risk of future share offerings and dilution is low.

Is Anavex stock a buy?

The consensus analyst price target for Anavex is $41.80. That's more than four times the $9.40 it closed at on Monday. Given the broad need to help dementia patients all over the globe, it's hard not to understate the significance of Anavex 2-73 and what it could mean for the business. Approval of the treatment would not only give the company a source of revenue for years to come, but it could potentially make Anavex an appealing acquisition target, which could help it fetch an even higher price tag and better return for investors.

Anavex isn't for risk-averse investors, and you shouldn't assume Anavex 2-73 will obtain approval for anything. There's a real risk that the company still may not generate any meaningful revenue for years. However, if you're OK with those risks, then this could be a stock worth buying today, as Anavex does certainly have the potential to produce some fantastic returns for investors.