The stock market has seemingly found a way to become even more volatile recently; the fear in banking is the latest thing shaking investor confidence. So, how do investors put their money to work and sleep well at night?

Most know who Warren Buffett is -- he's one of the world's most famous investors and has been through the market's ups and downs for decades. However, not as many may understand how Buffett built his holding company, Berkshire Hathaway (BRK.B 0.54%), for long-term success.

Let's dive into Berkshire Hathaway's many holdings, its balance sheet, and why the stock might be the safest investment in today's market.

1. Diversification with a common theme

Berkshire Hathaway is a holding company, which is a business that holds controlling interests in other companies. That can include full ownership; Berkshire owns dozens of businesses, including some household names like Dairy Queen, GEICO Insurance, Business Wire, Duracell, and more.

The company's net earnings come from various businesses and investments, organized into segments:

Image source: Berkshire Hathaway 2022 annual report.

Berkshire also owns various stakes in publicly traded corporations, which shows up in the row called investment and derivative contract gains (losses). These stakes fluctuate in value based on share prices, even if the company doesn't sell them. So investors shouldn't look at the quarterly fluctuations but rather at the individual companies that make up Berkshire's portfolio. Buffett cares more about the dividend income these stakes produce.

You can see Berkshire's top five holdings by position value below:

| Company name | Position market value (Billion) |

|---|---|

| Apple | $139.8 |

| Bank of America | $29.3 |

| Chevron | $25.8 |

| The Coca-Cola Company | $24.0 |

| American Express Company | $24.0 |

Source: Berkshire Hathaway.

So what is the takeaway? Buffett is famously focused on long-term investing; he's bought and held several positions for decades. However, the common theme is that most of Berkshire's business interests are recession-resistant and established businesses. Insurance, railroads, energy, and banks -- all of these industries have been around for more than a century and show no sign of going anywhere.

Buying Berkshire means buying a share of a diversified basket of companies in reliable industries. Warren Buffett is the turtle, not the hare; slow and steady growth is what you get here.

Sleep peacefully on piles of cash

If Buffett's taste in businesses didn't calm your mind, his conservative approach to the balance sheet should. Buffett is always socking cash away; it's a two-sided safety net that can protect the business from unforeseen problems and maintain Buffett's flexibility.

BRK.B Cash and Short Term Investments (Quarterly) data by YCharts

Buffett can spend opportunistically, like when he went shopping in 2022. Then, the cash from his various companies and dividend stocks begin replenishing. The company's cash position has more than doubled over the past decade, which could continue as all the assets under Berkshire's umbrella grow and raise their dividends.

Is the stock a buy?

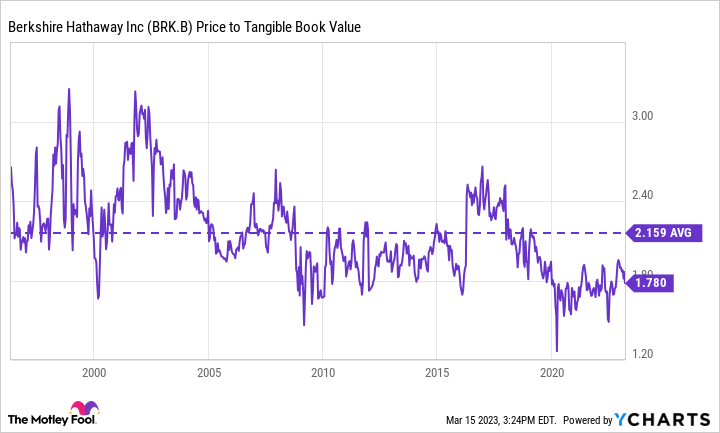

You wouldn't value Berkshire on sales or profits like most other companies; Buffett says that earnings based on generally accepted accounting principles (GAAP) for Berkshire specifically are virtually meaningless because swings in market value can skew operating results. Instead, consider Berkshire's book value, which is the collective value of Berkshire's various assets. Try to pay as little for those assets as possible; the price-to-book ratio (P/B) helps with that.

BRK.B Price to Tangible Book Value data by YCharts

Berkshire has traded at an average P/B ratio of 2.1 over the past few decades. Today, shares trade at 1.7 times book value, nearly 20% below their long-term average. Considering how Berkshire's been built as a durable and diversified collection of quality businesses, the stock arguably becomes more attractive in this environment. Investors looking for a top-tier blue chip stock in a turbulent market should have Berkshire near the top of their list -- getting shares at a discount is icing on the cake.