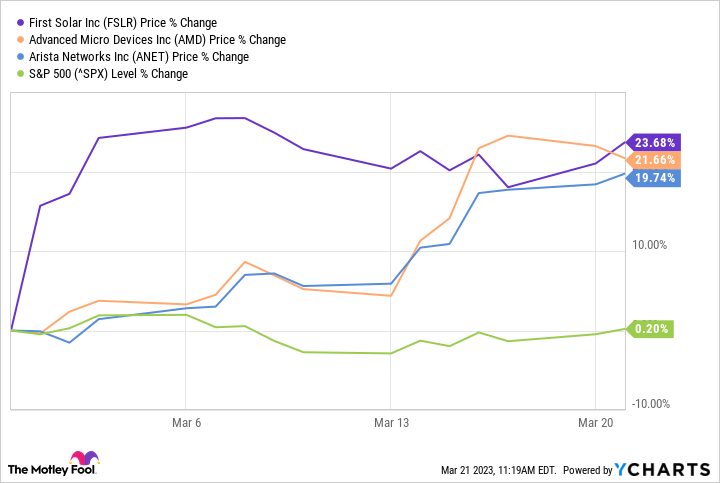

March has only been a so-so month for the stock market, with the S&P 500 essentially where it was as of the end of February. Why the stagnation? Investors are struggling to get a handle on the true condition of the economy.

There are some wildly bullish exceptions to this broad lethargy, however. S&P 500 constituents First Solar (FSLR 2.85%), Advanced Micro Devices (AMD -5.78%), and Arista Networks (ANET -1.33%) are up an impressive 23.6%, 21.3%, and 20% (respectively) month to date, spurred higher by a combination of headlines and rekindled investor confidence in these companies.

The big question is whether it's too late to jump into these red-hot names. The answer, in a word, is "no."

Rallies don't always stop so soon

Don't misread the message. There's still much to be said for being bargain-minded and stepping into quality stocks when they temporarily peel back.

That's not a hard-and-fast rule for picking stocks, however. It's just an approach to consider in the aftermath of unexpected sell-offs. There's nothing inherently wrong with buying stocks while they're in rally mode. Indeed, it's not uncommon for a stock that's making new highs to continue doing so for weeks (if not months) on end. That's what shares of the aforementioned Arista Networks certainly did back in 2016 and 2017 before finally taking a breather in 2018 and 2019. Then it started happening again in 2020 and 2021.

Yes, ANET shares did peel back once those buying sprees finally cooled. There are a couple of problems with holding out for such dips, though. First, you don't know when -- or even if -- a pullback is in the cards. Second, even if you jump in at the lowest point of a future pullback, that still may not be the lowest price at which you could have purchased a stock. Take a closer look at the chart of Arista above. Notice how last year's and 2019's pullbacks only retraced about one-third of the rallies that got the stock to its pre-dip peaks.

Translation: If you're a true long-termer, the potential cost of waiting for that perfect entry point can be high. If it's a quality company you feel good about owning for the long haul, the time to buy is now.

The right stuff for the long haul

And to this end, all three of the S&P 500's biggest March winners are certainly quality names worth adding to your portfolio as long-term picks.

Take AMD as an example. Although its roots are largely in the video gaming arena, it's increasingly moving into the data center space. Indeed, around one-fourth of the company's 2022 revenue came from its data center business, and this arm's profits are roughly twice as strong as its gaming business' bottom line.

For perspective, McKinsey & Co. believes the United States' demand for data center services will grow by 10% per year through 2030.

Networking technology company Arista Networks is another outfit with real longevity. While wired and wireless networks are nothing new, there's still plenty of opportunity for growth on this front. The key to that growth is simply finding ways to do more with a limited amount of spectrum and bandwidth. Arista delivers on this big time. For example, the company's website explains its CloudVision CUE Wi-Fi platform will "continuously perform supervised and unsupervised learning required to apply AI concepts to decipher Wi-Fi users' application experience." Put in layman's terms, CloudVision CUE uses artificial intelligence to ensure people connected to a particular network are enjoying an optimized experience they don't even have to think about.

And that's just one example of Arista's know-how.

There's also little doubt as to the company's growth prospects. A forecast from market research outfit Mordor Intelligence suggests the world's Wi-Fi market will expand at an annual pace of more than 13% through 2027.

And First Solar? Little needs to be said about the opportunity solar panel companies are facing at this time. Legislative support for the business has never been stronger (last year's passage of the Inflation Reduction Act provides significant tax credits for new solar panel installations), finally catching up with consumer interest in the environmentally friendly alternative source of energy. The only thing investors may want to know is that less than 5% of the world's current electricity needs are met by solar power facilities, according to Ember's Global Electricity Review for 2022. The rest is opportunity for future market penetration.

Don't overthink it

Of course, there's always a catch. In this case, it's entirely possible any investors stepping into these stocks at their current prices could find their positions underwater at some point in the future. Stocks go up. Stocks go down. But, we can't predict those short-term ebbs and flows.

If you're a real buy-and-hold investor, though, your bigger risk isn't stepping into a particular trade at the wrong time. It's being out of a particular trade when you should be in one. That's the bigger of the two risks, in fact, precisely because we can't predict when or to what degree dips happen. You can only hold quality stocks for the long haul on faith that the overall market's -- as well as most individual stocks' -- histories confirm they reliably recover from temporary setbacks.

More to the point, don't sweat this month's unusually big gains from AMD, Arista, and First Solar. Five years from now you won't even care or remember if you jumped in at a near-term high or near-term low. You'll just be glad you got in at all a few years back.