A company can talk about how much it values its shareholders all day long. But actions speak louder than words.

Having recently delivered a 7.3% raise in its quarterly dividend to $0.59 per share, Dollar General (DG -1.36%) doesn't just talk the talk -- it also walks the walk. But is the discount retail chain a buy for investors seeking growing passive income? Let's discuss Dollar General's fundamentals and valuation to find out.

A winning growth strategy

With more than 19,100 stores across the U.S., Dollar General is (almost) everywhere. The company sells food, health and wellness products, and cleaning supplies from many of the most recognized consumer brands at bargain-bin prices.

| Q4 2022 Same-Store Sales Growth Rate | Q4 2022 Store Count Growth Rate |

|---|---|

| 5.7% | 5.4% |

Dollar General's net sales soared 17.9% year over year to $10.2 billion for the fourth quarter ended Feb. 3. A rise in the average transaction amount due to inflation was only partly offset by a decline in traffic last December. That's how the company produced mid-single-digit same-store sales growth during the quarter.

Coupled with opening nearly 1,000 net new stores over the past year, this explains much of Dollar General's net sales growth in the quarter. Finally, the extra week for the quarter added nearly $700 million to the company's net sales base over the year-ago period.

| Q4 2021 Net Profit Margin | Q4 2022 Net Profit Margin |

|---|---|

| 6.9% | 6.5% |

Dollar General's diluted earnings per share (EPS) grew 15.2% year over year to $2.96 for the fourth quarter. Stemming from the inflationary environment, the company's cost of goods sold and selling, general and administrative expense items increased at a faster clip than net sales. This is what contributed to the contraction in net margin.

But Dollar General partially neutralized this reduced profitability with a 4.2% decrease in its weighted average diluted share count. This explains why the company's diluted EPS growth closely lagged net sales growth during the quarter.

Aside from opening more stores, Dollar General has been pulling the growth lever in another way. The company has been building on its selection of products by adding basic groceries to its stores via its DG Fresh initiative and widening its offerings of healthcare goods via DG Wellbeing.

As these offerings expand to more of the company's stores, this should draw more customers to existing stores, boosting same-store sales further. That's why analysts believe that Dollar General's diluted EPS will grow by 7.9% each year over the next five years. For context, that's better than the discount stores industry average earnings growth forecast of 5.2%.

Image source: Getty Images.

The best is yet to come for the dividend

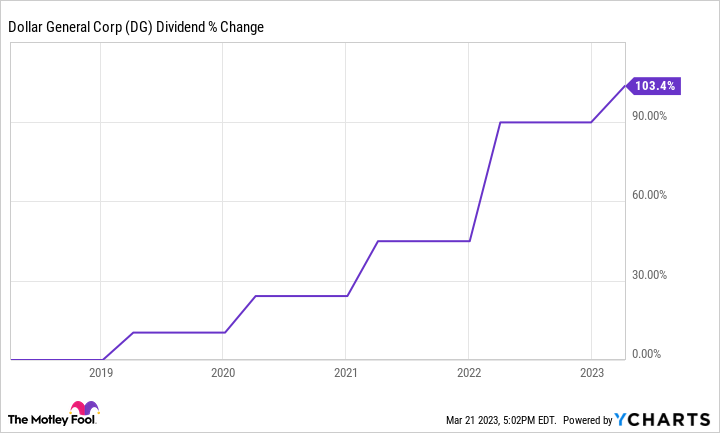

Dollar General's 1.1% dividend yield is significantly below the S&P 500 index's 1.7% yield. But with the quarterly dividend per share more than doubling over the last five years alone, what the company lacks in immediate income it makes up for with dividend growth.

DG Dividend data by YCharts

Fortunately, strong payout growth appears poised to continue. This is because Dollar General's dividend payout ratio is set to be approximately 20% this fiscal year. That leaves the company with funds necessary to open new stores, expand its product offerings, and repay debt. That's why I would be surprised if the dividend didn't double again in the next six to seven years.

Dollar General's valuation is enticing

Amid the market sell-off, shares of Dollar General retreated 9% over the last year. This pushed the forward price-to-earnings (P/E) ratio to just 16.6, which is much less than the discount stores industry average forward P/E ratio of 21.4. Considering Dollar General's above-average growth potential and below-average valuation, the stock looks like a great pick for dividend growth investors at its recent $210 share price.