The advertising industry is in a rut. Economic concerns have companies tightening their budgets and spending less on advertisements. The squeeze has impacted everyone, from Meta Platforms to Alphabet.

But ad-tech company The Trade Desk (TTD -4.34%) has held up surprisingly well in this challenging environment. The company is set to post double-digit revenue growth next quarter, and it's printing cash flow. That relatively strong performance could make it a big runner during the next bull market. Here is why.

The Trade Desk is establishing itself as a pack leader

Global advertising is enormous; it has an estimated total market value of approximately $816 billion. But it's highly fragmented. Ads come in many formats, from print to radio and television to the internet. But digital ads, meaning those online and in internet-connected devices like smart TVs, are steadily growing in significance.

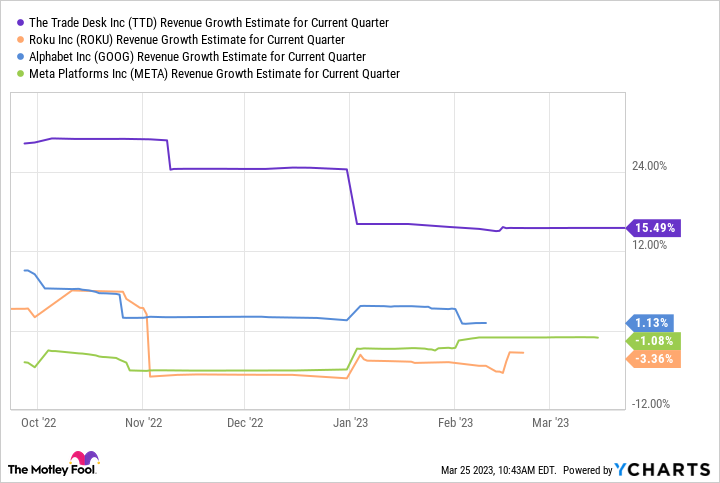

Big technology companies like Alphabet and Meta Platforms are the dominant players in digital ads today. Below, you'll see the industry-wide slow-down in expected revenue growth among digital ad companies (growth estimates keep shrinking each quarter). The Trade Desk is the fastest-growing by a wide margin. Why?

TTD Revenue Growth Estimate for Current Quarter data by YCharts

The Trade Desk is a demand-side ad company, a cloud-based software platform where companies can buy ads autonomously. For example, suppose you want to advertise your shampoo product. The Trade Desk can match your ad with an audience that would be more likely to be interested in your product.

Big ad-tech companies like Meta Platforms are examples of "walled gardens;" in other words, they control all aspects of the transaction, such as keeping user data to themselves. The Trade Desk is transparent, giving its customers a look behind the curtain, so they know where and how their ads are performing. The Trade Desk's stellar growth relative to its peers stands out. During tough times, a company will hunker down and likely concentrate its spending on its best vendors. The Trade Desk's growth could reflect the platform's quality and good standing with its customers.

Growth isn't coming at the cost of profits

The Trade Desk is a software company; its asset-light nature has helped it generate free cash flow for several years. Currently the company is converting nearly 29% of revenue into cash, meaning it shouldn't need to raise more money -- a big positive in a shaky economy.

TTD Revenue (TTM) data by YCharts

Perhaps more importantly, The Trade Desk also has net income, meaning its stock-based compensation isn't large enough to push the bottom line into the red. Compensation was significant over the past year, totaling $498 million (about a third of sales). Investors should monitor ongoing quarters to make sure that number comes down.

Investors are getting more value on those profits today

Valuation is where most investors are torn on The Trade Desk as an investment. The Trade Desk's stock commands a price-to-sales ratio (P/S) of 19 today, which is much higher than its peers. (Its peers' P/S ratios range between 2 and 5).

So the argument becomes whether the stock justifies its premium. You've already seen the superior growth, and The Trade Desk is also profitable. Consider that The Trade Desk sports a free cash flow yield of 1.5% today, solidly above its average since its initial public offering (IPO). In other words, investors are getting more of Trade Desk's cash profits for their investment than they typically would.

TTD Free Cash Flow Yield data by YCharts

The Trade Desk is a fundamentally rock-solid company, and the market seemingly recognizes that. Ideally, you would have bought shares a few months ago when its yield was near its highest. A long-term investor with patience could slowly accumulate the stock and let the business continue growing into its pricey shoes over the coming years. Take the opportunity to jump if market turbulence pushes the stock back toward its lows.