Wall Street offers few, if any, guarantees. But one thing that's a near certainty is the forward-looking nature of investors. They're always looking to the horizon for the next great investment idea or game-changing trend. In 2023, anything having to do with artificial intelligence (AI) has fit the bill.

AI utilizes software and systems to perform tasks usually overseen by humans. The key with AI is the machine learning aspect that allows software and systems to evolve and grow smarter over time. Because of this evolutionary aspect, AI has applications in virtually all sectors and industries. That's likely why Grand View Research sees global AI revenue growing by an annualized rate of 37.3% between 2022 and 2030. In nominal dollars, we're talking about global sales surging from around $137 billion to $1.81 trillion by the turn of the decade.

Image source: Getty Images.

Although next-big-thing investments are known to attract capital from professional and everyday investors alike, not all companies involved in game-changing innovations are necessarily going to be winners. Looking back at previous hyped innovations and trends, there were certainly losers in the internet space, business-to-business commerce, genomics, cannabis, and 3D printing, to name a few hot trends over the past quarter of a century.

Then again, there are also eventual winners. Despite investors outrunning the potential of a next-big-thing innovation in the short run, long-term winners do tend to emerge.

What follows is one artificial intelligence stock that stands out a clear buy right now, as well as another widely held AI stock with numerous red flags that should be avoided.

The artificial intelligence stock you can confidently buy hand over fist: CrowdStrike Holdings

Although AI has broad application beyond the tech space, cybersecurity stock CrowdStrike Holdings (CRWD -1.74%) stands out as the top AI stock to buy hand over fist.

Arguably, the biggest headwind CrowdStrike faces at the moment is its premium valuation -- 42 times forward-year earnings, based on Wall Street's consensus. While this isn't particularly expensive given CrowdStrike's phenomenal growth rate and addressable market, which I'll touch on shortly, it is a bit eye-popping during a bear market and with a number of recession-probability indicators flashing warning signs.

However, there are a number of reasons to believe CrowdStrike is worth every bit of its premium.

CrowdStrike's cloud-native Falcon security platform is where this company earns its AI stripes. Falcon relies on artificial intelligence and machine learning to become more efficient at recognizing and responding to potential threats to end users over time. Every week, Falcon is overseeing trillions of events, which is what allows it to outperform on-premises security solutions.

Every facet of data suggests that Falcon is a superior option that businesses prefer. For example, during CrowdStrike's investor day last week, the company pointed to an International Data Corporation (IDC) report that labeled it No. 1 in worldwide, modern endpoint-security market share (from July 2021 to June 2022). CrowdStrike's 17.7% share sits above a number of legacy software providers from which it can steal share.

To add to this point, CrowdStrike's gross retention rate has pretty consistently risen over a six-year stretch from less than 94% to 98% on the nose, as of the end of fiscal 2023 (Jan. 31, 2023). Even though Falcon is far from the cheapest end-user security solution, the company's operating results show businesses are willing to pay more for a premium product.

But the best thing about CrowdStrike might just be the add-on sales. Sure, growing from 450 subscribers to more than 23,000 in six years is impressive. But what's even more phenomenal is having 62% of its 23,019 clients purchase five or more cloud-module subscriptions. With subscribers continuing to add to their initial purchase, CrowdStrike is getting closer to an adjusted gross-subscription margin of 80%. With margins this high, earnings growth can outpace its already supercharged sales growth for years to come.

The icing on the cake is that cybersecurity solutions have become basic necessity services. Businesses have been shifting their data into the cloud at an accelerated pace in the wake of the pandemic, which is putting more on the plates of third-party providers like CrowdStrike. With a potential addressable market of $158 billion in calendar year 2026, CrowdStrike's best days are still to come.

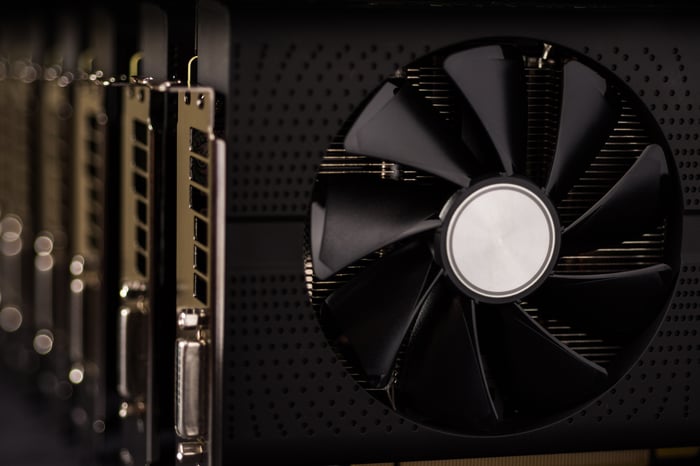

Image source: Getty Images.

The artificial intelligence stock to avoid like the plague: Nvidia

However, the fascination with artificial intelligence has also sent the valuations of certain AI stocks into the stratosphere. One such company that investors would be wise to avoid like the plague is semiconductor solutions specialist Nvidia (NVDA 1.97%).

Nvidia is one of Wall Street's top-performing companies in 2023, all thanks to AI. But it didn't become one of Wall Street's darlings by accident. It's best known for controlling close to a fifth of global graphics processing unit (GPU) market share, as well as holding the lion's share (more than 80%) of the discrete GPU market. Discrete GPUs are separate from the central processing unit and are typically used for things like video editing and 3D modeling, as well as by hardcore gamers.

Although Nvidia has AI software solutions of its own, such as virtual chat agents that can assist with customer interactions, the bulk of the AI hype surrounding Nvidia has to do with its innovative chips that allow for rapid processing and decision-making. If numerous sectors and industries hop aboard the AI bandwagon, Nvidia could see orders for these AI-focused chips ramp up.

For what it's worth, industry sources have noted that chip foundry Taiwan Semiconductor Manufacturing Company, known better as TSM, has seen an increase in orders from Nvidia for its powerful A100 GPUs, as well as the A800 GPUs, which were specifically developed for its China-based customers.

But there are abundant red flags with Nvidia, too.

To start with, the company's highly profitable gaming segment has been nothing short of a disaster over the past three quarters. With the COVID-19 pandemic waning and people returning to work, demand for gaming solutions and new personal computers fell considerably last year. For Nvidia, it's led to a huge sales drop-off (as much as 51% year over year) in a key segment.

Another concern can be found with a competitor, Advanced Micro Devices (AMD 0.26%). AMD, as it's more commonly known, noted a "significant inventory correction across the PC supply chain," in its latest quarterly report, and saw a sizable build in its year-end inventory. While some of this inventory increase relates to AMD's acquisition of Xilinx in 2022, it's a potential harbinger of inventory issues to come for Nvidia in the consumer space. It's also a big-time worry with U.S. recession fears mounting.

Perhaps the biggest headwind of all is Nvidia's valuation. Supporting a premium valuation isn't a problem for CrowdStrike because it's set to grow sales by an estimated 34% in fiscal 2024 and 29% in fiscal 2025. Nvidia's gaming struggles have completely stalled its growth engine.

Taking into account that AI is unlikely to represent a significant portion of Nvidia's sales anytime soon, investors are currently paying 60 times earnings for fiscal 2024 and nearly 23 times sales. In other words, Nvidia is priced for perfection and can't afford any mistakes. Unfortunately, hiccups and headwinds are common on Wall Street.