If you have cash sitting on the sidelines, it might be time to deploy some of it to pick up some stocks that look like incredible bargains. At the top of my shopping list are Airbnb (ABNB 1.03%) and Alphabet (GOOGL 1.42%) (GOOG 1.43%), both with bright days ahead of them.

But why are these two great buys right now? Let's take a look.

1. Airbnb

In the business of alternative accommodations, no one can match the brand power Airbnb has, as it practically invented the category. While many worried that the company would struggle if the economy slowed or consumers became pressed for cash, 2022's results proved that thesis wrong.

In the fourth quarter, Airbnb delivered strong 24% revenue growth to $1.9 billion and posted its best fourth-quarter net income margin ever: 17%. Furthermore, 2023 also looks strong, with management seeing a healthy booking backlog.

Wall Street analysts are also quite bullish, as they think revenue and earnings per share (EPS) will rise substantially in 2023 and 2024, as this table shows:

| Year | Revenue | Revenue Growth | EPS | EPS Growth |

|---|---|---|---|---|

| 2023 | $9.6 Billion | 14.2% | $3.32 | 19% |

| 2024 | $11.1 Billion | 15.3% | $4 | 21% |

Data source: Yahoo! Finance.

Using those growth projections to value the company yields a forward price-to-earnings (P/E) ratio of 33 times 2023 earnings and 27 times 2024's. However, Airbnb has a strong track record of blowing analyst expectations out of the water, as its "worst" quarter (compared to what analysts were expecting) was a 22% beat.

Airbnb is rapidly expanding while also becoming highly profitable. This is a rare combination that few companies have displayed. With the stock at a reasonable valuation, it's a no-brainer buy at today's prices.

2. Alphabet

As the economy slows, advertising companies don't perform well. With 78% of Alphabet's revenue coming from this stream, it's highly exposed to the trend. This advertising slowdown caused Alphabet's ad revenue to fall 4% in the fourth quarter, while overall revenue increased by 1%.

That dichotomy occurred because Alphabet's other segments are performing exceptionally well. Cloud computing, a massive long-term growth driver, saw its sales rise 32%. It's also extremely close to breaking even, with a 7% operating loss in the fourth quarter of 2022 compared to a 16% loss in 2021.

There's also Alphabet's massive investment in artificial intelligence (AI), which the world is starting to adopt en masse. With tools to integrate AI into apps, data sets to train AI, and cloud computing segments dedicated to training AI, it's clear that Alphabet will be at the forefront of this shift.

So while Alphabet's primary business isn't doing well right now, it won't always stay that way. Plus, with promising segments like AI and cloud computing executing strongly, the stock has much better days ahead.

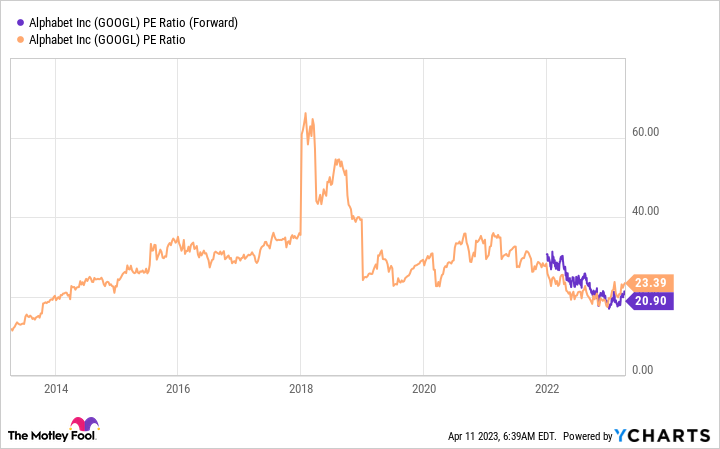

But it's valued like Alphabet's best days are behind it.

GOOGL PE ratio (forward) data by YCharts.

Alphabet trades at about 21 times forward earnings, which is cheap compared to its historical valuation. If you're investing for the long term, the stock has reached strong buying levels, and investors should use cash on the sidelines to take a position before the recovery begins.