The long swoon in the stock market that began early last year left shares of many companies trading meaningfully lower. Because of that, there are plenty of stocks around that look like bargain buys these days. But which ones are the real bargains?

Among the companies that look undervalued are three real estate investment trusts (REITs): Alexandria Real Estate Equities (ARE 0.05%), W. P. Carey (WPC 2.13%), and Tanger Outlets (SKT 1.28%). Because of their lower share prices, they offer particularly attractive dividend yields and compelling upside potential. That makes them look like great places to invest $1,000 these days.

Here's what three Motley Fool contributors had to say about these REITs.

Lab space: This office owner's not-so-secret recipe for success

Marc Rapport (Alexandria Real Estate Equities): Alexandria Real Estate Equities is a REIT focusing on office space, a sector that the pandemic altered (perhaps permanently). Hordes of people who began working remotely by necessity during the pandemic now continue to do so even as the health threat has receded.

But this is an office REIT with a difference. Alexandria specializes in providing lab and support space to life sciences operations and related endeavors. Its list of tenants includes a who's who of pharmaceutical companies, universities, and research institutions, many of whose employees are doing work that frequently can't be done at home.

The San Diego-based REIT went public in 1997, and since then, it has built a large collection of collaborative office campuses in the Boston, Seattle, New York, San Francisco, San Diego, and Washington, D.C., metro areas and North Carolina's Research Triangle.

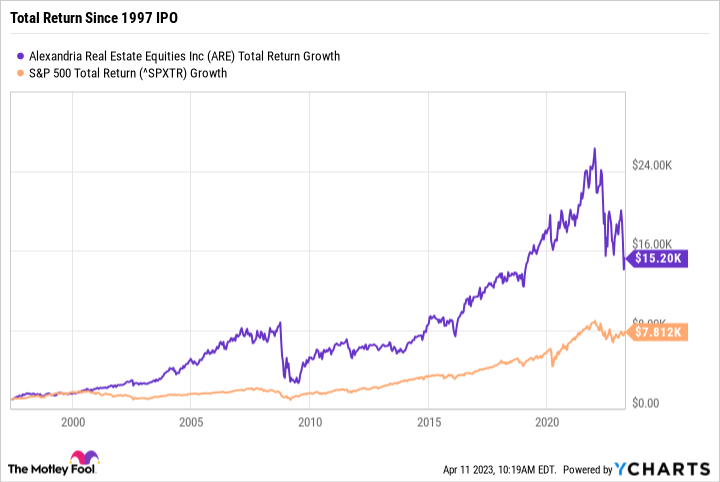

As a REIT, Alexandria is required to distribute at least 90% of its taxable income to shareholders every year in the form of dividends, but over the years, this dividend machine has been more of a growth machine with a side of income. The chart below shows what $1,000 invested in Alexandria at its 1997 IPO would be worth now. Essentially, over that time frame, it has delivered twice the total return of the S&P 500.

ARE Total Return Level data by YCharts.

That chart also shows the impact of the recent stock market downturn on total return, which combines share price and dividends and, along with Alexandria's fortress balance sheet, low vacancy rates, and ability to regularly raise rents, points to this stock as an undervalued opportunity.

Alexandria shares now trade at about $123, which pushed its dividend yield up to about 3.9%. And analysts' consensus price target on the stock is $172.83 -- about 40% higher than its price today. Given this seasoned REIT's portfolio, performance, and prospects, it seems likely that this buy-and-hold equity will meet those analysts' expectations.

High-quality real estate for a bargain basement price

Matt DiLallo (W. P. Carey): Diversified REIT W. P. Carey trades today at a valuation that's lower than other REITs and the broader market. This year, the company expects to generate between $5.30 per share and $5.40 per share in adjusted funds from operations (FFO). With shares recently below $75, it trades at about 14 times its adjusted FFO. For comparison, larger rival Realty Income trades at about 15.5 times FFO, while many other REITs trade at 15 to 20 times their adjusted FFO, or higher. Meanwhile, the S&P 500's price-to-earnings ratio is just above 18.

There's no discernable reason for W. P. Carey to be trading at such a discount. It owns a high-quality real estate portfolio of operationally critical industrial, warehouse, office, retail, and self-storage properties that it leases to credit-worthy tenants. The REIT uses triple net leases, the majority of which feature annual rental rate escalation clauses tied to inflation. Because of that, its rents are rising faster these days than those of its rivals that write leases with fixed rent hikes.

Thanks to its relatively undervalued price, W. P. Carey's dividend currently yields an attractive 5.8%. That's higher than Realty Income (4.9%) or the REIT sector average of around 4.1%. A $1,000 investment today in W. P. Carey would generate about $58 of annual dividend income.

W. P. Carey has increased its payout every year since its initial public market listing in 1998. That upward trend should continue as W. P. Carey's rents rise and it acquires more income-producing real estate. That combination of income and growth should enable the REIT to deliver attractive total returns for its investors over the long term.

Consumer spending remains robust

Brent Nyitray (Tanger Outlets): Tanger Outlets is a real estate investment trust that focuses on outlet centers. As of Dec. 31, it operated 29 outlet centers with approximately 11.4 million square feet in gross leasable area. Its tenant base includes 600 different store brands in a total of 2,200 stores. The company also has a partial ownership interest in six unconsolidated centers with 2.1 million square feet.

The outlet center concept is based on established retailers selling their products at a discount in their outlet stores. Outlet centers are generally located at a substantial distance from standard shopping malls. This encourages customers to spend more money at the outlets to make their trips to them more worthwhile. So far this year, consumer spending has held up reasonably well, and if this continues, Tanger will benefit.

Tanger's 2022 core funds from operations came in at $1.83 per share. REITs generally use the funds from operations metric to describe their earnings rather than earnings per share as reported under generally accepted accounting principles (GAAP). This is because depreciation and amortization are big costs for a REIT, but they don't represent cash expenses. As such, the funds from operations metric tends to give a more accurate representation of their cash-flow-generating capacity.

Tanger is guiding for 2023 FFO per share to come in between $1.80 and $1.88. At the midpoint, that would give the company a valuation of 10.6 times this year's FFO per share, which is an attractive level for a leading REIT. The company just raised its payout to $0.245 per share per quarter, which gives it a dividend yield of 5% at the current share price. A $1,000 investment today in Tanger Outlets would generate about $53 of annual dividend income.