Shoe and apparel company VF Corp. (VFC 1.26%) has had a tough 12 months, falling a whopping 60%. A few mishaps, from a sudden CEO departure to a big dividend cut, were justifiable reasons for the stock's plunge. But that was then, and investors want to know whether it's worth picking up the pieces.

This company with a basket of iconic brands has become an intriguing comeback candidate, but the journey could have bumps. Here is what investors should look for.

Do legacy brands still have value?

VF Corp. is a footwear and apparel conglomerate. You've probably run into several of its iconic brands, including Vans, The North Face, Dickies, Jansport, Timberland, and more. Collectively, these brands add up to nearly $12 billion in annual revenue.

It was the world's largest publicly traded apparel company in the 1980s, but has faded a bit over the past 40 years, and is a fraction of the size of Nike today. In other words, VF's decline wasn't an overnight phenomenon but a slow and steady tumble. The company's revenue has grown a total of just 6% over the past decade.

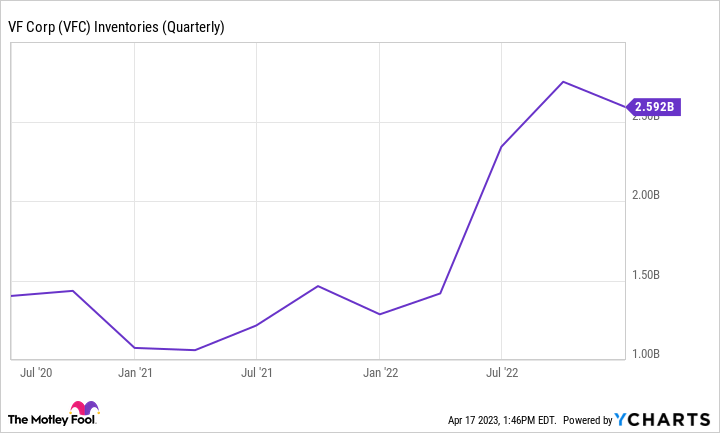

VFC Inventories (Quarterly) data by YCharts

That doesn't mean VF can't turn things around, but there are some problems. For starters, the company is dealing with an inventory surplus. A business might have to cut prices to move excess inventory, which could hurt margins, and even damage the brand if consumers start viewing it as cheap -- ask Under Armour about that.

There are positives for VF, including brands like The North Face, which posted 13% year-over-year growth globally for the quarter ending Dec. 31. At the same time, key brands like Vans are falling off, including a 13% decline in the Americas. Company-wide revenue fell 3% in the quarter, so the bad outweighs the good -- and that has to change.

The balance sheet must recover

VF's steady decline shows up on the balance sheet, which is reporting increasing debt while free cash flow deteriorates, especially over the past few years. Management recently cut its dividend by 41% to free up cash, but there's still lots of work ahead in getting VF back on firm financial footing.

VFC Free Cash Flow data by YCharts

Management expects margin improvement next year, which should set the stage for a rebound in cash flow. The company has $1.9 billion in liquidity today, so bankruptcy doesn't seem like a threat. With that said, investors should pay close attention to VF's quarterly cash flow and margins to verify things are heading in the right direction.

Are shares cheap enough yet?

Time will tell whether VF's struggles were due to mismanagement or if the brands don't have the sway with consumers they once did. For investors, the stock's valuation is a question of whether there's enough potential upside to justify owning shares during this turnaround attempt.

Understandably, a 60% decline in share price will move the valuation quite a bit. The stock trades at a forward price-to-earnings ratio (P/E) of 10, which looks very cheap when you compare it to those of some peers like Nike or Lululemon. But considering the higher growth outlooks, VF seems cheap for a reason.

VFC PE Ratio (Forward) data by YCharts

So here's the bottom line. I'm not going to try and justify paying a P/E of 10 when a business is struggling to the point that analysts expect negative earnings growth. Investors are likely better off staying away until VF can show multiple quarters of revenue growth and a decreasing debt load. Feel free to revisit it at that point, but there's still too much risk in VF to feel comfortable owning it today.