Wondering what to do with that income tax refund? Have uninvested money sitting in an investment account? Or maybe you have some idle cash ready to be put to work. It's never too early (or too late) to think about the future, and investing is tremendously important to meet financial goals. Buying exchange-traded funds (ETFs) or index funds is great, but many investors also like picking individual stocks.

The world of growth stocks is tremendously diverse, and patient investors often make market-beating profits. For example, Airbnb (ABNB 0.10%) and CrowdStrike (CRWD 0.13%) offer long-term investors (who don't mind moderate risk) unique opportunities to profit as leaders in the short-term rental and cybersecurity markets. Let's take a closer look at these two beaten-down growth stocks.

1. Airbnb is a rare mix of profits and growth

Many growth companies sacrifice profits for growth in their early years to get to scale. This can work out tremendously well; for example, Amazon started this way. But it demands attention when a company simultaneously pulls off fantastic growth and meaningful profits. That is the case at Airbnb.

Airbnb finished 2022 with $8.4 billion in sales on 40% year-over-year growth. Even more importantly, this was 75% higher than in 2019 -- the last full year before the pandemic. The company also posted a $1.8 billion operating profit and has excellent momentum, as shown below.

Data source: Airbnb. Chart by author.

Free cash flow has also been on fire, with $3.4 billion on a 40% margin in 2022. How the company got here might surprise you.

During the worst of the pandemic, things looked dire at Airbnb. The company was regrettably forced to lay off many employees and focus on a few core areas. While other big tech companies are laying off workers now after going on hiring sprees during the pandemic, Airbnb is ahead of the curve. Its staffing is already 5% lower than in 2019 (and revenue is 75% higher).

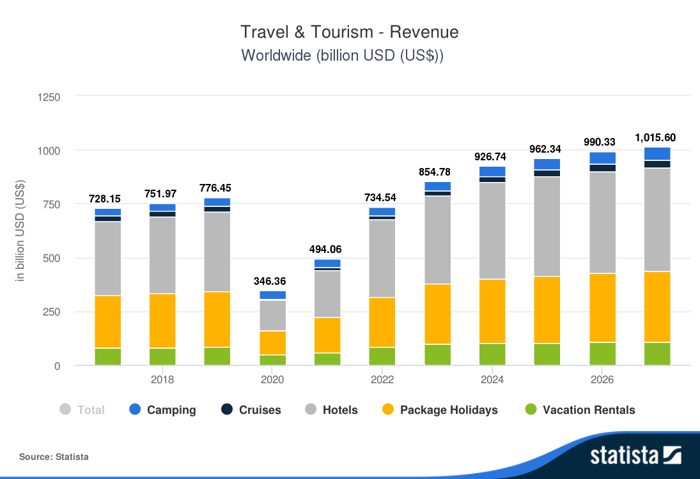

This lean approach is paying off big time, and travel is rebounding, as shown below.

Data source: Statista.

Statista predicts that 2023 will be the first year global tourism revenue exceeds 2019 levels. This should mean more revenue and more profits for Airbnb and its shareholders.

The stock sits more than 30% off its 52-week high and trades near its lowest price-to-sales (P/S) ratio in its short history. While a deep recession could negatively affect earnings, Airbnb is resilient, efficient, and poised to reward long-term investors.

2. CrowdStrike: Cybersecurity is a must, recession or not

Company executives know that skimping on cybersecurity is a no-no, so CrowdStrike's results should remain durable. Annual recurring revenue increased 48% year over year last quarter to $2.6 billion despite the challenging economy. CrowdStrike's Falcon platform is the industry favorite for endpoint protection. Also, CrowdStrike provides cloud security and other functions, giving it an addressable market estimated to reach nearly $100 billion over the next few years.

Unlike Airbnb, CrowdStrike isn't GAAP profitable. Growth is the name of the game right now. CrowdStrike's customer base is over 23,000 on 41% growth last year, and it includes more than half of the Fortune 500. These customers spend more on CrowdStrike's services over time, and its gross retention rate is solid -- 98% last quarter. Total revenue reached $2.2 billion (55% growth), and free cash flow hit $677 billion (53% growth) in fiscal 2023.

CrowdStrike's stock is more than 42% off its 52-week high, but it still doesn't come cheap at 13.5 times sales. The stock is most appropriate for long-term investors who don't mind moderate risk and volatility.

Investors with $2,000 could allocate it all to Airbnb due to its profitability or to CrowdStrike for its tremendous growth and potential. Or have the best of both worlds and split their investment between these industry leaders.