If you have $1,000 to invest this month, there are some good deals in the market right now. The truth is that even less money could go a long way. That's because some growth stocks, like Amazon (AMZN -1.64%) and eBay (EBAY -0.14%), are trading well off their previous highs and appear undervalued.

As long as you're investing money you don't need for a while, here's why putting $500 in each stock as part of a diversified portfolio could be a smart move.

1. Amazon

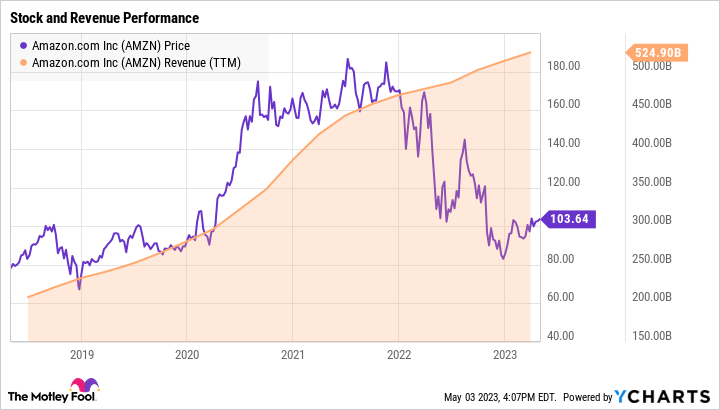

While Amazon's growth has slowed significantly over the last few years, the market's low expectations sets up a good entry point to buy the stock right now.

The market is concerned about cloud growth, especially with Microsoft Azure expanding faster than Amazon Web Services (AWS). Azure posted a year-over-year increase of 27% in the recent quarter, which might suggest that Microsoft is taking market share from Amazon, with the latter reporting a year-over-year jump of just 16% in Q1. But that's not the case. Instead, Microsoft is taking share from smaller competitors in the cloud market. According to Synergy Research, AWS is still holding its market share position in the low 30s percentage range.

The long-term outlook for cloud spending is still strong, with customers continuing to migrate workloads over to cloud services. Companies are tightening their budgets over the near-term macro headwinds, but AWS is in good shape to see strong growth over the next several years.

AWS makes up only 17% of Amazon's total revenue, but it generates the bulk of the company's profit, which is why it's a major growth catalyst.

Another area of weakness for Amazon has been its retail business. But this, too, still has some legs behind it to drive long-term growth. In fact, revenue from online stores saw a small acceleration last quarter, improving from 2% growth in the fourth quarter to 3% to start 2023.

Data by YCharts

Amazon can expand faster. The global e-commerce market is worth over $5 trillion and still growing. Amazon remains the leader, with billions in cash resources to invest in artificial intelligence (AI) that fuels many areas of the tech titan's online retail business, including personalized recommendations and customer service. It's got enormous advantages to drive growth for a long time.

For these reasons, the stock's 45% fall from its all-time high is a perfect buying opportunity for long-term investors.

2. eBay

There are several reasons to like this sleeper e-commerce stock. eBay is seeing progress in transitioning its marketplace to faster-growing categories. It's starting to implement AI in the shopping experience with tangible results so far. Most importantly, the market is not fully appreciating the clear improvements happening right now. The stock trades at a conservative valuation with an above-average dividend yield of 2%.

Wall Street has been put to sleep by the snail's pace with which eBay is growing revenue. The total value of all transactions on the marketplace (gross merchandise volume, or GMV) has been declining for several quarters now. But the important thing is that this metric is starting to stabilize. Gross merchandise volume (GMV) fell just 3% year over year last quarter, compared to 17% in the year-ago period.

The transition to faster-growing categories is partly pressuring the company's GMV growth. However, it is positioning eBay for sustainable expansion over the long term. Collectibles, luxury goods, and auto parts are growing faster than the rest of the marketplace, which is validating management's strategy.

Moreover, revenue, which eBay earns from taking a cut of each transaction, is consistently increasing faster than GMV. This suggests management is doing a good job of monetizing its active buyers and sellers. In Q1, revenue rose 2% year over year -- the third consecutive quarter of improvement. Revenue is being fueled by eBay's transition to its own payments system (as opposed to using third parties) and growth in advertising.

Data by YCharts

Similar to the case with Amazon, I believe eBay can expand a lot faster. One reason is investments in AI.

eBay has tens of billions of images on its marketplace tied to commercially available products, and it is starting to leverage this advantage by applying AI to help shoppers find what they are looking for much faster.

For example, by training deep neural networks using all these images on the marketplace, a buyer can take a picture of an object and find an immediate replacement on eBay. Management said this initiative has already led to improved search results and purchase behavior.

It seems eBay could be on the verge of achieving its best growth in years once the economy straightens up. But the market doesn't seem to get it yet. The share are down 45% from their previous highs, sporting a price-to-earnings ratio of 11 based on this year's earnings estimates -- about half the valuation of the average stock. With investors also getting about a quarter of the company's $1.9 billion of free cash flow paid out in dividends every year, the stock looks like a genuine bargain.