There has been plenty of discussion and news reports about artificial intelligence (AI) and machine learning (ML) this year. The topic seems to be of great interest among investors. The spark for much of the discussion was the debut earlier this year of OpenAI's generative chatbot ChatGPT.

It may seem like the topic emerged out of nowhere, but AI technology and efforts to capitalize on it have been around for years. Dozens of companies are researching how to improve it and many have been using some form of it for years.

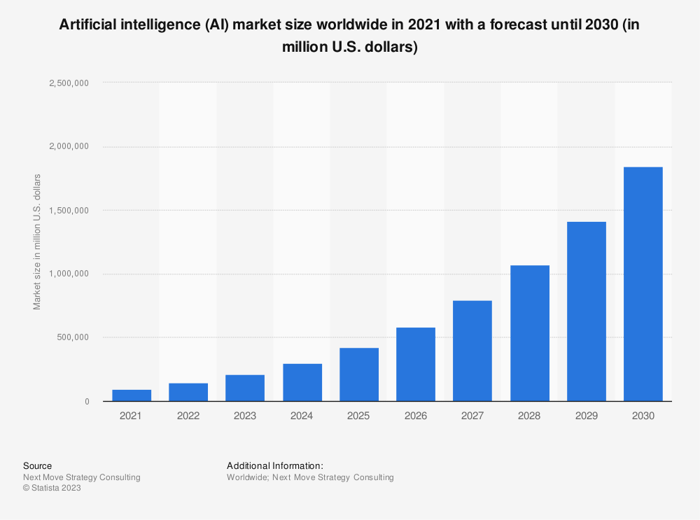

The current media hype will inevitably subside, but that doesn't mean the global market for AI isn't going to greatly expand. Statista predicts the global AI market will grow from $142 billion in 2022 to over $1.8 trillion by 2030, a compound annual growth rate (CAGR) of 38% (see chart below).

Data source: Statista.

Many of the best companies for AI investors to consider are already massive and successful, but the potential of AI should fuel years of additional strong growth. It's not too late to get in early on AI's potential even if among the established leaders. Let's take a look at four of them.

Microsoft is integrating AI into all its business segments

With its multibillion-dollar investment in ChatGPT-creator OpenAI, Microsoft (MSFT 0.37%) set an aggressive tone for the AI competition. It is integrating ChatGPT technology into its Bing search engine in hopes of chipping away at the dominance of Alphabet's Google Search. Google Search brought in $162 billion in revenue for Alphabet in 2022 and holds 85% of the global search engine market, so even a small percentage of market share gain would add billions to Microsoft's top line. But this isn't the only thing Microsoft has cooking.

The cloud will see a gigantic boost as companies need more data and processing power to run AI applications. This means Microsoft Azure and Intelligent Cloud, which already produce $88 billion in annual sales, will continue to see strong demand. Overall, Microsoft's results are stellar. Q3 fiscal 2023 saw $53 billion in sales on 7% growth and $22 billion in operating income -- a 42% operating margin that is simply fantastic.

Microsoft's stock is at a 52-week high after earnings and just 9% off its all-time high, so interested investors would be wise to accumulate shares over time to take advantage of potential dips in the share price. AI offers a massive market opportunity, and few companies execute as well as Microsoft.

CrowdStrike is leveraging AI to keep its cybersecurity lead

Cybersecurity is as critical as ever, and companies can't afford to scrimp in this area, recession or not. CrowdStrike's (CRWD -0.68%) cloud-based AI-powered platform Falcon is the market leader in endpoint protection and offers many other services (like Cloud security and threat intelligence). Endpoint protection is in high demand since many companies have remote or hybrid workforces. CrowdStrike holds the largest share of this market at 17.7%, edging out Microsoft at 16.4% and it's growing faster, according to IDC's report as of June 2022.

CrowdStrike's prolific growth is fueled by new and existing customers adding more services. As shown below, subscription customers have more than doubled over the last two years alone.

Data source: CrowdStrike. Chart by author.

In addition, existing customers account for over 20% of sales growth annually, while CrowdStrike retains customers at a 98% clip. This means an explosion of annual recurring revenue. CrowdStrike produced $600 million in fiscal 2020 and just hit $2.6 billion in fiscal 2023.

CrowdStrike isn't GAAP profitable yet, so the stock is moderately risky. However, its 76% gross margin, steadily improving operating leverage, and increasing free cash flow ($677 million in fiscal 2023) show it is moving in the right direction. The stock is 40% off its 52-week high and trades near its lowest price-to-sales (P/S) ratio since going public in 2019. CrowdStrike's ability to leverage AI for cybersecurity has made it an industry leader. The stock looks enticing for long-haul investors who can handle some risk and volatility in the short run.

Texas Instruments is an under-the-radar AI, ML play

When mining for gold, don't forget the picks and shovels. And when developing autonomous systems, you need censors and processors to translate real-world data. This is why Texas Instruments (TXN 5.64%) is a terrific under-the-radar stock that could see a boost from AI and ML "at the edge." In a nutshell, edge AI refers to machines that process AI locally rather than in the cloud.

For instance, advanced driver assistance systems in cars and autonomous robots in factories use input from multiple camera sensors and then interpret and act on it using ML. Texas Instruments' vision processors facilitate this. For decades, the company's portfolio of analog semiconductors bridged the gap between real-world data (like temperature, speed, and pressure) and digital functions, and the demand will only grow with AI.

On the financial front, Texas Instruments is best known for its excellent cash management. It has increased free cash flow per share by an 11% CAGR since 2004, allowing it to increase the dividend each year while reducing the share count by 47%. As expected, revenue in Q1 2023 was down 11% due to the slowdown in the economy. However, results were still strong, with $4.4 billion in sales and a 44% operating margin. Texas Instruments is a sneaky AI play and an excellent stock for dividend growth investors.

Amazon's AWS stands to benefit from AI's data demands

Amazon (AMZN -1.64%) may not be the first company that comes to mind when talking about AI, but perhaps it should be. Simply put, AI demands enormous amounts of data. As the global leader in cloud infrastructure, Amazon Web Services (AWS) stands to benefit tremendously. Amazon also leverages AI to improve logistics, personalize product recommendations, and improve customer service. Its Amazon Bedrock platform allows companies to build generative AI applications using foundational models (more details here) that run on AWS.

The easing of the pandemic has brought challenges for Amazon as inflation, increased costs, and other woes hit home. As a result, the stock is 27% off its 52-week high and trading near its lowest P/S ratio since 2015. But Q1 results were encouraging, with 9% sales growth and improved cash flow and profitability.

One concern is the slowdown in growth for AWS. This segment only grew 16% year over year in Q1, a far cry from the 30%-plus growth shareholders are used to. However, Amazon is actively working with customers to lower their bills because of the economy, so the slowdown isn't surprising. It will benefit Amazon in the long run by retaining these customers. With businesses continuing to transition to the cloud and AI increasing data needs exponentially, Amazon has a brilliant future and a beaten-down stock price, meriting strong consideration from investors.