Is now a good time to buy stocks? We're still in a bear market, and low prices provide great opportunities. At the same time, it doesn't look as if the economy is going to shape up in the near future, and a recession is possibly on the way. Although the market doesn't always move in tandem with the economy, as evidenced by a 7% increase in the S&P 500 so far in 2023, it's typically impacted to some degree. The broader market isn't likely to skyrocket while economic volatility continues.

What does this mean for investors? For most individuals, successful investing involves buying great stocks and holding onto them for many years. As long as you have a long time horizon, now is a great time to buy top stocks. Costco Wholesale (COST -0.45%), Lululemon Athletica (LULU -0.09%), and Starbucks (SBUX -0.06%) are three top choices. Here's why.

1. Costco: the paid membership model

Costco has a differentiated model with paid membership fees and dirt-cheap retail prices. It marks up products with razor-thin margins that just account for associated expenses and makes most of its income through the membership fees. That generates consumer loyalty, because shoppers want to make the most of their memberships and benefit from the cheapest prices around.

This business model functions well in any environment, and it's particularly useful when we're experiencing inflation and economic volatility. That's why Costco had elevated sales growth for about two years when the pandemic started. And even now that the emergency is finally winding down, membership renewals remain at record rates, and profits are strong.

Consider these statistics. In the latest quarter (ended Feb. 12), sales growth decelerated from double digits to 6.5% year over year, or about the typical pre-pandemic rate. That's been slowing further, with just a 3% increase in April. Still, second-quarter earnings per share (EPS) increased from $2.92 last year to $3.30 this year.And renewal rates topped 90%, with nearly 93% in the North American market. Overall membership was up 7% over last year.

Costco stock is up 10% so far in 2023, and at this price, the shares trade at 37 times trailing-12-month earnings. Valuation is often a discussion point about Costco stock, since it is usually high compared with that of similar companies. Then again, what counts as a similar company? Costco gets a premium valuation because it has qualities that "similar" retailers don't have, making it more valuable to own as a stock.

You might be able to buy Costco stock for a cheaper price, but if you are a long-term investor, you should know that you can't time the market. Costco is a top stock with tons of future opportunity and resilience, and it also pays a dividend.

2. Lululemon: premium activewear

It's pretty astonishing that Lululemon has been able to expand from a niche athleisure maker to a formidable rival to industry leader Nike. I don't think Lululemon will topple Nike anytime soon, but the fact that it's even in the conversation is a huge sign of its success.

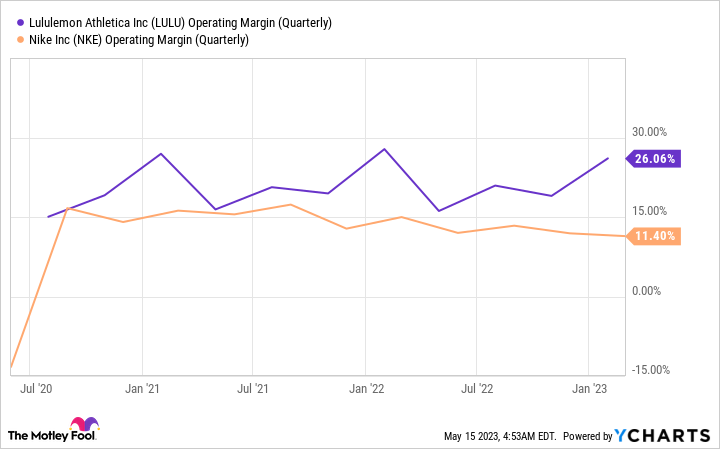

Lululemon's sales are growing faster than Nike's and that of most other apparel retailers. And its premium pricing and all-season versatility allow it to charge higher prices and demonstrate stronger profitability than its peers. Consider its operating margin as compared with Nike's.

LULU Operating Margin (Quarterly) data by YCharts.

Despite macroeconomic pressure, Lululemon has been posting outstanding performance. Sales increased 30% year over year in both the fourth quarter and fiscal 2022 (ended Jan. 29). Management is expecting a huge slowdown this year, with an 18% year-over-year increase in the 2023 first quarter and 15% for the year, but that's still competitive growth in this climate.

Lululemon targets upscale customers, which makes it more resilient, and it has tons of potential down the line as it enters new markets and develops new products. This company has outperformed the market for many years and should continue to do so.

3. Starbucks: the undisputed leader in coffee

Starbucks has an immense lead on any other coffee shop chain, with more than 36,000 stores globally. It still has massive opportunities, even in the U.S., but significantly in China; the company expects to reach 9,000 stores in China by 2025, up from 6,200 now.

Plus, Starbucks continues to roll out improvements and embrace digital commerce, leading to comparable-sales increases. Mobile ordering now accounts for 47% of total orders, up 4% from last year. Delivery increased 21% year on year in the latest quarter and accounts for 23% of orders.

That's a new landscape for a company that previously had the goal of being the "third place" for customers, after work and home. It's had to shift, along with society, to the digital or omnichannel retail model. This have led to robust performance. Sales increased 14% year over year in the fiscal second quarter (ended April 2), and comparable sales rose 11%.

Starbucks stock took quite a beating last year, when the market was pessimistic and its business was posting slow growth. But investors have been impressed with its rebound and new CEO, and the stock is now up 40% over the past year.

At this higher price, the dividend yields just under 2%, which is an attractive figure. Starbucks stock is an excellent choice for both income investors and long-term investors.