Technology stocks get a reputation as high-flying, high-risk bold investments, but that's not always true. Plenty of technology companies with dependable, steady business models pump out cash that gets funneled to shareholders as dividends.

Long-term dividend investors should diversify their portfolios to reflect as many industries as possible, including sprinkling in some tech names. But don't worry if you're not sure where to look. Here are three quality dividend-paying tech stocks trading at attractive valuations today.

1. Automatic Data Processing

People are often a company's greatest asset, but managing employees can be challenging. Automatic Data Processing (ADP 0.25%) offers a range of cloud-based solutions for managing human talent. ADP helps companies handle payroll, tax, and benefits -- just about anything involving the people working inside a business.

ADP has been at it for a long time; the company's paid and raised its dividend for 48 consecutive years, making the stock a soon-to-be Dividend King. And the dividends should continue increasing for years -- the payout consumes just over half of ADP's cash profits, and gets a low-to-mid single-digit boost each year.

ADP Dividend Yield data by YCharts

The stock trades at a price-to-earnings ratio (P/E) of 27, a notch below its decade average of 29. Analysts believe ADP will grow earnings by an average of 12% annually over the next three to five years. The company's long track record of steady performance and double-digit growth outlook make ADP arguably an excellent stock trading at a fair price.

2. Verizon

Are you looking for something with a higher dividend yield? U.S. telecom giant Verizon Communications (VZ 0.14%) has you covered. Verizon operates wireless networks and internet services, primarily in the United States. Verizon faces little threat from outside competitors, because a few operators dominate a business that requires billions of dollars in continuous investments to upgrade and maintain its network.

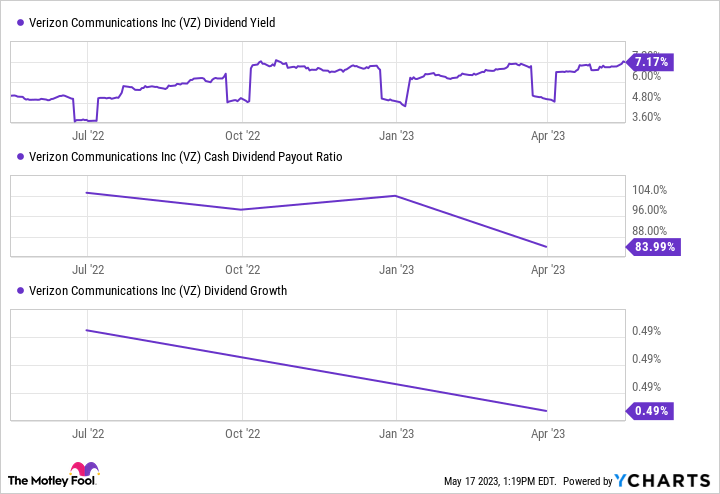

Verizon's business generates a lot of operating profits, which lets Verizon pay a big dividend despite continually investing in its business. The company has raised the payout for 19 years, climbing the dividend growth ranks. The big headline is that shareholders can score a 7% dividend yield at today's share price, though you can see below that it offers little growth to go with it.

VZ Dividend Yield data by YCharts

Verizon's business isn't growing very much; analysts believe earnings-per-share (EPS) will increase by an average of just 4% annually over the next several years. That explains why shares trade at a P/E of just 8. That's enough growth to give investors roughly 10% annual investment returns once you add in the juicy dividend, a solid haul for income-focused investors.

3. Corning

Technology goes beyond software, including hardware and materials that sometimes must be on the cutting edge of science. Corning (GLW 1.21%) sells various specialized glass and materials products, such as displays for smartphones and fiber optics for communications. Its end markets span the economy from automotive to aerospace and defense.

Corning is an up-and-coming dividend stock with 13 consecutive dividend increases to its name. You'll see that the dividend payout ratio is currently more than 100%. The company has had a soft year due to weaker demand in some end markets. However, management expects cash profits to turn positive in Q2, and there is $1.1 billion in cash on the books. Investors shouldn't panic and assume a cut is coming, but it's something to keep an eye on.

GLW Dividend Yield data by YCharts

The company's short-term headwinds have pushed the stock down to a P/E of 15 against 2023 earnings estimates, and that's right on par with its average over the past decade. A stock with a dividend yield nearing 4% and EPS expected to grow by 7% annually offers investors a solid bet at double-digit total returns, with additional potential if Corning can improve its performance.