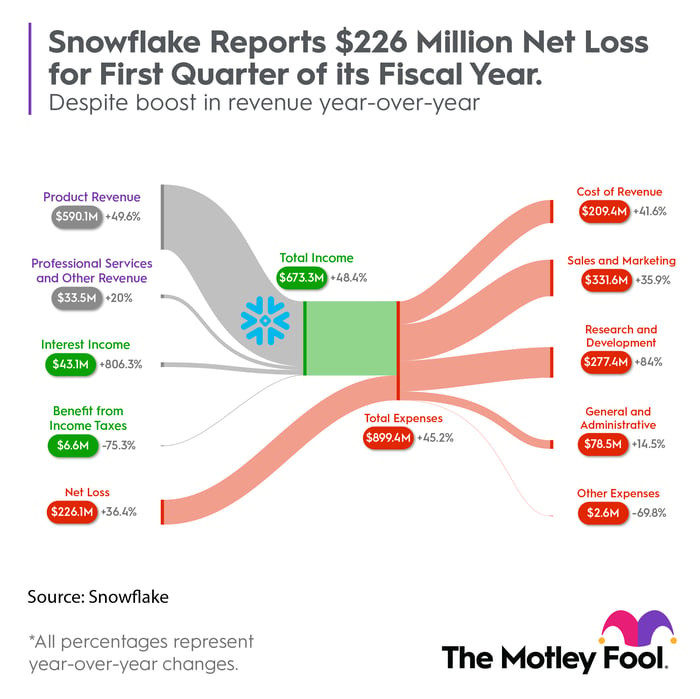

Shares of Snowflake (SNOW -1.00%) are down 15% following its financial results for the first quarter. The data cloud provider reported a 50% year-over-year increase in revenue for the first quarter of fiscal 2024, which shows a significant slowing in the company's top-line growth.

Some investors probably balked at the company's widening net loss, but compounding the problem is management's commentary about weakening demand trends. Snowflake's revenue growth is continuing to decelerate as companies tighten their spending on cloud services, and management expects these trends to continue through 2023.

Here's what management had to say about the near-term business environment and what it means for long-term investors.

The broader trends impacting Snowflake

Management was upfront on the earnings call, explaining that the near-term demand for the data cloud platform is weakening. CEO Frank Slootman said, "While enthusiasm for Snowflake is high, enterprises are preoccupied with costs in response to their own uncertainties." As companies cut back on cloud storage spending, Snowflake felt the impact with top-line growth decelerating in April and May.

It doesn't appear to be a competition issue, but rather a slowdown across the broader cloud services market. The leading cloud services provider, Amazon Web Services (AWS), reported just 16% year-over-year revenue growth in the first quarter, which is a steep deceleration compared to a year ago. Microsoft Azure, which has been gaining market share in the cloud infrastructure market, has also reported slowing revenue growth.

Growth at Azure and AWS is important to consider since they both partner with Snowflake to offer its data warehouse capabilities to their cloud customers. Slowing growth at AWS is going to impact growth for Snowflake, which appears to be the main issue.

Snowflake expects the trend to reverse, but it doesn't know when. For now, guidance calls for product revenue to slow to a range between 33% and 34% year over year in the second quarter. That is not the growth investors are used to seeing from Snowflake. It was just a few quarters ago that revenue was increasing over 80% year over year.

However, even when Snowflake was reporting faster growth, its stock was tanking last year, reflecting the high growth expectations investors have placed on the company. The stock is now down 40% from its initial public offering price a few years ago.

AI is an opportunity for Snowflake

One indicator that Snowflake, and other cloud services, should see more robust growth down the road is the growing demand for Nvidia's data center hardware. The chipmaker is seeing explosive demand for advanced processors that power accelerated computing in data centers. There is still a lot of investment pouring into the cloud space, especially with interest in artificial intelligence (AI) heating up.

The growing demand for AI is good news for Snowflake, which is in the business of helping companies process and gather insights from data. Management pointed out that the number of customers using AI capabilities on its data cloud platform was up 91% year over year.

Where does the stock go from here?

The soft guidance is going to weigh on the stock performance for a while. Even looking ahead to management's long-term target of reaching $10 billion in revenue by 2029, that still puts the stock's forward price-to-sales ratio at 4.9, which might leave some room for return, but probably not enough to satisfy growth investors.

Historically, Microsoft and Salesforce give investors a helpful example of what a high-growth software business capable of generating a high profit margin is worth on a price-to-sales basis. Both stocks traded close to 10 times sales during their high-growth years.

At best, investors shouldn't expect to more than double their money from Snowflake's current share price through 2029.

The stock is starting to sell off just enough to become lukewarm for value investors. If it continues to fall, Snowflake could be a bargain buy with high return potential over the long term.