Digital payments are becoming the norm for many around the world, and PayPal (PYPL -1.83%) is the industry leader in the segment. But being at the top and having a first-mover advantage in the market hasn't been enough to satisfy investors who are disappointed with its performance over the past couple of years. Maintaining such high growth rates can be tough to sustain, especially as new companies come with fresh thinking that a large, established company can sometimes miss.

PayPal is working hard to stay at the top and regain some of this lost investor confidence. The changes it is working toward are likely to mean this fintech will look somewhat different a year from now. What should investors expect?

PayPal expects slowing growth, more profits

PayPal's growth rates have slowed, but business is still booming. It got a boost at the beginning of the pandemic when digital retail sales skyrocketed, but since it also works with physical stores, the headwinds of store reopenings haven't been fierce.

Total payment volume (TPV) increased 10% year over year in the first quarter of 2023 to $355 billion, and revenue increased 9% to $7 billion. Adjusted earnings per share (EPS) of $1.17 came in above analyst expectations, and management raised its full-year guidance from $4.87 to $4.95. It maintained its second-quarter guidance for revenue to increase by 6.5% to 7%.

The EPS beat came about after a significant cost-cutting program, and that's likely to continue generating more efficiency and higher profitability over the next 12 months, even as revenue growth looks sluggish.

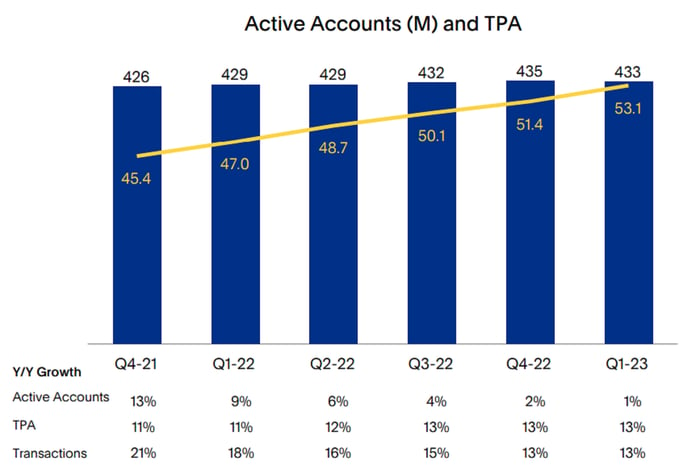

Something to keep an eye on is the slowdown in new accounts. PayPal is huge and already has 433 million active accounts. That was a 1% increase year over year in the first quarter, but it was a decline from the previous quarter. Management pointed out that transactions per active account (TPA) are still growing and were 13% more than last year. It said that it was focusing on generating higher activity per account, and the lost quarterly customers were the "churn of minimally engaged accounts."

Image source: PayPal. TPA = Transactions per active account.

New features and capabilities

Fintech is a hot industry, with upstarts like Affirm and Marqeta, but also older companies that are upping their game, like Visa and American Express. Apple has become an important digital payments contender with Apple Pay, which provides easy contactless payments. It's the No. 1 payments app for teens, according to Piper Sandler's annual Taking Stock With Teens survey.

PayPal added many new features and functions to its services, which are on both the merchant end and the individual end. It offers Braintree and PayPal Complete Payments to merchants, both merchant payment platforms that help small businesses with a suite of payment solutions, and it recently added buy now, pay later capabilities. It also recently launched a new all-in-one personal finance app for users to bank, trade, and buy.

Although it's adding services to its platform to stay competitive, it often looks like it's following instead of leading, allowing other companies to be the innovators. That could underscore what investors are seeing as bland business execution.

A higher stock price?

Investors have soured so much on PayPal stock that it's 25% below its price of five years ago, while at the same time, it increased revenue in a dramatic fashion and also grown its bottom line. The theory behind that is that PayPal is no longer a growth stock and needs to be priced as such. Accordingly, its valuation has dropped. Not only is it well below its five-year average at the current price-to-earnings ratio of 25, it's close to its five-year low.

PYPL PE Ratio data by YCharts

PayPal is still the dominant player in its industry with lots of gas in the tank, even if it's moving more slowly. It's hard to say where it will be in one year; if we're still in a bear market, PayPal's stock price won't necessarily budge higher. But in a bull market, investors might realize that PayPal stock is undervalued and push it up.

Long-term, PayPal should reward investors as it captures market share and powers digital payments, and this is a good entry point for new investors.