Did you know that Alphabet (GOOG 0.74%) (GOOGL 0.55%), the parent company of Google, is already the third-largest American company? Indeed, Alphabet's $1.5 trillion market cap trails only Apple ($2.8 trillion) and Microsoft ($2.4 trillion).

Not bad for a company that debuted on the stock market less than 20 years ago.

But today's investors want to know more than what Alphabet has done; they want to know where it's going. So, what does the future hold for this corporate giant? Where will it be in three years? Let's take a closer look.

Alphabet has grown due to its search engine dominance

Let me be clear: Alphabet is a search engine company. And in some ways, it is the only search engine company that matters.

As of last year, Google Search held between 84% to 96% of the search engine market, according to Statcounter and Statista.

You will find more infographics at Statista.

Needless to say, that type of market share represents a near-monopoly, which brings opportunities and challenges.

On the positive side, Google's dominance of the search market is extremely lucrative. Google Search generated $40 billion of the company's $70 billion in first-quarter 2023 revenue. Google Cloud accounted for less than $8 billion; YouTube drove less than $7 billion.

In short, Alphabet is likely to remain heavily dependent on its Search unit for the next three years. Luckily for the company, the online search market is expected to grow by leaps and bounds for many years to come.

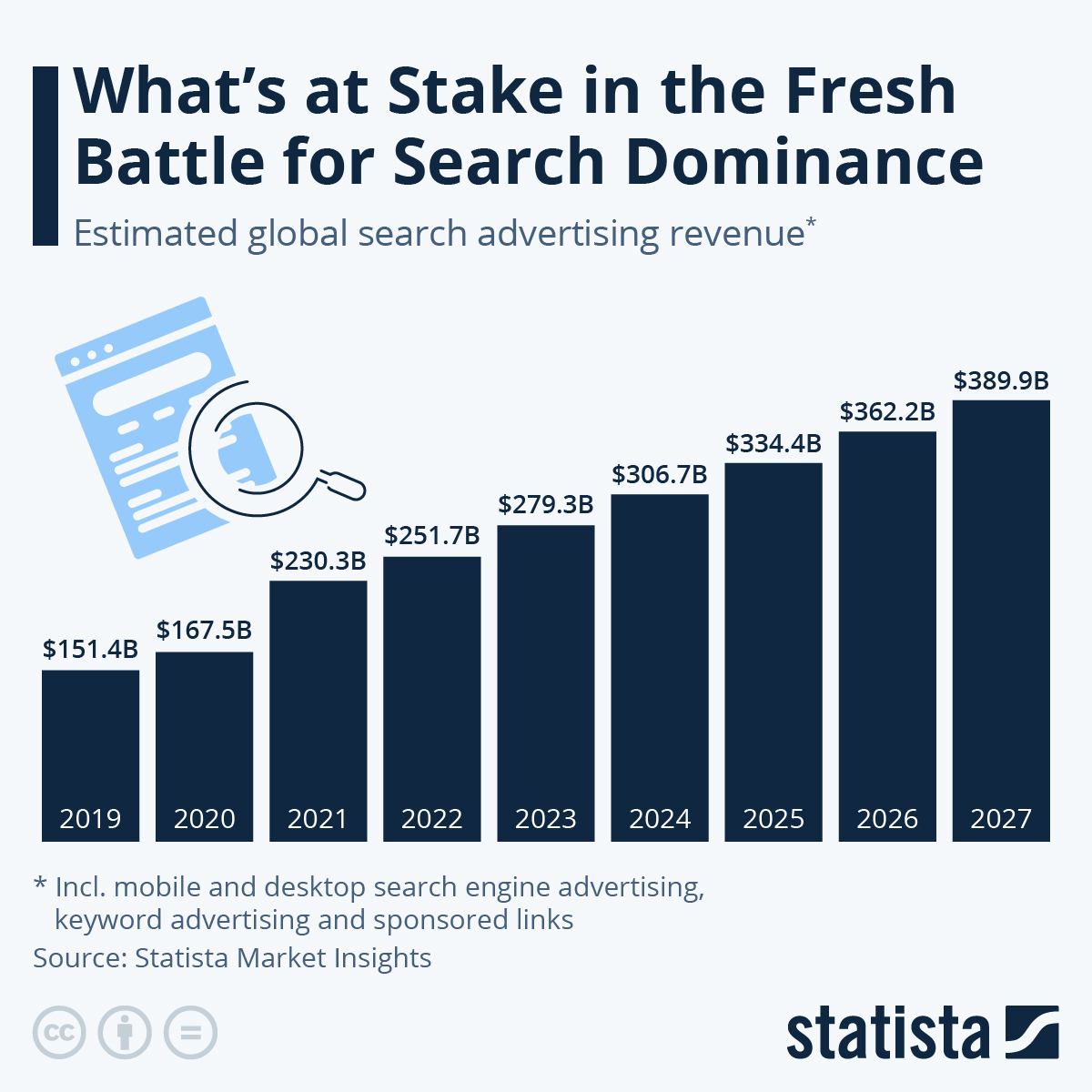

You will find more infographics at Statista.

According to Statista Digital Market Insights, the online search market should expand from just under $297 billion this year to more than $400 billion by 2026.

If Alphabet can maintain anything close to its 90% share of the online search market, then the future will be very bright for Alphabet.

Conversely, if Alphabet's market share slips due to adverse regulatory impacts, competition, or some other unforeseen influence, the company will likely struggle to generate overall revenue growth from its smaller business segments.

Is Alphabet a buy now?

In summary, Alphabet is well positioned to grow rapidly over the next three years, assuming it can maintain its domination in online search.

Of the challenges it faces, I believe the regulatory concerns will come and go. Yet the competitive challenges, particularly those coming from Microsoft and its Bing search engine, shouldn't be overlooked.

Bing, which is now powered by OpenAI's ChatGPT, is likely to chip away at Google's market share. However, with less than 10% market share (and almost no mobile presence), Bing is unlikely to unseat Alphabet before 2026.

Yet, long-term investors should keep a watchful eye on Google Search's market share. It might be time to reevaluate owning Alphabet stock if it drops meaningfully.