Palantir Technologies (PLTR -0.34%) has put up astounding returns in the last few years. Since the beginning of 2023, shares are up more than 2,200%. That's over a decade's worth of life-changing returns in just two and a half years.

Now, at a market cap of $350 billion and a price-to-sales ratio (P/S) greater than 100, it looks like future returns for Palantir stock will be weak. The math around valuation eventually catches up to a stock in the long run.

Miss out on Palantir? Then you might be interested in this other fast-growing artificial intelligence (AI) and software platform: The Real Brokerage (REAX -2.66%). Here's why the stock has a chance to put up 10x returns like Palantir in the next few years.

Image source: Getty Images.

A lower-cost digital brokerage for real estate agents

The residential real estate market has not yet been brought into the 21st century. People looking to buy and sell homes have to deal with high commission rates, while real estate agents deal with legacy in-office brokerages that operate slowly. There is a lot of friction and time wasted in real estate transactions that can be saved with digital tools.

This is where The Real Brokerage steps in. As a cloud-based brokerage, it offers a digital brokerage and software tools to real estate agents who want to escape legacy brokerages. You see, every real estate agent is required to use a brokerage to process residential real estate transactions.

However, historically, these brokerages would take a large cut of the commissions earned by real estate agents, a process still employed today even with modern internet real estate portals.

With no offices and a software-first approach, The Real Brokerage has lower costs and therefore can take a smaller cut of transactions for real estate agents who work for the platform.

Lower costs and robust software tools are driving agents to switch to The Real Brokerage. In the first quarter of 2025, the number of agents signed up with the brokerage grew 61% year over year to around 27,000. More agents mean more real estate transactions, which led to a 76% increase in revenue in the quarter to $354 million.

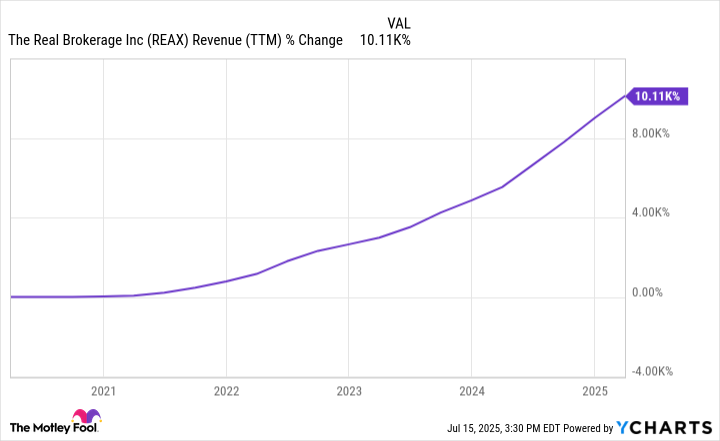

Since going public, The Real Brokerage's revenue is up more than 10,000% cumulatively, making it one of the fastest-growing companies on the planet.

Macroeconomic headwinds turning to tailwinds?

The Real Brokerage is growing quickly despite the fact that existing home sales have frozen in the United States because of high interest rates. Annualized transactions have fallen to 4 million in recent quarters, compared to around 6 million in a normal environment.

Fewer transactions in residential real estate mean weaker demand for The Real Brokerage. However, it is still taking a ton of market share and should benefit once this eventually unfreezes.

Think of this as a slowly filling demand for potential home purchases. People want to buy homes or move, but cannot afford to because of mortgage rates and home prices. As this changes, investors could see huge growth in existing home sales, which will help the growth of The Real Brokerage.

REAX Revenue (TTM) data by YCharts.

Why The Real Brokerage could become the next Palantir

What makes The Real Brokerage like Palantir is not only its fast growth, but its embrace of AI. It has launched Leo AI, a digital AI concierge for real estate agents to help with busywork around homebuying and selling. As mentioned above, buying a home is an arduous process for both the buyer and the agent. This is a tailor-made situation for AI, and The Real Brokerage is building products for it.

Over the long term, The Real Brokerage is working to build an AI-assisted real estate portal for clients, which would likely compete with Zillow Group. While it's a long way away from being widespread, The Real Brokerage has large ambitions and is executing at a blistering pace to try to become the AI and software layer of the residential real estate market.

Today, you can buy shares of The Real Brokerage at a market cap of just $823 million. The company is not yet profitable and close to breakeven, but this is quite a small feat for a company that generates $128 million in gross profit and is growing revenue at more than 50% year over year.

It does not come without risks, but The Real Brokerage looks like a potential huge stock winner for those who buy shares today.