Audio controls expert SoundHound AI (SOUN +4.45%) is preparing its next earnings report for the evening of Thursday, Nov. 6. The company knocked the previous report out of the park, crushing analyst expectations across the board. The stock rose 26% the next day and 54% over the following week. SoundHound AI's Q2 report was a big win. Case closed!

...or was it?

Call me a nitpicker, but I'm not so sure that SoundHound AI deserved a 54% price jump after that report.

Image source: Getty Images.

SoundHound AI's explosive growth turned heads on Wall Street

At first glance, everything looked perfect. SoundHound AI's revenues more than tripled year over year to $42.7 million. Adjusted net losses shrank from $0.04 to $0.03 per share. Those are the headline numbers, and SoundHound AI aced both of them. The average Wall Street analyst would have settled for a deeper net loss of $0.09 per share on lower revenues in the neighborhood of $32.9 million.

SoundHound's Q2 was a "show me" quarter, and the company delivered where most people were looking. Top-line growth surged to unexpected heights and the artificial intelligence (AI) developer signed a raft of impressive new deals. Together with milder adjusted losses, these upsides helped justify the market's excitement and the stock's big move. Management's raised outlook and cash cushion are real strengths.

SoundHound AI's fundamentals still raise an eyebrow

But the underlying fundamentals show a company still early in its transition toward sustainable, profitable growth. Cash burn, dilution, narrowing margins, a heavy dose of stock-based compensation, and the reliance on lumpy, sometimes low-margin deals are all realities that a level-headed investor shouldn't ignore.

All of these issues showed up in the widely celebrated Q2 report. Execution risk remains, particularly if SoundHound AI's revenue momentum stalls or costs aren't reined in.

What's not to love? Let's start with these three things.

Let's take a quick look at some of the concerns I listed above.

Cash burn

SoundHound AI burned $24.7 million of cash in the second quarter, based on $24.5 million in negative operating cash flows and $0.2 million of capital expenses.

And the cash burn is growing larger. Free cash flows were a negative $18.7 million in the year-ago quarter.

Stock dilution

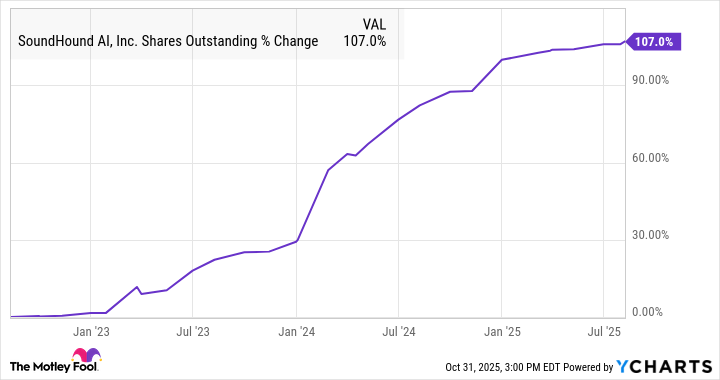

The company keeps its lights on by selling new shares on the open market. SoundHound AI pocketed $260.8 million of extra cash from stock sales over the last four quarters, for example. The number of shares has more than doubled in three years:

SOUN Shares Outstanding data by YCharts

Sure, it makes sense to take advantage of unreasonably high share prices by issuing more stock to hungry buyers. But this strategy undermines the value of long-term stock holdings, essentially halving each share's participation in future profits in this three-year period. Maybe it's time to start looking at fresh debt as an incoming cash source instead -- or positive cash flows, even.

Stock-based compensation

This problem is kind of complicated. SoundHound AI is glossing over its deeply unprofitable operations by issuing stock instead of cash-based paychecks. Twenty-three percent of last quarter's operating expenses consisted of stock awards.

This approach makes the company's financial statements less transparent while adding fuel to the dilution fires mentioned earlier. The non-cash stock awards also result in stronger adjusted bottom-line results, helping people forget about the painfully negative GAAP earnings and cash flows.

It's true that many companies rely on stock-based compensation, especially in the tech sector and during the early high-growth phase of a long-term business plan. That doesn't mean I have to like it -- so I don't. GAAP earnings and free cash flows are better than adjusted earnings, any day of the week.

NASDAQ: SOUN

Key Data Points

The best way to think about SoundHound AI's next move

The best long-term investments marry explosive growth with a credible path to profitability and strong unit economics. SoundHound's Q2 showed the former in spades, but investors should keep a close eye on the latter to make sure the business can ultimately live up to the hype.

I say this as a SoundHound AI shareholder with lofty expectations for the company's long-term growth story. I just think people are too quick to brush off the risks and challenges this company faces on the road to potential greatness.

Unless next week's Q3 report is truly game-changing, I wouldn't mind a calmer market response or even a price cut. Meanwhile, SoundHound AI is more of a hold than an active buy idea in my book.