Is Exact Sciences (EXAS +2.28%) about to go on a sustained run? The medical diagnostics specialist has lagged the market over the trailing-12-month period, but the stock is rebounding. In the past six months, Exact Sciences' shares have climbed by 41%.

The company's third-quarter update is on Nov. 3, and if it impresses investors with its results, that might lead to even more gains. Is it worth it to invest in Exact Sciences?

The business is doing (pretty) well

Exact Sciences' claim to fame is Cologuard, an at-home stool-based test it developed for the early detection of colorectal cancer (CRC) in patients with average risk. CRC is the third-most-common cancer in the world and the second-leading cause of cancer death, despite having a high five-year survival rate when it is caught early.

That suggests that large segments of eligible patients aren't being screened when they should (it is recommended to start screenings at 45). Exact Sciences has successfully targeted this demographic. Since its launch in 2014, Cologuard has been used in over 20 million screenings.

Exact Sciences has benefited from rapidly rising sales. Second-quarter revenue increased by 16% year over year to $811 million. That included $628 million in screening revenue, primarily from its Cologuard test, and $183 million in precision oncology revenue. In the latter segment, Exact Sciences offers its OncotypeDx tests that help predict the probability of recurrence in patients with breast cancer.

One knock against Exact Sciences is that the company still isn't profitable, although it is improving on that front. In the second quarter, it reported a net loss per share of $0.01, better than the $0.09 loss per share in Q2 2024.

Potential catalysts on the horizon

Exact Sciences' shares have rebounded, partly because it is poised to tap into growth opportunities that should improve its results. First, it launched its next-gen Cologuard Plus in March, a test that is even more accurate than its previous one. Second, Exact Sciences acquired exclusive rights to a blood-based CRC test from a privately held biotech company, Freenome, for $75 million upfront and potential additional milestone payments. This test hasn't yet received FDA clearance, but Freenome has filed for approval.

Adding a blood-based test will help Exact Sciences expand its appeal. This is important, as Exact Sciences estimates there are still over 55 million patients in the U.S. aged 45 to 85 who are eligible for CRC screening but haven't yet received it. If Exact Sciences can show that its next-gen Cologuard is already gaining significant traction in its third-quarter earnings release, the stock could jump.

NASDAQ: EXAS

Key Data Points

Third, Exact Sciences launched Oncodetect in April to test for recurrence across multiple cancers. This newer product could also boost sales and help the stock maintain its momentum. Lastly, we could also see other potential catalysts in Exact Sciences' upcoming update, including its work with its blood-based multicancer screening test, Cancerguard, which it launched as a laboratory-developed test (meaning it is not FDA cleared or widely commercially available, and blood samples are analyzed in a single laboratory) in September. Is Cancerguard seeing decent traction already? If so, Exact Sciences shares could rise.

Is Exact Sciences stock a buy?

Buying a stock before its earnings release in anticipation of a big jump is always risky. While some catalysts could send Exact Sciences' shares up, it's hard to predict these things. The good news, though, is that Exact Sciences' long-term prospects look attractive. The company estimates a nearly $60 billion total addressable market across the range of its services. Exact Sciences has barely tapped into that, given its trailing-12-month revenue of $2.94 billion.

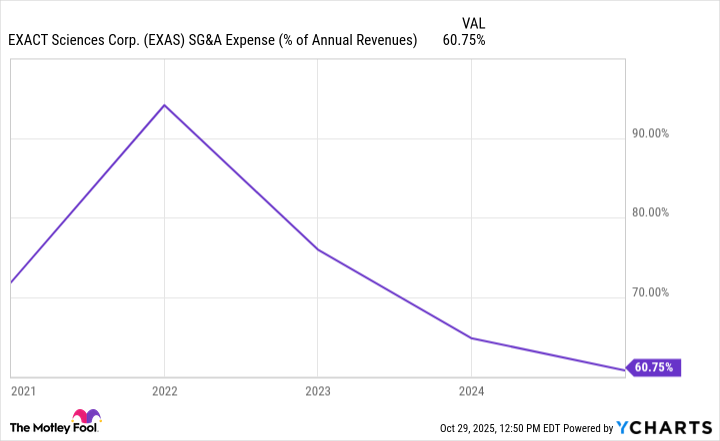

And although competition is fierce, the company has continued to grow its revenue over the past few years while costs -- including marketing-related expenses -- make up a smaller percentage of the top line, a sign that it could be building a strong reputation or developing relationships with decision-makers in the healthcare sector and relies less on advertising to attract patients.

EXAS SG&A Expense (% of Annual Revenues) data by YCharts

And to make things even better, Cologuard Plus is 5% cheaper to manufacture, helping the company further reduce costs and achieve profitability. These factors make the stock attractive to long-term investors, even if it doesn't soar on Nov. 3.