Advertising-technology (adtech) company AppLovin (APP 1.84%) launched its Axon 2.0 software in early 2023. That upgraded software, which has artificial intelligence aspects, has propelled the business ahead and lifted its market cap high enough to earn it a spot in the S&P 500.

On Sept. 5, S&P Global announced that AppLovin would be included in the broad large-cap index. AppLovin already had a market capitalization of over $150 billion at the time and trailing-12-month net income of over $2.7 billion. That made it both big and profitable, which are two of the criteria that the selection team looks for when considering new additions to the S&P 500.

Image source: Getty Images.

AppLovin's rise was thanks to the successful launch of its Axon software. Previously, the company had two primary business units, but this software unit has had much higher profit margins. As it grew, profits soared.

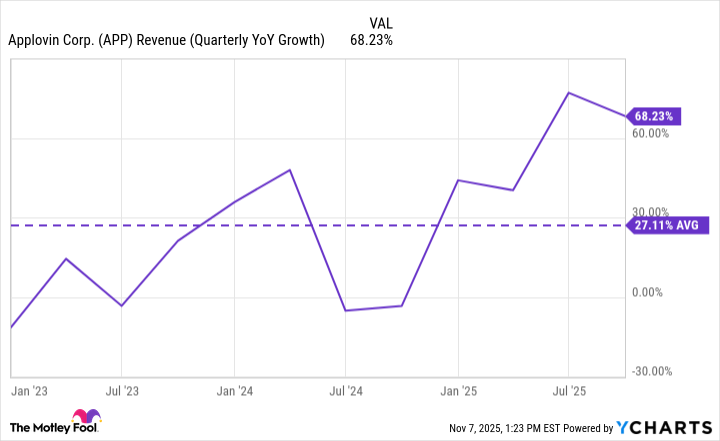

And indeed, AppLovin has averaged tremendous growth since the start of 2023. As the chart below shows, its year-over-year quarterly revenue growth rate has been close to 30% and its revenue was up by a whopping 68% in the third quarter of 2025.

AppLovin has been a part of the S&P 500 for about a month. What can investors expect now that it's part of the index? Well, the answer may surprise you.

A pattern or a coin flip?

In the short term, stocks tend to get a boost when they get added to the S&P 500 -- and by short term, I mean about a month or so. But The Motley Fool's investing philosophy encourages investors to plan on holding stocks for five years or more. And over those longer time periods, there's no clear pattern as to whether S&P 500 inclusion hurts or helps stocks' performance.

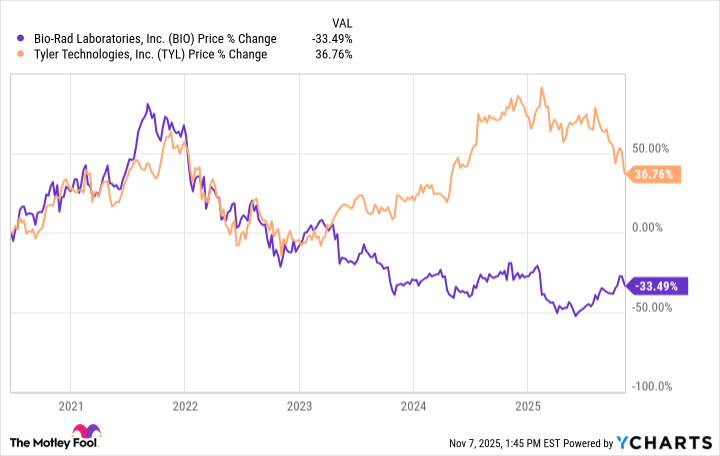

To illustrate that point, let's consider two stocks that gained entry to the index in 2020: Bio-Rad Laboratories and Tyler Technologies. Both were added to the index on June 22 of that year. But Tyler Technologies is up by more than 36% since then, whereas Bio-Rad is down by almost as much, and lost its place in the index. This is how it goes: Being added doesn't guarantee positive future returns.

Moreover, there isn't even enough of a pattern to use words like "usually" or "most of the time." In short, there appears to be no correlation between how a stock performs over five-year periods and that stock's inclusion in the S&P 500.

However, while AppLovin's ascension into the popular index may not offer any hints about how its stock will perform over the long term, there are other historic patterns worth paying attention to.

What investors should watch instead

A 2006 study from Boston Consulting Group analyzed the top 25% of stock performers over a 20-year period. The study found that for those winners, revenue growth was responsible for 58% of a stock's gain over rolling five-year periods. In other words, the single biggest contributor to a top stock's performance was its top-line growth.

NASDAQ: APP

Key Data Points

So if AppLovin can continue to grow at an above-average rate, one would expect it to deliver above-average stock returns.

Of course, there are caveats to this thesis. The study also found that shares of companies that sacrificed long-term profits in pursuit of revenue gains didn't perform as well. So profits generally need to increase as well for stocks to go up. But directionally, the point still stands: AppLovin needs to grow for its stock to perform well from here.

AppLovin's long-term growth prospects are surprisingly strong. Its success to this point has been achieved by primarily serving a single market: mobile gaming. Its advertising software gets such games discovered and downloaded. But the company is now ready to promote virtually everything in the world of apps.

This means expanding into new arenas such as e-commerce and even connected TV. More than this, the company recently launched a self-serve interface, making its platform more accessible to more advertisers.

In the Q3 earnings call, co-founder and CEO Adam Foroughi said that self-serve customers are growing their spending by 50% week over week. Foroughi pointed out that this group of customers is still small, and therefore, so is the sample size. But that growth rate is incredibly encouraging.

Keep in mind that AppLovin is growing with a high-margin revenue stream. History suggests that if its margins stay strong, AppLovin stock could be a strong performer, particularly if e-commerce platforms and self-serve customers provide it with red-hot, profitable growth in the coming years.

In conclusion, AppLovin is in the S&P 500 now, and that's a nice feather in its cap. But the more consequential matter for long-term investors will be the company's ability to profitably grow. And when it comes to profitable growth, the outlook is incredibly bright for AppLovin.