While nothing is official or guaranteed, Intel (INTC +7.30%) may be on track to win Apple (AAPL +0.82%) as a major foundry customer. In a recent post on X, Analyst Ming-Chi Kuo noted that visibility around Intel becoming an advanced node supplier had "improved significantly."

According to Kuo, Apple's experience with an early process design kit (PDK) for Intel's 18A-P process, an enhanced version of its Intel 18A process, has met expectations. Apple is now waiting for version 1.0, which is expected from Intel in the first quarter of 2026. The PDK enables potential customers to design, simulate, and verify chip designs for a specific manufacturing process.

Kuo says that Apple plans to use the Intel 18A-P process for its lowest-end M-series processors, which currently power the MacBook Air and iPad Pro, with shipments expected to begin around the second quarter of 2027. Kuo expects initial annual volumes between 15 million and 20 million chips.

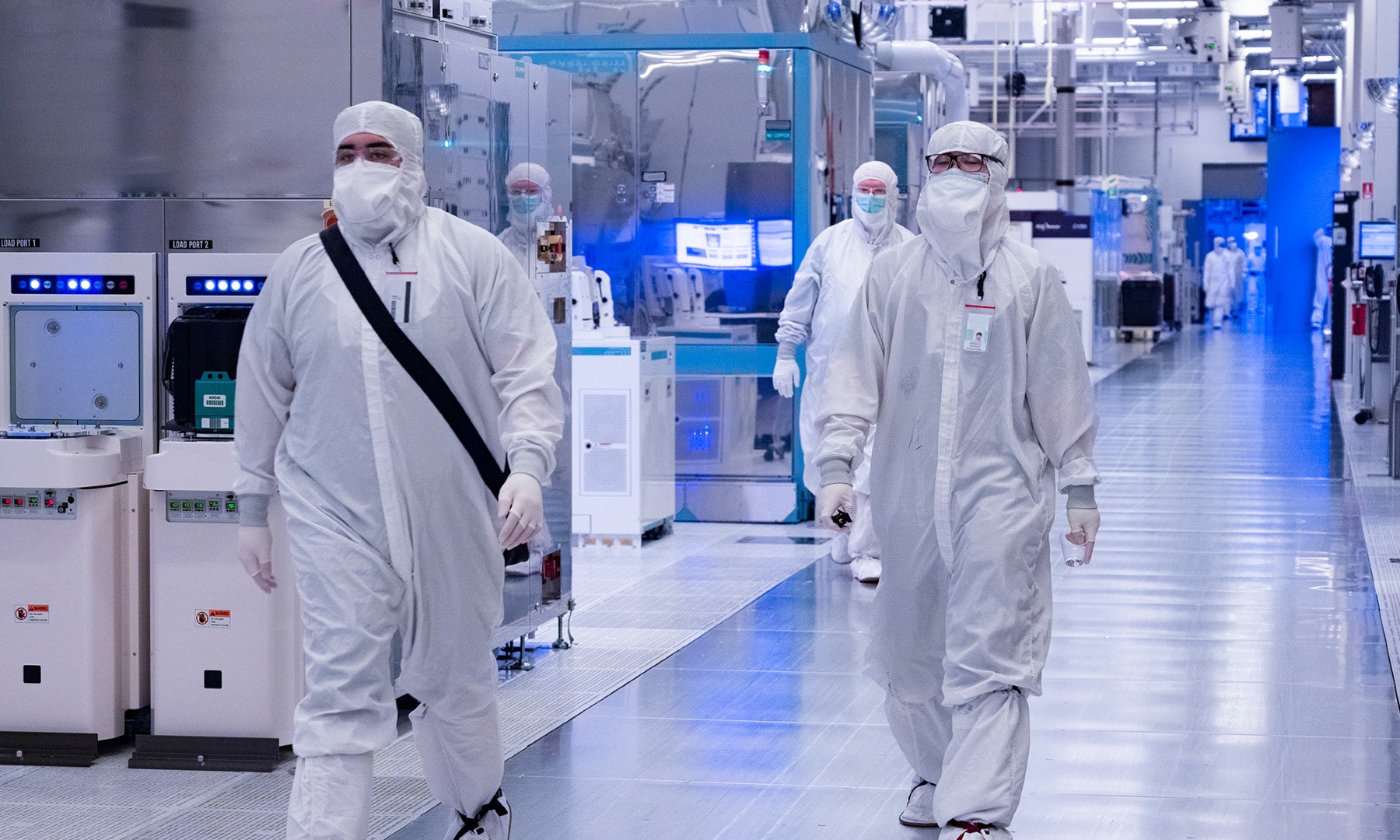

Image source: Intel.

A shot in the arm for Intel Foundry

If the Apple deal materializes, Intel's initial revenue impact will be meaningful. Apple reportedly pays TSMC around $45 for each of its A18 chips, with costs expected to rise dramatically for TSMC's next-generation nodes. Depending on volumes and the amount Apple pays Intel per chip, this potential deal could be worth $1 billion annually for Intel.

Beyond revenue, a major benefit for Intel is the vote of confidence it will receive from the world's largest semiconductor buyer. Intel faces technical hurdles as it attempts to build a sustainable and competitive foundry business, including achieving manufacturing yields that produce acceptable profit margins. The bigger challenge, though, is winning the trust of potential customers.

Intel previously attempted to build a foundry business more than a decade ago, but the company ultimately abandoned the effort. Apple reportedly considered Intel as a manufacturer for its iPhone chips in 2011, but ultimately chose TSMC. Morris Chang, TSMC's founder, has said that Apple CEO Tim Cook told him that "Intel just does not know how to be a foundry."

That perception remains Intel's most significant challenge as it tries again to become a world-class foundry. Intel CEO Lip-Bu Tan has made listening to customers a key priority, something that Intel has struggled with in the past. That strategy is apparently working as Apple moves toward choosing Intel as a manufacturing supplier.

The Apple deal could eventually be worth more if the company chooses to move more volume over to Intel. As it stands today, Apple is entirely dependent on TSMC for all its manufacturing needs, giving the company little leverage in price negotiations. Bringing Intel in as a secondary supplier, with the option to shift additional chips away from TSMC, could help Apple reduce its overall costs.

NASDAQ: INTC

Key Data Points

Intel's comeback comes into focus

Even if this Apple deal pans out, it will still take multiple years for Intel Foundry to achieve profitability. The company will need additional customers for both its Intel 18A family of processes and its upcoming Intel 14A process. If the 18A-P process serves Apple well, the company could be a 14A customer down the road.

Intel has some of its own chips scheduled to ship as early as the end of this year on the Intel 18A process. Panther Lake for PCs is coming soon, with Clearwater Forest for servers set for 2026. If those chips perform well using Intel's latest manufacturing node, potential foundry customers may be more eager to seriously consider Intel.

Of all the foundry customers that Intel could win, Apple would be one of the most impactful. The revenue potential is significant, especially if Apple shifts more volume to Intel over time, and additional customers could follow suit as Apple provides a major vote of confidence. Intel isn't out of the woods yet, but it looks like the company's worst days may be behind it.